Tether (USDT) is seeing its market capitalization rise to new all-time highs as the company behind the top stablecoin generated billions of dollars in profits earlier this year.

Analytics firm IntoTheBlock says that USDT’s market cap is rapidly approaching the $84 billion level after starting the year at just $66 billion.

IntoTheBlock adds that Tether’s circulating supply has risen by almost 30% year-to-date.

“Tether’s supply and market capitalization have hit new highs this month, approaching the noteworthy $84 billion benchmark.”

At time of writing, USDT’s market cap is hovering at $83.79 billion.

The on-chain analytics firm also reveals that Tether printed $1.5 billion in net profits in Q1 of 2023 and predicts that the stablecoin issuer will likely see more income this quarter as the amount of USDT in circulation continues to grow.

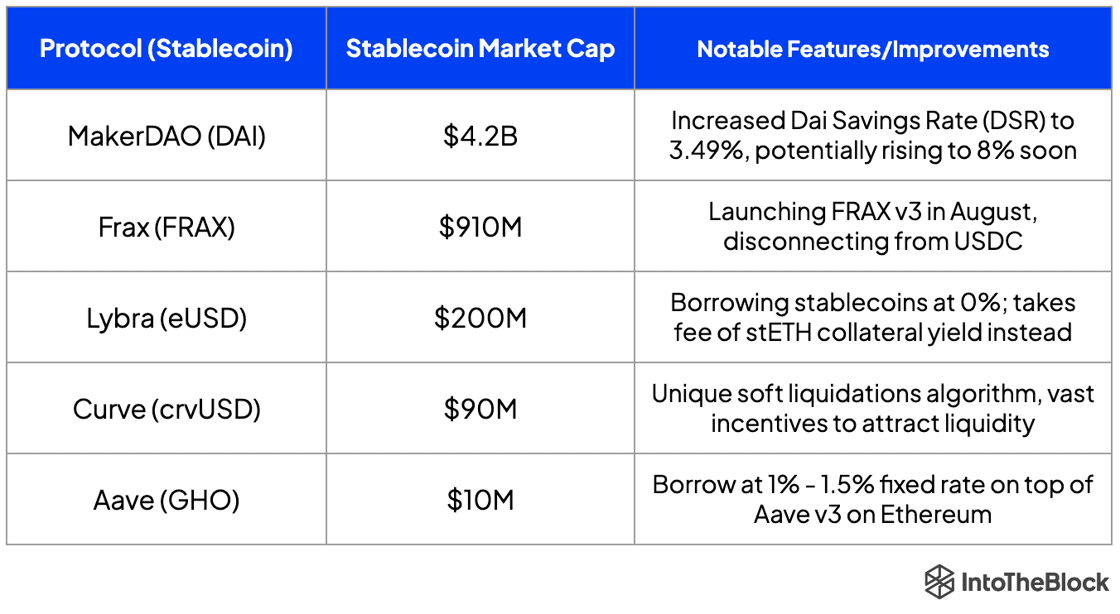

With USDT on the rise, IntoTheBlock says that its competitors operating in the realm of decentralized finance (DeFi) are working on improvements designed to attract more users.

“DeFi stablecoins are making moves to catch up with centralized counterparts. Take a look at this comparison of the most popular decentralized stablecoins.”

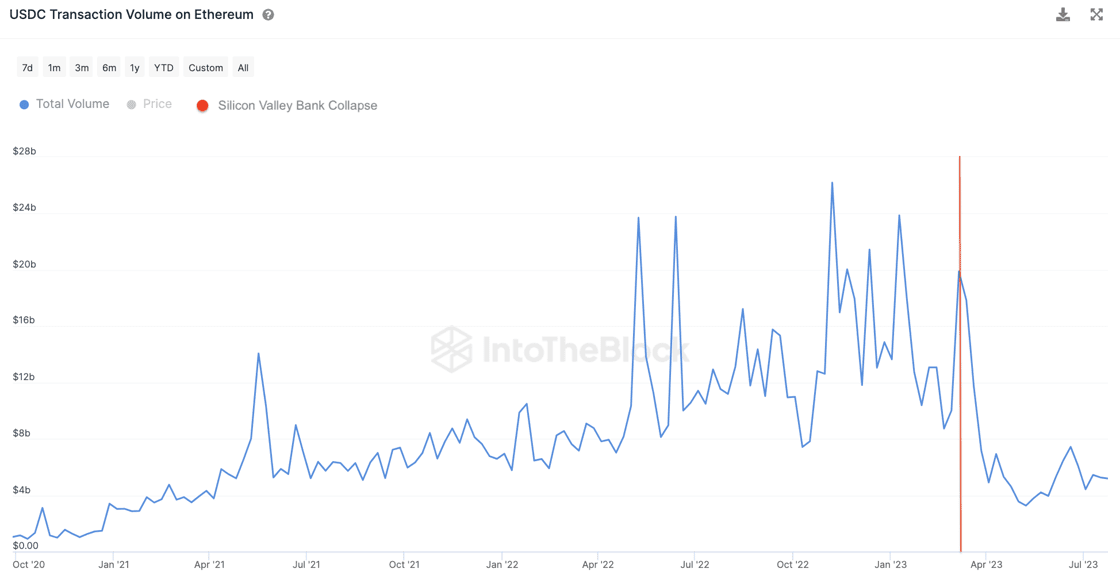

Looking at USDT challenger USD Coin (USDC), the analytics firm says the second-largest stablecoin by market cap has been struggling since the collapse of Silicon Valley Bank (SVB) in March.

Circle, the firm behind USDC, was SVB’s top depositor to the tune of $3.3 billion.

“USDC volumes and supply have dipped significantly since March, with on-chain volumes reaching a two-year low just a month post-SVB collapse. Furthermore, circulating supply is down 37% since March and continues to decrease.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/art.disini/WindAwake

Credit: Source link