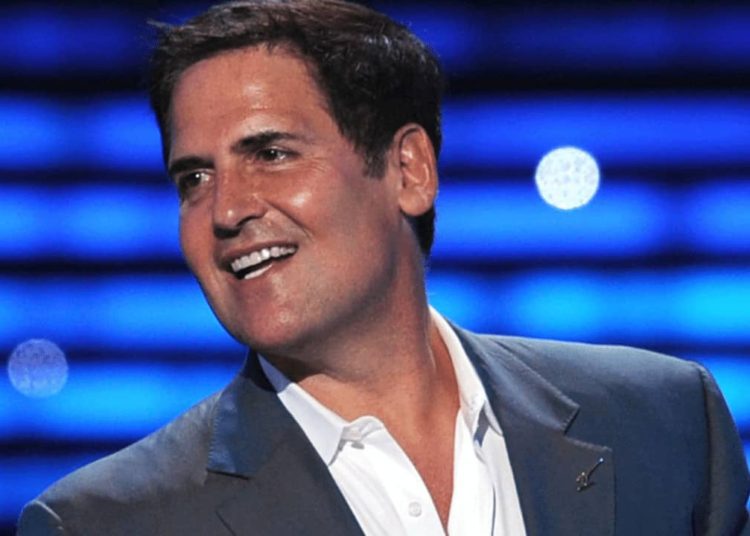

The American businessman, philanthropist, and television personality – Mark Cuban – lambasted the United States Securities and Exchange Commission (SEC) for providing misleading guidance regarding which digital currencies could categorize as securities.

The agency has not been kind to the crypto sector and recently filed lawsuits against two of the largest exchanges – Binance and Coinbase. It also claimed that some leading digital assets, including BNB, SOL, ADA, and MATIC, operate as unregistered securities.

The SEC Treats Crypto Differently

The billionaire and owner of The Dallas Mavericks – Cuban – is yet another individual who believes the Commission has not done enough to properly supervise the cryptocurrency sector and determine which tokens classify as securities and which as commodities.

In one of his recent Twitter posts, he claimed that the watchdog’s public statements on the matter differ from the official position on its website. Cuban added that the lengthy guidance does not give information regarding “what is or is not a security in the crypto universe.” He went further, stating one wouldn’t be able to find out the status of the different digital currencies even with “an army of securities lawyers.”

The American thinks the SEC has double standards when speaking of crypto and other aspects of finance. He said last week that the Gary Gensler-spearheaded agency had called the stock loan industry “opaque” and required additional transparency. Unlike the digital asset sector, though, it did not categorize “stock loans” securities and did not file lawsuits against brokers or banks.

“They should do the same thing with crypto as an effort to determine which aspects of crypto are securities and which are not and the best way to regulate the industry and protect investors. I think their difference in approach is emblematic of their intent for one industry vs another,” he concluded.

The SEC’s War on Crypto

The agency’s unfriendly attitude toward the industry intensified last week. For starters, it sued the world’s largest cryptocurrency exchange – Binance, the CEO – Changpeng Zhao (CZ), and the American subsidiary of the company – Binance.US.

The main accusation is that the platform operated “unregistered national securities exchanges, broker-dealers, and clearing agencies.” According to the regulator, Binance’s unlicensed products include certain lending offerings, a staking program, the native token BNB and a fiat-backed stablecoin BUSD.

The SEC continued with its harsh actions with another lawsuit against Coinbase a day later. It alleged that the latter served as a broker, national securities exchange, and clearing agency without obtaining the necessary authorization.

It also claimed that well-known cryptocurrencies such as Solana (SOL), Cardano (ADA), and Polygon (MATIC) are securities, accusing Coinbase of offering trading services with them.

“Coinbase has elevated its interest in increasing its profits over investors’ interests and over compliance with the law and the regulatory framework that governs the securities markets,” the Commission stated.

It is worth noting that Binance’s CEO – Changpeng Zhao – and Coinbase’s – Brian Armstrong – remained unfazed by the accusations. The former tweeted his signature number – “4,” urging his followers not to trust fake news or any sort of misleading information.

For his part, Armstrong said his exchange would be “proud” to represent the crypto sector in its SEC court battle, assuring “we will get the job done.”

Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

Credit: Source link