Ever since China strengthened the supervision of cryptocurrency mining and related trading, causing “fear, uncertainty, and doubt” (FUD) sentiment that has intensified among investors, Bitcoin (BTC) has been on the receiving end as its price continues to drop.

The leading cryptocurrency was down by 20.48% in the last 7 days to hit $31,643 during intraday trading, according to CoinMarketCap.

The number of BTC addresses holding more than 1,000 Bitcoins also plummeted, as acknowledged by Glassnode. The on-chain metrics provider explained:

“The number of Bitcoin addresses holding 1k+ coins just reached a 1-month low of 2,152.”

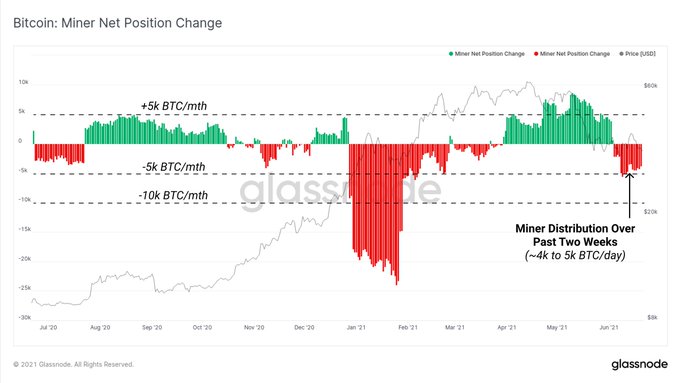

The BTC mining crackdown happening in China has caused miners to sell their holdings to attain the needed capital to establish new facilities in other nations.

Market analyst Lark Davis noted:

“Chinese miners are being forced to either shut shop or move shop, the result has been that they are selling Bitcoin to both exit the market and recoup investments or to fund their move to greener pastures like Kazakhstan or Texas.”

Davis added that a lot of BTC mining machines were being switched off, which was detrimental in the short term but good in the long term.

A bear market is near?

According to CryptoQuant CEO Ki-Young Ju, the Bitcoin bear market might be confirmed by the fact that many whales are sending their holdings to crypto exchanges. He pointed out:

“I hate to say this, but it seems like the Bitcoin bear market confirmed. Too many whales are sending BTC to exchanges.”

Market analyst Michael van de Poppe also noted that Bitcoin needs to hold the current level to avoid a slump to the $24K area.

With leading American business intelligence firm MicroStrategy accumulating more Bitcoin holdings to a record-high of 105,085 BTC, it remains to be seen whether such actions by institutional investors will prompt the much-needed upward momentum in the Bitcoin market.

Image source: Shutterstock

Credit: Source link