Ethereum 2.0 deposit contract continues to see an uptick in investments based on a surge in the total value locked (TVL).

Crypto analytic firm Glassnode said:

“The total value in the ETH 2.0 Deposit Contract just reached an ATH of 7,824,674 ETH.”

Market analyst Lark Davis had previously stated that the Ethereum 2.0 upgrade would prompt a 90% daily emission reduction from 12,800 to 1,280.

Ethereum has been witnessing various upgrades, which seek to boost the digital asset’s efficiency. The London Hardfork or EIP 1559 upgrade was the latest one to be incorporated, which triggered the first-ever deflationary block on the Ethereum network on August 5.

Ethereum supply on exchanges shrink

According to on-chain insight provider Santiment:

“Our metrics indicate an encouraging downtrend on ETH’s supply on exchanges. Traders have focused more on volatile & pumping coins, which is historically good for Ethereum.”

This is a bullish sign because it illustrates a holding culture. Furthermore, a drop in ETH supply on exchanges is usually correlated with a price increase.

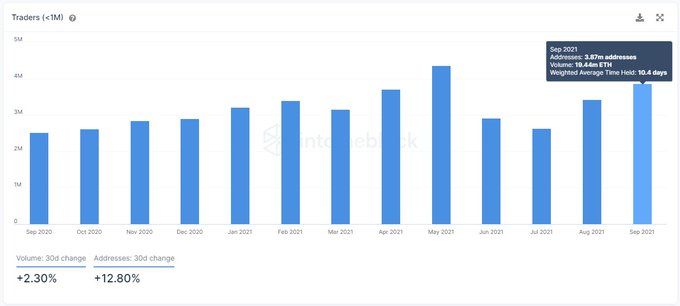

Meanwhile, the interest from short-term traders on the Ethereum network is going through the roof. Data analytic firm IntoTheBlock explained:

“The price of ETH rising above $3,000 is propelled by a renewed interest by short-term traders. The number of addresses holding ETH for less than 30 days is up 43% since July and quickly approaching the ATH experienced in May. 3.87m addresses with a volume of 19.44m ETH.”

On the other hand, the amount of unique tokens moving on the Ethereum network, known as token circulation, has been increasing because they recently hit levels last seen in June. Token circulation and price are usually strongly correlated.

Ethereum 2.0, also known as the Beacon Chain, was launched in December 2020 and was regarded as a game-changer that sought to transit the current proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) framework.

The proof-of-stake algorithm allows the confirmation of blocks to be more energy-efficient and requires validators to stake Ether instead of solving a cryptographic puzzle. As a result, it is touted to be more environmentally friendly and cost-effective. ETH 2.0 is also expected to improve scalability through sharding.

Image source: Shutterstock

Credit: Source link