The price of bitcoin has dipped a hair in value this past week, but the crypto asset is still up 14.4% over the course of the last month. Statistics show that Bitcoin’s hashrate has seen a resurgence and because bitcoin’s price has increased, mining profitability and hashrate has followed suit. Today’s top bitcoin mining rig is Microbt’s Whatsminer M30S++ (112 TH/s) but with higher bitcoin profits, older machines like Bitmain’s Antminer S9 have seen a revival as every S9 model is profitable today.

New Generation Models Rake in $20 to $29 per Day

The end of August is approaching and over the last month, bitcoin (BTC) prices have increased a great deal. Currently, BTC is over 14% higher in value than it was 30 days ago and this has elevated mining rig profitability.

At the time of writing, there’s 124 exahash per second (EH/s) of SHA256 hashrate dedicated to the BTC chain. BTC’s hashrate has risen dramatically after sliding to a low of 69 EH/s on June 28, 2021. Today’s BTC prices mean that a great majority of mining rigs are showing profits even after subtracting the cost of electricity and dealing with today’s mining difficulty.

As mentioned above, the 112 terahash per second (TH/s) model crafted by Microbt, the Whatsminer M30S++, is currently profiting by $28.77 with an electrical cost of around $0.12 per kilowatt hour (kWh). Most bitcoin miners today spend much less than $0.12 per kWh if they are located in regions with cheap power.

The second most profitable mining machine today is Bitmain’s Antminer S19 Pro (110TH/s) as the mining rig can get up to $28.72 per day in profits using the same electrical cost rate. Microbt and Bitmain manufacture the most profitable bitcoin miners on the market today, and the firm Canaan’s products follow behind the two manufacturing giants.

Old Miners Become Profitable Again

Of course, new generation application-specific integrated circuit (ASIC) models with the latest semiconductors can see daily profits mining BTC between $10 to $25 per day if they are using 100 TH/s units down to 50 TH/s units. If the $0.12 per kWh is cut in half to $0.06 then a great number of rigs can make close to double these rates.

It also means older ASIC machines are profitable today as machines that process less than 50 terahash can pull in small fractions of daily BTC. For instance, the Innosilicon T2 Turbo with 25 TH/s can get around $3 per day using today’s BTC exchange rates and $0.12 per kWh.

The old GMO B2 miner that launched in 2018 with 24 TH/s can make around $2.69 per day in profits. At $0.12 per kWh, the Canaan Avalonminer 921 processes around 20 TH/s, and an owner of this rig can get $2.03 per day. Bitmain’s popular mining rig the S9 at one time was estimated to power around 70% of the BTC hashrate.

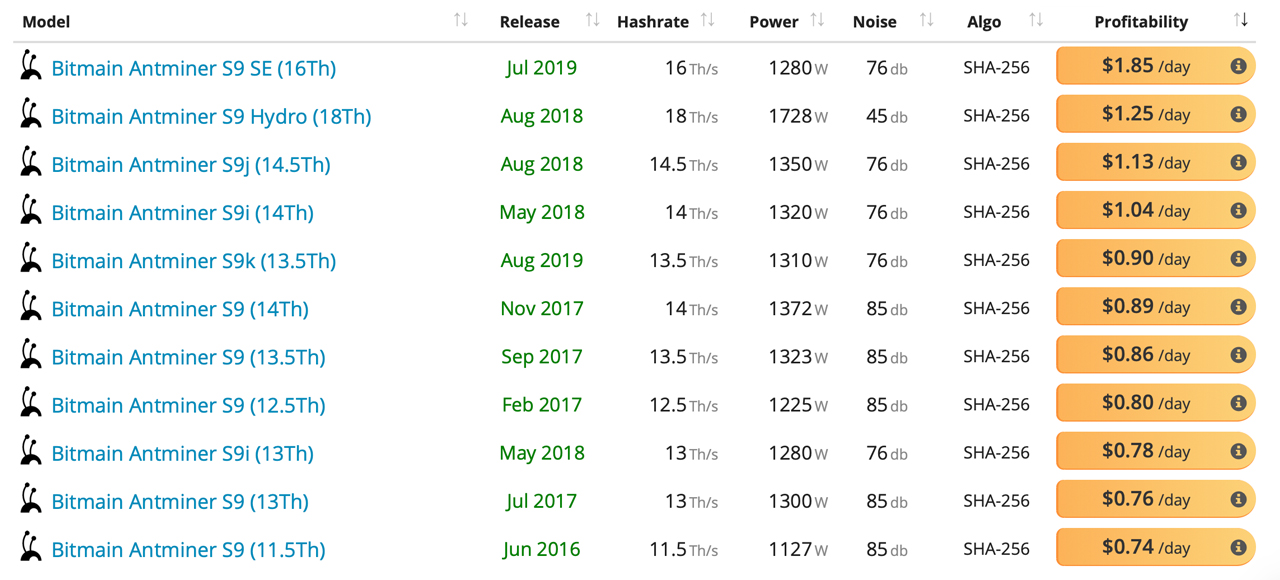

Bitmain’s S9 models saw a resurrection in November 2020 and this month, all S9 models are once again profitable. In fact, they are more profitable than they were back in November 2020, when S9 models made between $0.10 to $0.59 per day in profits.

On August 30, 2021, using today’s BTC exchange rate and electrical consumption of around $0.12 per kWh, S9 models between 11.5 TH/s to 16 TH/s can get around $0.74 to $1.85 per day. Of course, the 16-terahash Bitmain Antminer S9 SE is the most profitable S9 model. Other older mining models produced by companies like Bitfury, Bitfily, Ebang, Halong, and more, are seeing profits at today’s BTC prices.

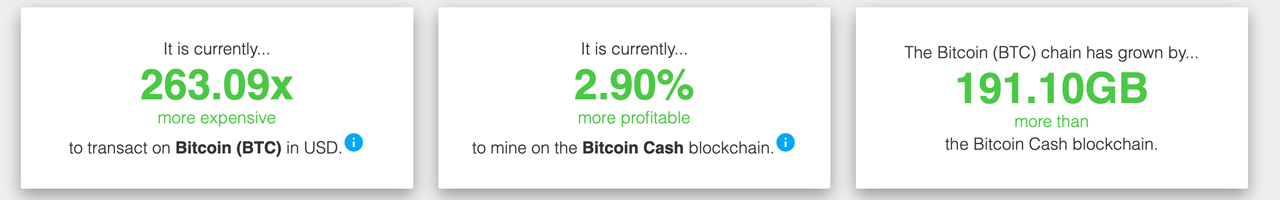

Moreover, one would think that the best SHA256 coin to mine is BTC but on Monday, SHA256 blockchains such as Bitcoin Cash (BCH), Bitcoinsv (BSV), and Ecash (XEC) are seeing higher mining profits. Coin Dance statistics show that it is currently 2.9% more profitable to mine bitcoin cash (BCH) today, and 11.3% more profitable to mine on the Bitcoinsv (BSV) blockchain. Ecash (formally BCHA or Bitcoin ABC) is 10.7% more profitable to mine than bitcoin (BTC) on Monday.

What do you think about the resurgence of profitability with older bitcoin miners? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link