Crypto analyst Michaël van de Poppe is making a series of bold predictions for Bitcoin (BTC) and the overall crypto markets as 2021 comes to a close.

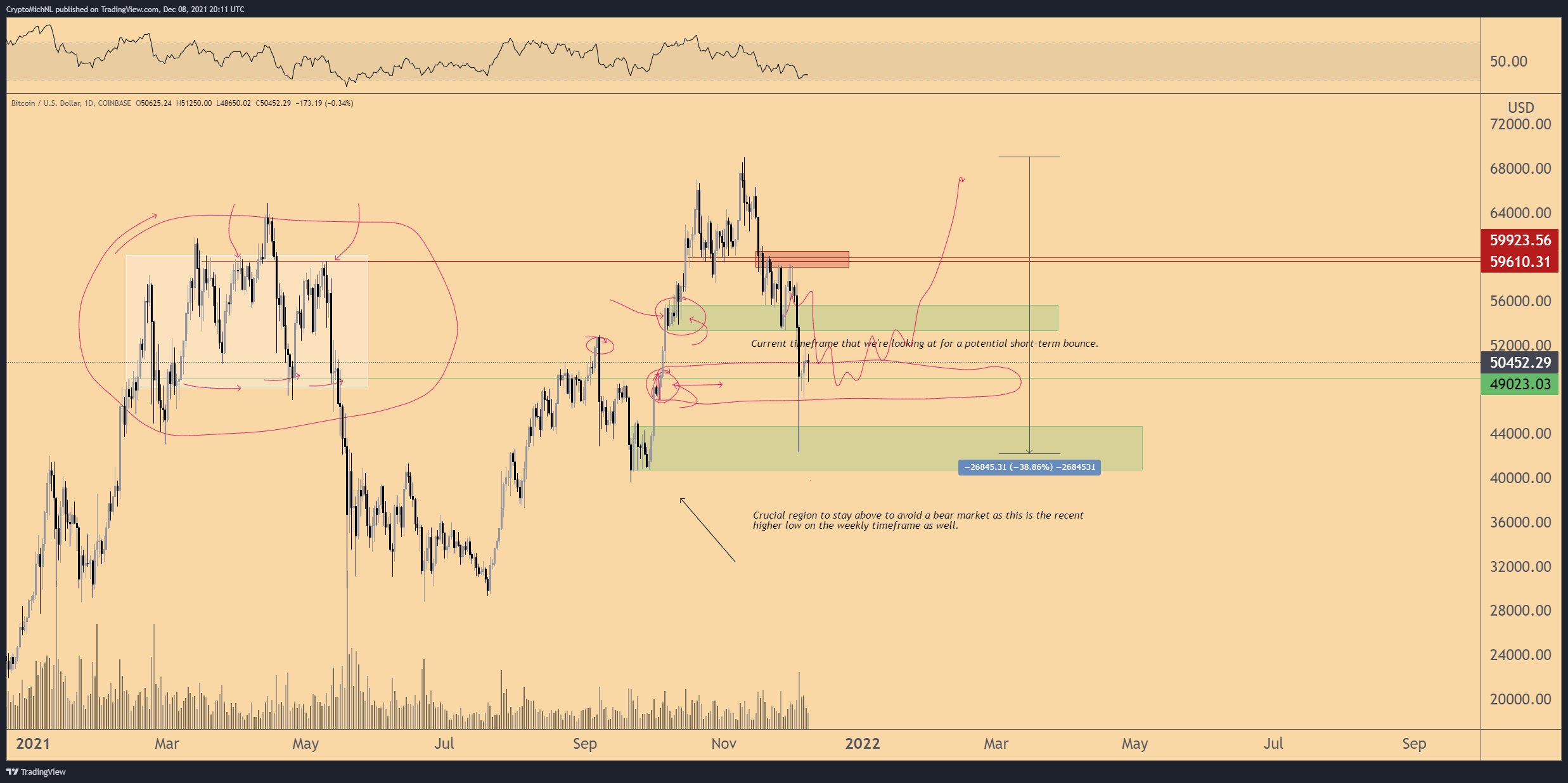

Van de Poppe tells his 524,800 Twitter followers that Bitcoin has already touched a crucial “make it or break it” area of support.

“Chop, chop, chop it is for Bitcoin. A crucial area to hold is that region we’ve touched already at $42K.

The close was above $46-47K and I’d prefer not to lose that at all.”

Van de Poppe predicts Bitcoin’s long-term bull run will continue into the new year despite recent choppy price action.

“Bull market is still going to continue for Bitcoin.”

Bitcoin is trading at $48,615 at time of writing, down 3% on the day.

As for the rest of the crypto and altcoin markets, Van de Poppe says that the bottom is nearly in.

“Markets to bottom out during this month, as the majority is coming to the conclusion that we aren’t going parabolic now.”

Though he no longer expects altcoins to “go parabolic” in the remaining three weeks of 2021, the trader believes crypto markets will rebound big during Q1, Q2, and Q3 of 2022.

“Big breakout Q1 2022 including alt season… Peak bull cycle Q2/Q3 2022.”

The current crypto market cap is valued at approximately $2.41 trillion, down 3% over the last 24 hours.

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/sdecoret/Vladimir Sazonov

Credit: Source link