After hitting an all-time high (ATH) of $4,350 in April, Ethereum (ETH) Tuesday plummeted to lows of $2,000 following the recent crypto market crash.

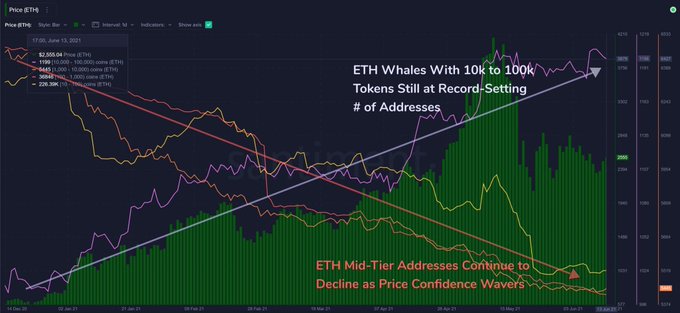

Nevertheless, this price drop seems not to be dampening the spirits of ETH whales because they are still on a record-breaking trend, as acknowledged by Documenting Ethereum. The crypto data provider explained:

“ETH whale addresses are still hovering around an all time high.”

On-chain metrics provider Santiment echoed these sentiments.

“We see that the long-term growth rate of ETH whale addresses with 10k to 100k tokens is staying near AllTimeHighs despite the drop-off from May. Meanwhile, addresses with 10-10k continue falling.”

Ethereum whales are, therefore, bullish in the long term as they continue accumulating more coins.

Meanwhile, famous French DJ David Guetta recently revealed that he would accept the sale of a Miami beachfront apartment worth $14 million in Bitcoin or Ethereum.

23% of ETH supply locked in smart contracts

Documenting Ethereum also disclosed that 23% of ETH supply was locked in smart contracts.

Some features on the Ethereum network, like smart contracts, are widely used in the decentralised finance (DeFi) and non-fungible token (NFT) sectors. This trend has been pivotal in aiding Ethereum’s recent bull run, which saw the psychological price of $4,000 breached.

Furthermore, the launch of ETH 2.0 in December 2020, which seeks to transit the present proof-of-work (POW) consensus mechanism to a proof-of-stake (POS) platform, has driven more participants to the Ethereum network.

POS is seen as a game-changer because it is environmentally friendly and can tackle the high gas fees challenges.

It, however, remains to be seen how ETH plays out in the short term because market analyst Michael van de Poppe recently stated that Ethereum might experience a period of consolidation based on the formation of a crucial support level.

Image source: Shutterstock

Credit: Source link