On-chain data shows that Bitcoin(BTC) is currently the third-most shorted cryptocurrency ever, while Ethereum(ETH) stands as the second-most shorted.

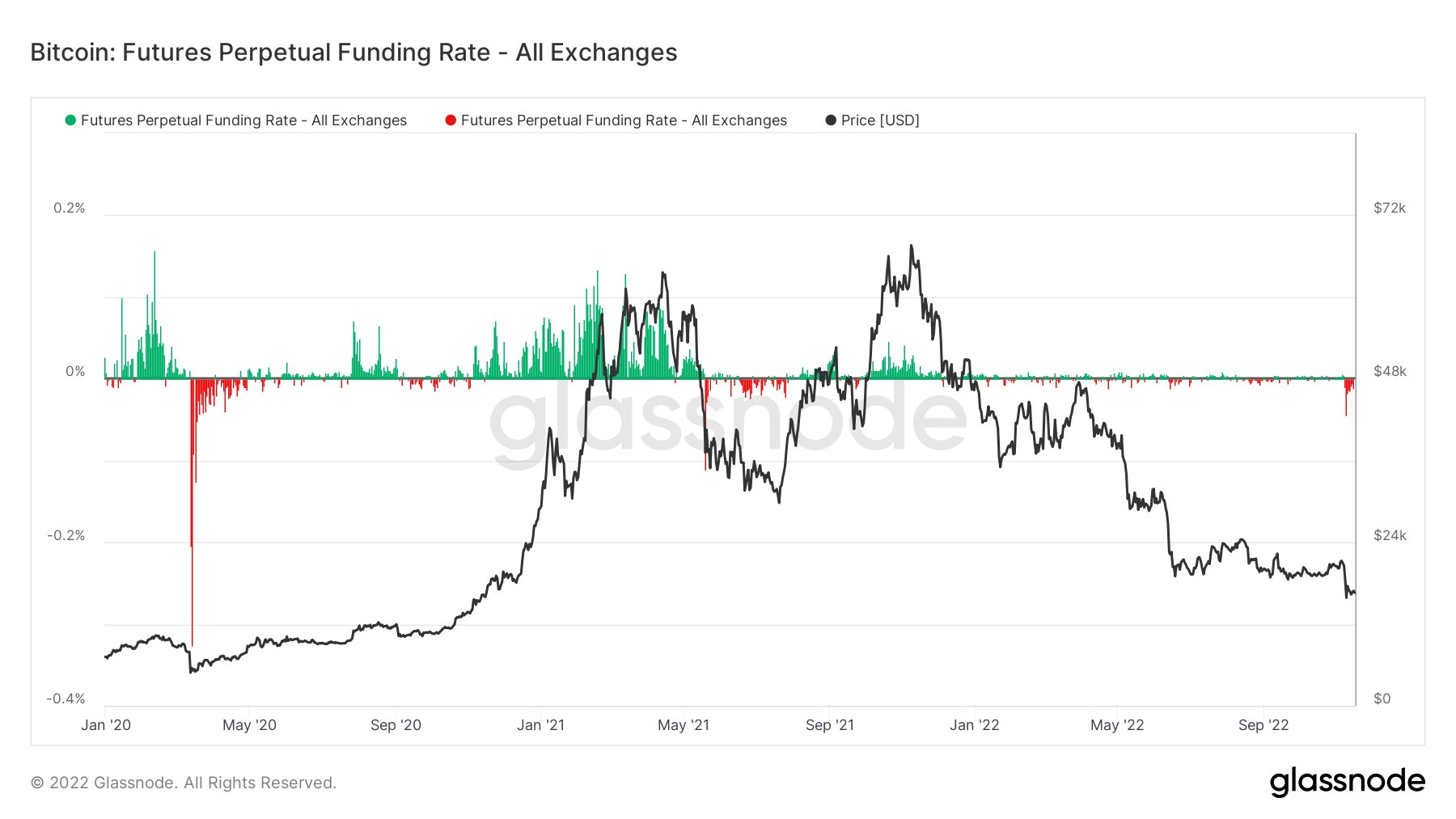

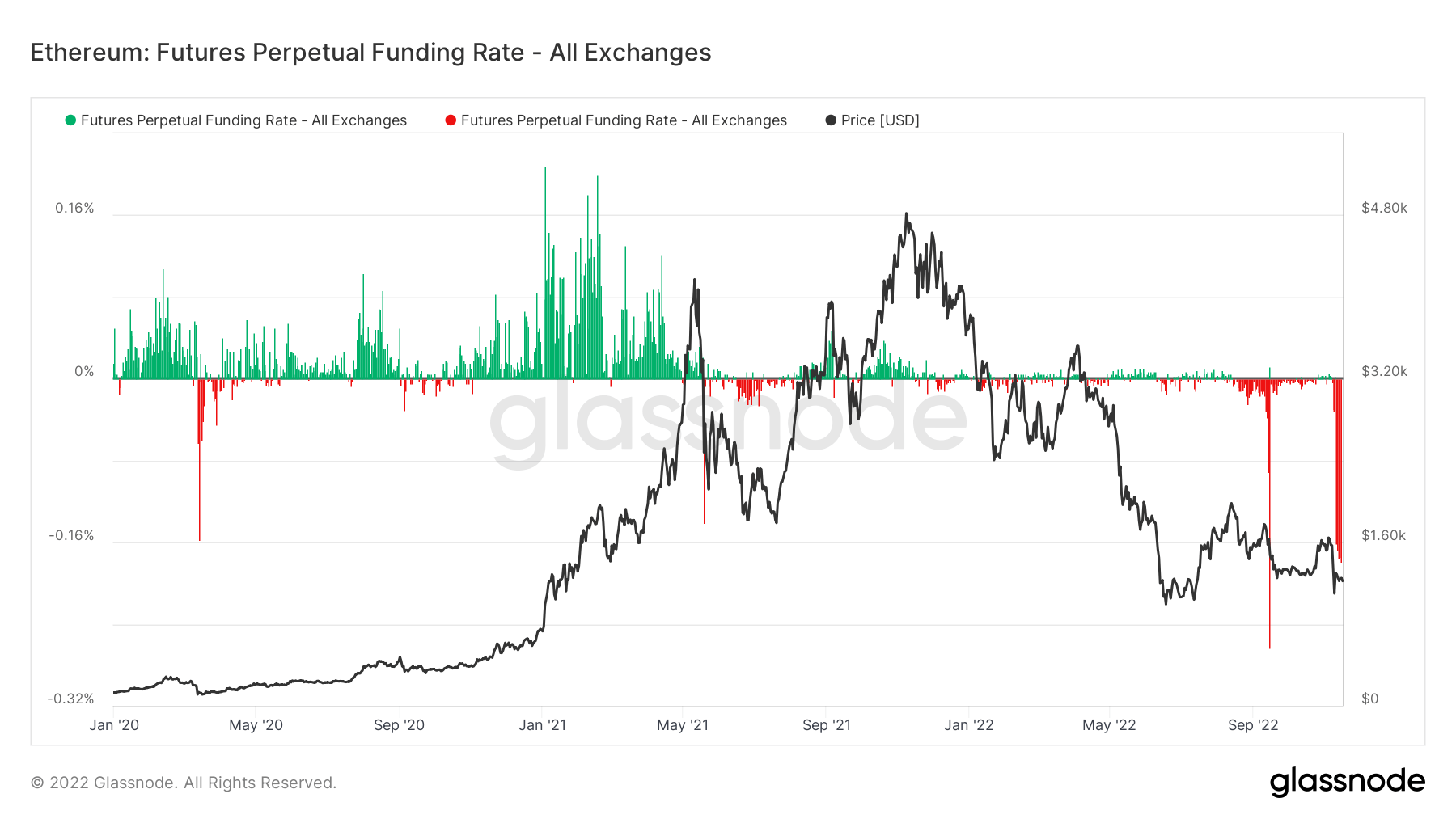

Analyzing the average funding rate (in %) set by exchanges for perpetual futures contracts, it can be observed above that long positions periodically pay short positions whenever the rate percentage becomes positive. On the other hand, when the rate dips towards the negative end of the chart, short positions can be seen to pay long positions periodically.

Events marked a low in the BTC cycle can be observed above in March 2020, Summer 2021, June 2022, and November 2022.

In second place regarding shorting, ETH was likely only shorted more during the Merge event due to the ‘buy the rumor, sell the news’ contagious mentality at the time.

We have seen the steepest dip toward negative funding rates in recent history through September. Despite the decline, the belief that shorting will drag a price to zero often snaps back – forcing buyers to add fuel to the rally.

To confirm this reversal for the times ahead, it is expected that further weeks of deep negative funding will be required before a snap-back event occurs.

Credit: Source link