Ethereum (ETH) has been consolidating ever since the second-largest cryptocurrency plummeted to lows of $2,000 before returning to $2,410 from an all-time high (ATH) of $4,350.

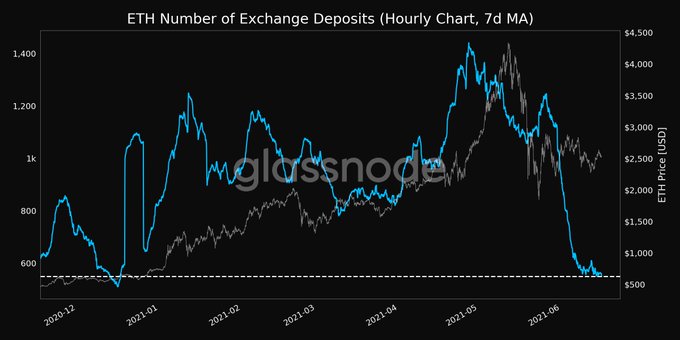

Nevertheless, the number of ETH deposits on crypto exchanges continues to diminish, as disclosed by Glassnode. The on-chain metrics provider explained:

“The number of Ethereum exchange deposits (7d MA) just reached a 5-month low of 548.940.”

It could, therefore, suggest that Ethereum stored in cold storage or wallets is not being moved for holding purposes, which is a bullish signal.

These statistics correlate with insights recently provided by Glassnode that Ethereum exchange inflow volume reached a monthly low of $34.27 million.

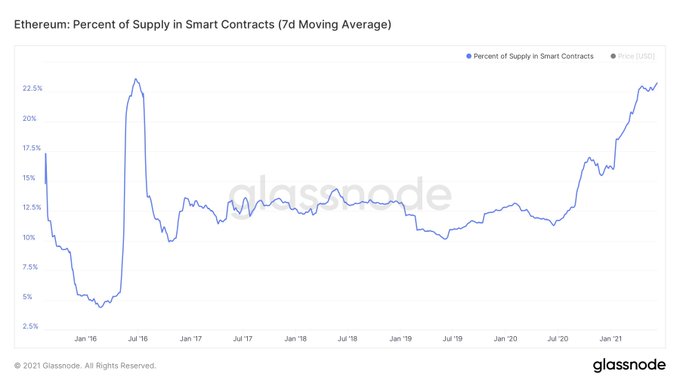

Ethereum worth $63 billion is locked in smart contracts

According to EthHub founder Anthony Sassano:

“The amount of ETH in smart contracts is now at a similar level to what it was during The DAO event (around 23% of all ETH). In June of 2016, that was ~$230 million worth of ETH. Today, it is ~$63 billion worth of ETH.”

The Ethereum network is one of the sought-after crypto spaces because its smart contracts are widely applied in the decentralised finance (DeFi) and non-fungible token (NFT) sectors.

These areas have been pivotal in aiding Ethereum’s recent bull run, which saw its market capitalisation surge past the $500 billion marks. As a result, the second-biggest crypto was more valuable than financial giants like Visa and PayPal.

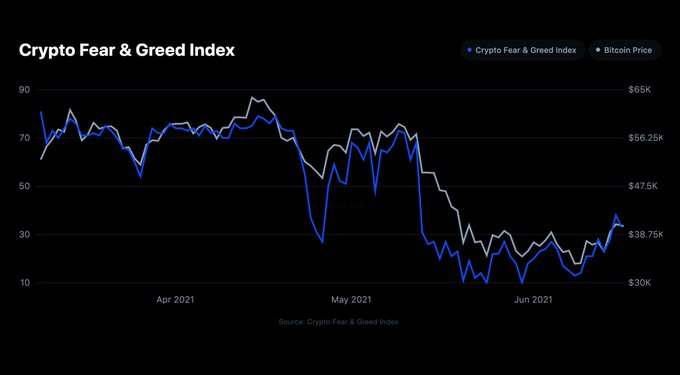

Ethereum will, however, need to get away from the fear range for an upward momentum to be triggered, as noted by Bloqport. The crypto analytic firm stated:

“Market sentiment is beginning to recover but is still in the ‘fear’ range according to the Crypto Fear & Greed Index.”

Meanwhile, Ethereum whales are on a record-breaking trend of accumulating more coins. It, therefore, shows that they are bullish about ETH in the long term.

Image source: Shutterstock

Credit: Source link