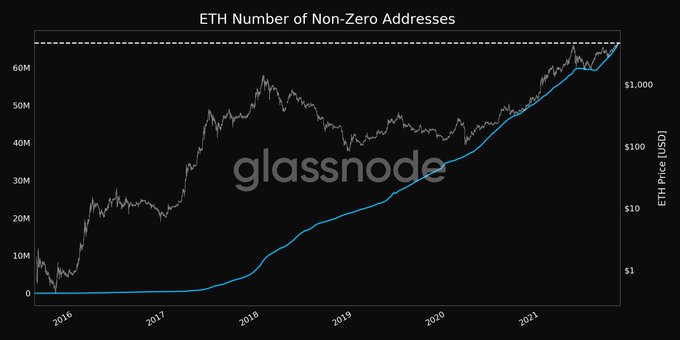

Last Friday, The Ethereum (ETH) network continued to attract more participants because the number of non-zero addresses broke the record at 66,788,634, according to market insight provider Glassnode.

This coincides with the fact that Ethereum has been experiencing remarkable growth because of increased utility from booming sectors like decentralized finance (DeFi) and non-fungible tokens (NFTs).

Furthermore, renewed interest from short-term traders has driven ETH’s price through the roof. The second-largest cryptocurrency reached a notable milestone in its 6-year journey by setting a new all-time high (ATH) price of $4,650.

Even though it has retraced a bit, Ethereum continues to experience remarkable growth this quarter.

The challenge of high gas fees

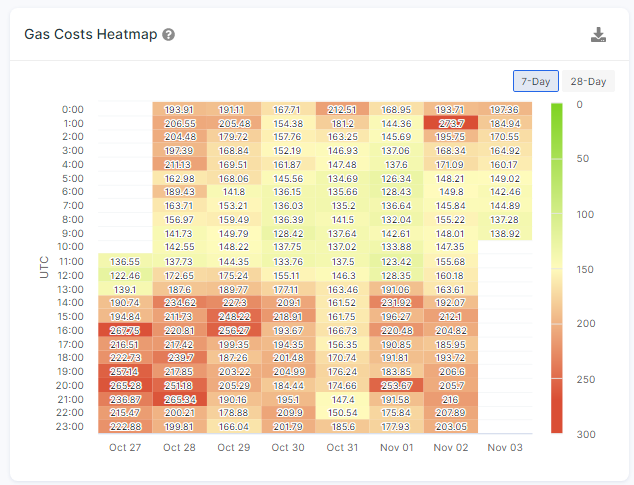

Despite the notable strides being made on the Ethereum network, high gas fees remain a significant challenge. Data analytic firm IntoTheBlock explained:

“Ethereum has been rough for small players lately. The Gas Cost Heatmap reveals how over the last 7-days, in the afternoon the Gas cost has been consistently above 200 Gwei.”

Therefore, this explains why the popularity of other networks like Solana has increased. For instance, Solana dethroned Tether (USDT) at the fourth position because it offers high speeds, low fees, and minimal congestion.

Solana can attain high transaction speeds because it merges the proof of stake (POS) consensus mechanism with the proof of history, which enables computers to keep time on a decentralized network without all of them communicating about it.

Nevertheless, the high gas fee problem witnessed on the Ethereum network is expected to be amicably solved by the ETH 2.0 deposit contract, which was launched in December 2020. It seeks to offer a transition to a proof-of-stake consensus mechanism from the current proof-of-work (POW) framework.

Image source: Shutterstock

Credit: Source link