Investment scams have been by far the most common type in Australia recently, a new report by the country’s consumer watchdog has revealed. And while a growing number of Australians fall victim to fraudulent schemes involving cryptocurrency, bank transfers remain the scammers’ favorite way to extract money.

Australians Lose $670 Million to Scammers in a Year, Including $75 Million Through Bank Transfers

Residents of Australia have lost $851 million Australian dollars (almost $670 million) in over 444,000 reported scam cases in 2020, the Australian Competition and Consumer Commission (ACCC) announced in its latest Targeting Scams report published Monday.

The review compiles data from the commission’s own Scamwatch website, Australia’s cybersecurity center Reportcyber, other government agencies, and about a dozen banks and financial intermediaries. ACCC Deputy Chair Delia Rickard commented:

Last year, scam victims reported the biggest losses we have seen, but worse, we expect the real losses will be even higher, as many people don’t report these scams.

The agency has registered increasing financial losses to investment scams in 2020 with the total figure reaching a record-high $328 million Australian dollars ($254 million). Reports to Scamwatch increased by 63% to 7,295 and losses rose to $66 million Australian dollars, or over $51 million. Almost 34% of people who reported an investment scam lost money. The average loss was $26,713 Australian dollars, or around $20,000.

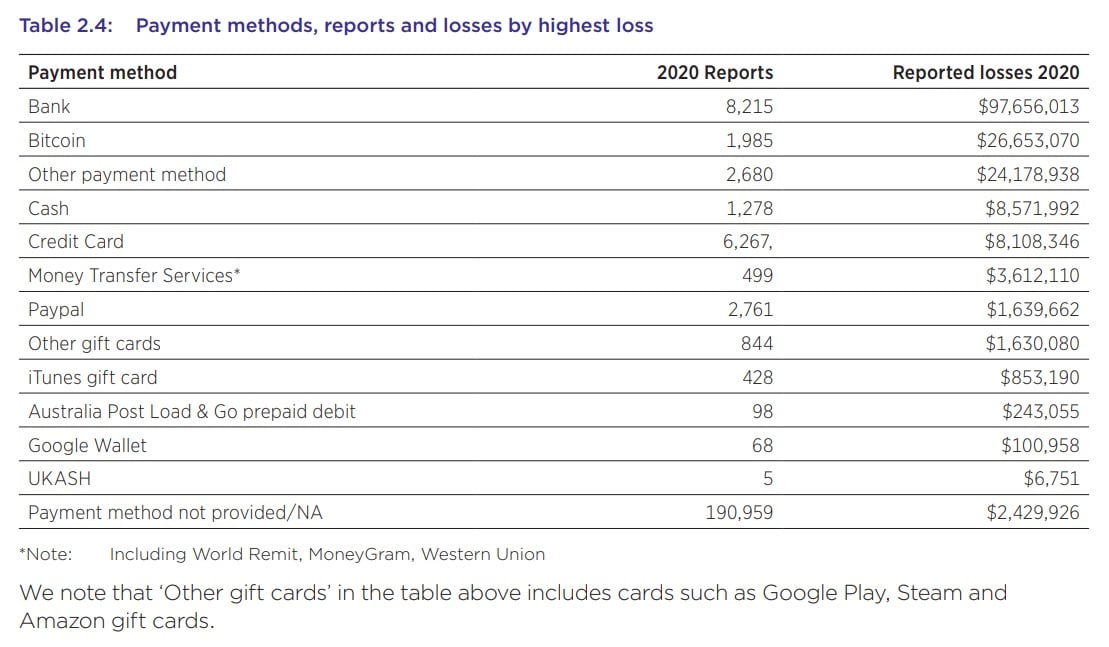

Bank transfers remained the most common payment method used by scammers, with over $97 million Australian dollars ($75 million) lost through such transfers, a 40% increase over the previous year. According to the ACCC, bitcoin (BTC) was the second-highest payment method, with $26.5 million in losses, or a little over $20.5 million. Adding these to the “Other Payments” category, including cryptocurrencies such as ethereum (ETH) and apps like Zelle or Skrill, brings the total to $50 million Australian dollars (almost $39 million).

