Americans are still concerned about dealing with inflation, as the cost of goods and services has continued to rise significantly in a short period of time. The Federal Reserve has published the latest Survey of Consumer Expectations report and U.S. households believe inflation will be up 5.3% one year from now. In addition to the dreary economic outlook, gas prices across the U.S. have skyrocketed up more than $1 from a year ago.

New York Fed’s Survey of Consumer Expectations Continues to Look Gloomy

After 2020’s massive monetary expansion, in order to help the economy combat the coronavirus outbreak and help facilitate the lockdown orders that subsequently followed, inflation has crept into the wallets of every American.

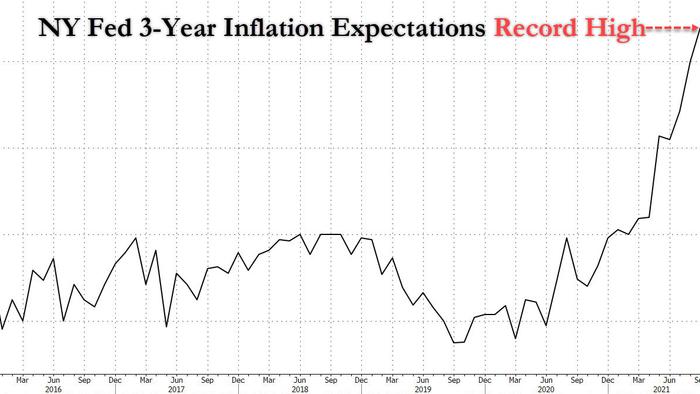

Month after month, the Federal Reserve has published the central bank’s Survey of Consumer Expectations (SCE) reports, and every month, inflation expectations jump higher. Once again, the latest Fed SCE report published on Tuesday indicates that Americans are still expecting higher inflation and low purchasing power a year from now.

The inflation expectations have surged to all-time highs and are the highest levels since 2013, with an expectation of 5.3% one year from now. Furthermore, the New York Fed (the branch that publishes the SCE report), once again mentions the coronavirus.

“Median inflation uncertainty – or the uncertainty expressed regarding future inflation outcomes – was unchanged at the short-term horizon and decreased at the medium-term horizon,” the Fed survey highlights. “Both measures are still well above the levels observed before the outbreak of Covid-19.” The recently published Fed SCE report leverages a rotating panel of 1,300 households.

IMF Warns Central Banks Like the Fed to Tighten Monetary Easing Policy

In addition to the SCE report, the International Monetary Fund (IMF) has noted, in the world organizations’ quarterly update on global economic conditions, that central banks may need to tighten monetary easing policy. The IMF emphasized countries like the U.S. and the U.K. where “inflation risks are skewed to the upside.”

IMF warns of need to be ‘very, very vigilant’ over rising inflation risk

We have gone from very transitory to we have to be very, very vigilant.

Got it…

— Gold Telegraph ⚡ (@GoldTelegraph_) October 12, 2021

“While monetary policy can generally look through transitory increases in inflation, central banks should be prepared to act quickly if the risks of rising inflation expectations become more material in this uncharted recovery,” the IMF’s economic counselor and director of research, Gita Gopinath stressed in the report. “Central banks should chart contingent actions, announce clear triggers, and act in line with that communication.”

Supply Chains Buckle, Gas Prices per Gallon $1 Higher Than Last Year

To make matters worse, the U.S. supply chain (and internationally) has been dealing with significant issues and gas prices across the country have risen significantly since last year. The media in the U.S. continues to tell tales of a buckling supply chain and some are blaming supply chain issues on the conflict between the U.S. and China.

Just 8 states have average #gasprices still under $3/gal:

OK $2.88

MS $2.89

TX $2.89

AR $2.91

LA $2.97

KS $2.98

AL $2.98

MO $2.99— Patrick De Haan ⛽️📊 (@GasBuddyGuy) October 11, 2021

Supply chain shortages and rising gas prices have fueled the inflation crisis in the U.S., so much so that doesn’t seem to be ‘transitory.’ Every week, headlines show that “the return of empty shelves” has returned in the United States as well as the United Kingdom. Grocery stores in nearly every state across the U.S. are starting to see empty shelves again.

U.S. gas prices have also risen by $1 since last year and the average price of gas in the U.S. today is $3.25 per gallon. Only eight states in the U.S. have gas for under $3 a gallon.

What do you think about the current inflation woes Americans are dealing with in 2021? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Twitter, Zerohedge,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link