Large Uniswap (UNI) holders are heavily accumulating the crypto asset, according to the analytics firm Santiment.

Santiment notes that addresses holding between 10,000 and one million Uniswap have added 10.74 million more UNI to their holdings from July 8th to July 24th, a trove representing 1.1% of the asset’s total supply.

According to the analytics firm, the 16-day accumulation of UNI key stakeholders equates to more than $74.3 million worth of the crypto asset.

The decentralized exchange (DEX) is also now competing with Curve’s (CRV) dominance over the decentralized finance (DeFi) space.

IntoTheBlock reports that Uniswap’s total value locked (TVL) briefly surpassed Curve’s last week.

Curve had been the top DEX in terms of TVL for more than a year, according to the analytics firm. It has since regained the top spot, but the race remains very close between the two DEXs. Curve has $5.86 billion in TVL at time of writing, while Uniswap has $5.85 billion.

The TVL of a blockchain represents the total capital held within its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

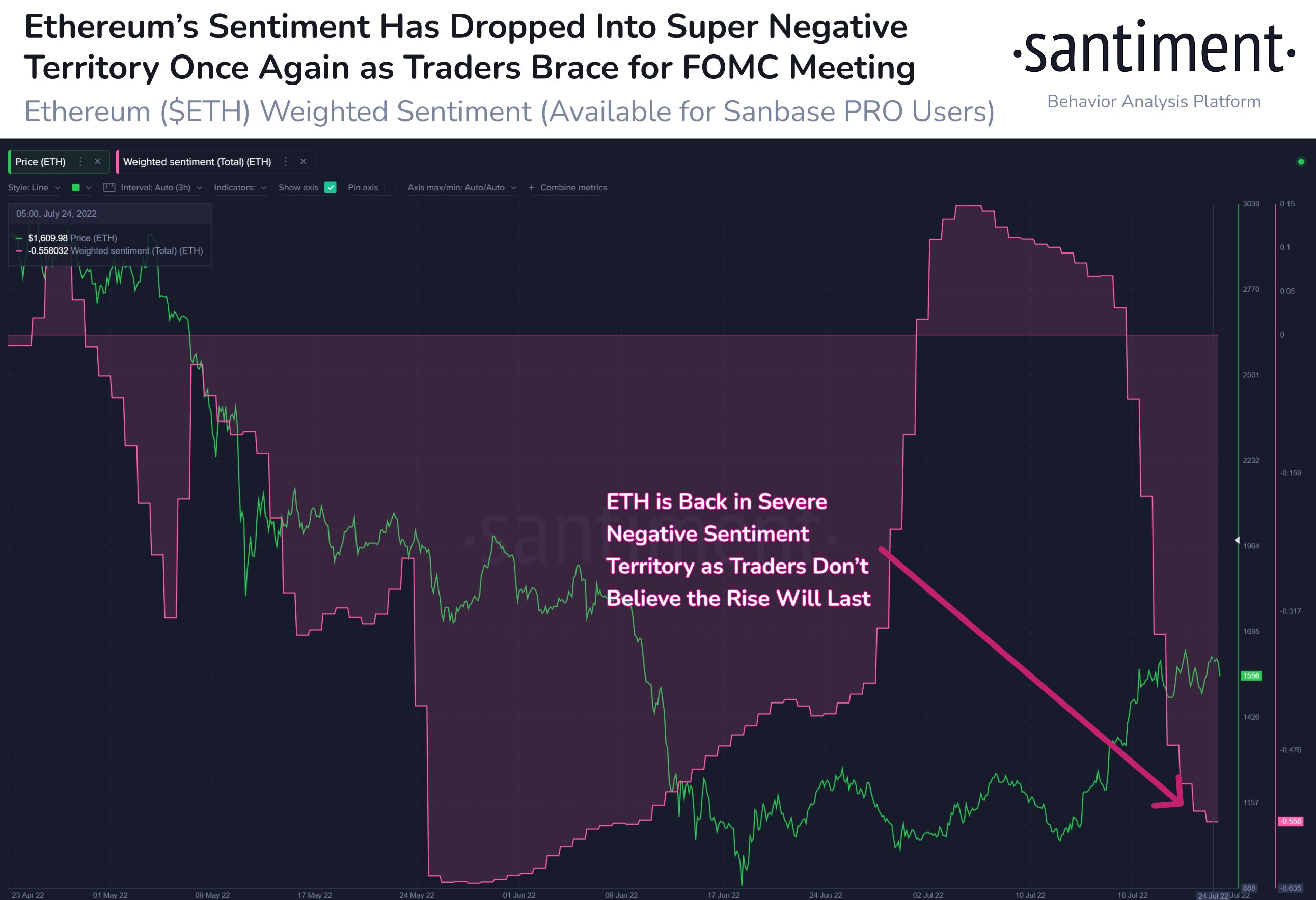

Santiment also predicts that Ethereum’s (ETH) prices will continue to stay volatile as traders brace for the Federal Open Market Committee (FOMC) meeting, which is scheduled to happen today.

“Ethereum had an up and down Sunday, jumping above $1,640 before dipping back down to $1,540. The trading crowd continues to not believe the hype, and is expecting prices to fall heading into the FOMC meeting. ETH should continue to stay volatile.”

ETH is trading for $1,424 at time of writing. The second-ranked crypto asset by market cap is down nearly 9% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Keith Tarrier

Credit: Source link