‘Romance Baiting’ Scams Lure Young Australians to Fraudulent Crypto Investment Schemes

Despite still lagging behind traditional payment methods, bitcoin and other crypto payments are becoming more common. “The perceived anonymity of unregulated cryptocurrencies can impede the ability to recover funds or identify scammers. It is likely that we will see increased use of Bitcoin and other cryptocurrencies in the years to come,” the ACCC report remarks.

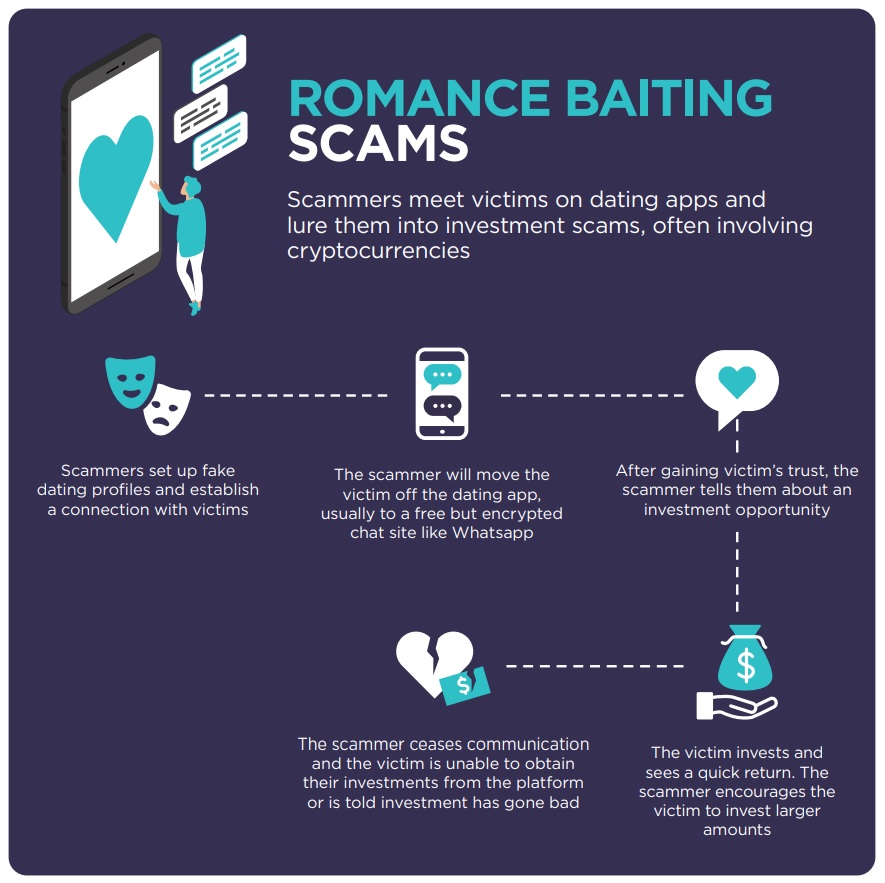

Amid an ongoing Covid crisis, health and medical scams increased last year more than 20 fold compared to 2019, accounting for over $3.9 million Australian dollars ($3 million) in losses. But in 2020, Scamwatch identified a new type of scam, which it refers to as “romance baiting,” often associated with crypto payments. Perpetrators are targeting social groups which have not previously suffered heavy losses.

Victims are typically contacted on a dating app, redirected elsewhere and lured into an investment scam involving cryptocurrency, the ACCC explained. Young Australians, aged between 25 and 34 years, have lost the most money to romance baiting last year – $7.3 million Australian dollars ($5.66 million). In total, citizens filed 414 reports of such scams, with losses reaching $15.4 million Australian dollars (almost $12 million). Crypto scams are by far the most common in this genre (57%), the commission noted.

Other scams targeting potential crypto investors have employed fake celebrity endorsements. The face, name, and personal characteristics of a well-known public figure are usually used to sell a product or a service. This product could be health-related or linked to an investment strategy encouraging people to invest in various cryptocurrency schemes. The report details that victims are offered an opportunity to collect high returns in a rather short period of time from a trading or investment platform that suddenly disappears.

What are your thoughts on the findings in the ACCC report? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link