The U.S. Securities and Exchange Commission (SEC) has brought 75 enforcement actions against companies and individuals in the crypto industry so far, according to a new report by Cornerstone Research. The agency also brought 19 trading suspension orders against digital asset market participants, and 43 were litigated in U.S. district courts.

75 Crypto Enforcement Actions by SEC

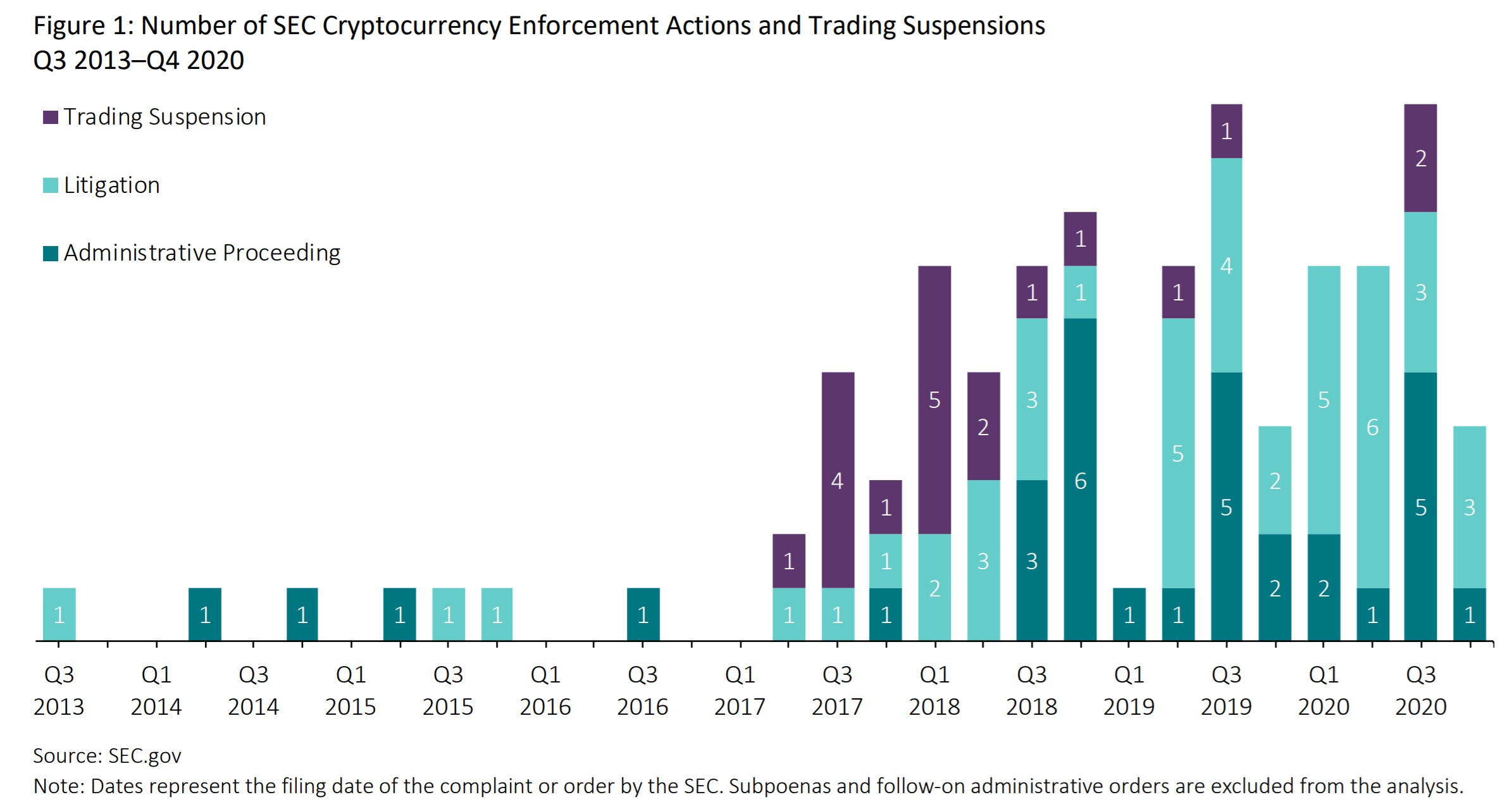

Cornerstone Research published a report entitled “SEC Cryptocurrency Enforcement” on Tuesday. The report analyzes 75 crypto-related enforcement actions brought by the SEC starting with the first one in July 2013 to Dec. 31, 2020. It found:

During that time, the SEC brought a total of 75 enforcement actions and 19 trading suspension orders against digital asset market participants.

Besides the 75 enforcement actions, the SEC also brought a number of subpoenas and follow-on administrative proceedings on crypto companies and individuals. The first enforcement action was in July 2013 against Trendon T. Shavers and his company.

“Of the 75 enforcement actions, 43 were litigated in U.S. district courts, and 32 were resolved within the SEC as administrative proceedings,” the report describes. “Of all enforcement actions, 21 administrative proceedings and 31 litigations alleged an unregistered securities offering violation.”

As for initial coin offerings (ICOs), the report states that “Among these alleged violations under Sections 5(a) and 5(c) of the Securities Act, 39 actions were related to ICOs, which represent 52% of all enforcement actions.”

The report details that out of the 75 crypto-related enforcement actions, “allegations of fraud and unregistered securities offerings were the most frequent.” There were 39 enforcement actions (52%) that contained an allegation of fraud.

“In 52 (69%) of the 75 enforcement actions, the allegation was an unregistered securities offering violation under Sections 5(a) and 5(c) of the Securities Act,” the report notes, adding that “In 28 actions (37%), the violation of an unregistered securities offering was alleged in combination with a fraud allegation.” The entire report can be found here.

What do you think about all these enforcement actions against crypto firms taken by the SEC? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link