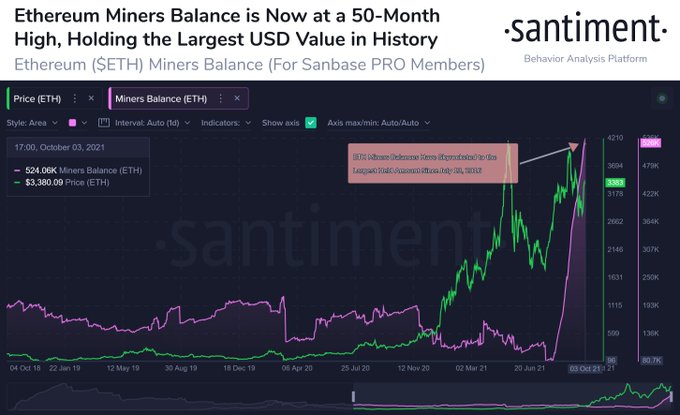

Ethereum (ETH) miners have seen their holdings go through the roof to the tune of $1.85 billion.

Crypto analytic firm Santiment explained:

“Ethereum miner balances have continued to skyrocket. 532.75K ETH is the largest balance held by miners since July 13, 2016. The value of these coins is $1.85B, easily an AllTimeHigh.”

A price surge coupled with increased usage has been instrumental in pushing ETH miner balances to a record high. For instance, Damian Sowers, the founder of Level Frames, recently stated that Ethereum usage was fifty-four times that of Bitcoin as the neck-to-neck battle between the two leading cryptocurrencies continues.

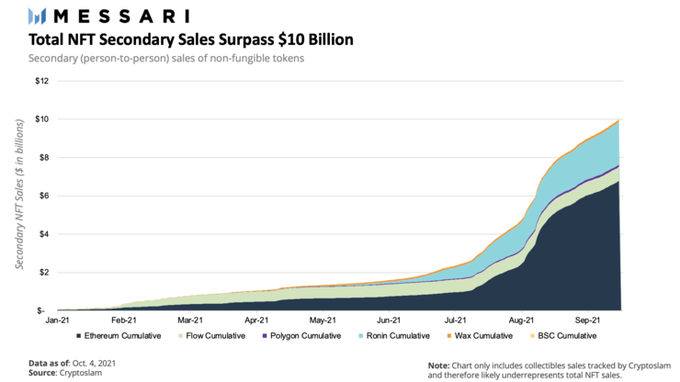

Ethereum enjoys significant NFT dominance

According to Mason Nystrom, a researcher at Messari Crypto:

“The NFT market officially surpassed $10 billion in secondary sales combined across a variety of categories including gaming, PFPs (profile pics), sports, and collectables. Ethereum leads all blockchains and Layer-2s with over $6 billion in secondary NFT sales.”

Therefore, Ethereum has surfaced as the backbone of the NFT sector, which is taking the crypto space by storm.

The non-fungible token (NFT) industry has experienced an uptick in activities, given that the tokens offered are different from the typical ones because of fungibility.

NFTs are blockchain-based ownership digital assets, and their value is pegged on their uniqueness, given that the tokens are non-divisible and have to be bought in their entirety.

As a result, these traits create intrinsic value for NFTs because of their limited supply.

Different industries continue to embrace NFTs, given that they are seen as significant stepping stones towards a virtual-reality world. For instance, leading Italian luxury fashion house Dolce & Gabbana recently sold a nine-piece collection of fashion NFTs dubbed Collezione Genesi for a whopping $6 million.

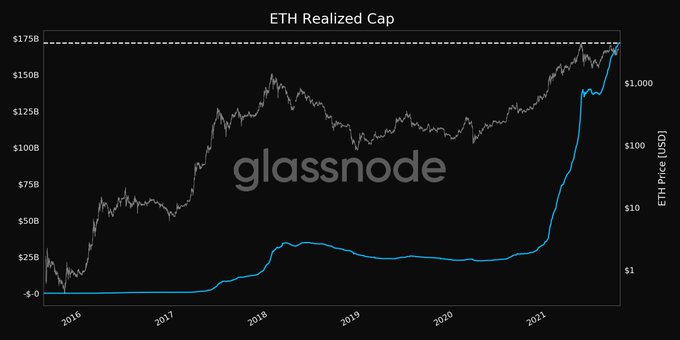

Ethereum realized capitalization scales the heights

According to market insight provider Glassnode:

“Ethereum realized capitalization just reached an ATH of $171,803,527,031.77.”

Realized market capitalization is a metric calculated by valuing each supply unit at the exact price it last moved on-chain or at the last time it was transacted.

As a result, it does not calculate coins that remain unmoved because cryptocurrencies can be lost, unreachable, or unclaimed. This contrasts with the standard market capitalization that values every supply unit evenly at the current market price.

Image source: Shutterstock

Credit: Source link