As Bitcoin (BTC) surpassed the $55K level for the first time since May, publicly-traded, miners have been cashing in because they have been in an accumulation stage.

Microstrategy CEO Michael Saylor said:

“In September, Riot Blockchain mined 406 BTC, sold none of its production, and ended the month with 3,534 BTC on its balance sheet. Publicly traded Bitcoin miners aren’t selling BTC; they are accumulating. The game has changed.”

Riot Blockchain is a Nasdaq-listed Bitcoin mining and hosting company.

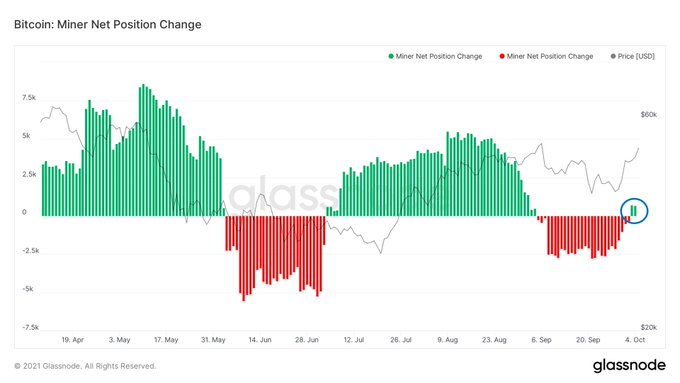

Generally, BTC miners have been accumulating more holdings, as endorsed by market analyst Will Clemente.

“After a few weeks of selling, Bitcoin miners have started accumulating again.”

Meanwhile, Institutional investors continue to show their confidence in Bitcoin based on their holdings. Reportedly, Bitcoin in public company treasuries recently surpassed 200,000 BTC.

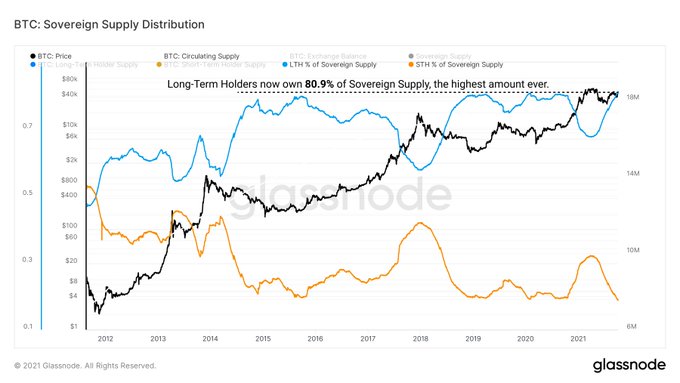

Long-term holders own the largest Bitcoin sovereign supply

According to an on-chain analyst under the pseudonym TXMC:

“Bitcoin long-term holders now own the highest % of sovereign supply in history: 80.9%. Sovereign supply is the total supply not on exchanges.”

BTC supply on exchanges has been nosediving because it recently hit a 28-month low. Therefore, a holding culture was presented, given that Bitcoin is transferred to digital wallets and cold storage for future purposes.

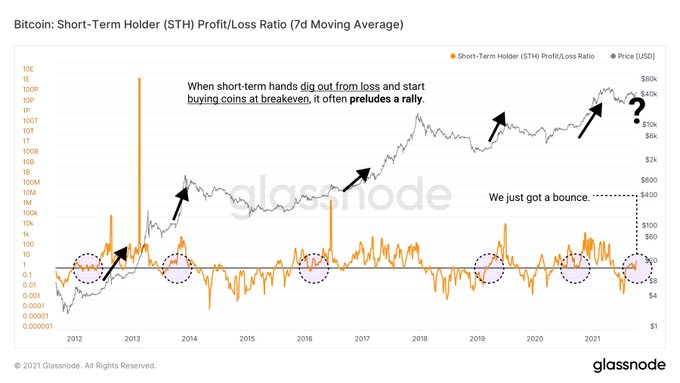

Meanwhile, short-term holders are buying BTC at breakeven, and this is prompting a price rally. TXMC explained:

“When Short-Term Holders dig themselves out of loss and begin buying coins at breakeven, shown here as a bounce off the black line, it often preludes a price rally. Paper hands are flushed out, and new buyers grab what they perceive as a value price.”

Long-term holder supply shock reached a record-high earlier this month, suggesting Bitcoin price could surge in coming months.

Image source: Shutterstock

Credit: Source link