Ethereum (ETH) has been the talk of the town since it hit its new all-time high at the beginning of the week. The world’s second-largest cryptocurrency spiked to a new all-time high (ATH) of $4,350 even though it has retraced to $4,316 at the time of writing, according to CoinMarketCap.

Ethereum’s remarkable bull run has pushed its market capitalization to the $500 billion level. ETH, therefore, needs to double this value to flip that of Bitcoin, which stands at $1.07 trillion, as alluded to by market analyst Lark Davis.

Moreover, Ethereum’s upward momentum is triggering a rise in Ether and Bitcoin’s implied volatility. The implied volatility spread is usually used as an indicator of upcoming shifts in the market, and it previously stood at 30%. It therefore means that crypto traders might be shifting their primary focus to Ethereum, in comparison with Bitcoin (BTC).

BTC has been struggling to maintain its dominance. It recently dropped to 44%, which is the lowest level it has gotten since 2018.

Ethereum’s journey to $5,000

According to crypto trader Carl Martin tweeting under the pseudonym The Moon:

“Ethereum to $5,000 is a matter of days.”

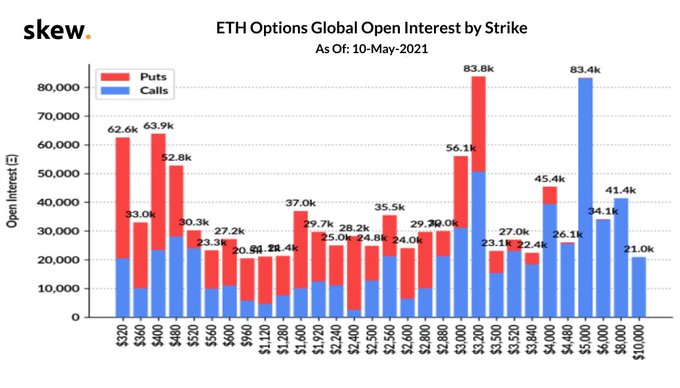

A price surge towards $5,000 is anticipated by many, as acknowledged by Skew. The crypto data provider explained:

“Large ETH open interest building up on $5k strike.”

Ethereum’s bull cycle has been supported by the boom in decentralized finance (DeFi) and non-fungible token (NFT) sectors. Furthermore, the anticipated launch of Ethereum 2.0 has also played a pivotal role in ETH’s uptrend.

More investments continue to trickle in to the Ethereum 2.0 deposit contract as the total value locked has reached a record-high of $18.86 billion, according to data by on-chain metrics provider Glassnode.

Additionally, the number of ETH addresses holding more than 0.01 coins has gotten to an ATH of 15,28 million. As the clock ticks, time will tell whether Ethereum will hit the psychological price of $5,000 soon.

Image source: Shutterstock

Credit: Source link