The well-known whistleblower Edward Snowden recently attacked Gary Gensler, the Chair of the United States Securities and Exchange Commission (SEC), for a serious error that included a deceptive statement concerning the approval of a Bitcoin spot Exchange-Traded Fund (ETF). Gensler was accused of making the announcement in a way that was inaccurate. Because of this occurrence, concerns have been raised about the legitimacy of the Securities and Exchange Commission (SEC), as well as worries regarding market manipulation and cybersecurity inside the regulating organization.

In the beginning of the dispute, the official Twitter account of the Securities and Exchange Commission (SEC) was hacked, which resulted in the dissemination of false information saying that the SEC had authorized Bitcoin spot ETFs for listing and trading. This unlawful tweet, which was seen millions of times before it was removed, produced a significant change in the price of Bitcoin, which surged for a brief period of time before witnessing a steep decrease.

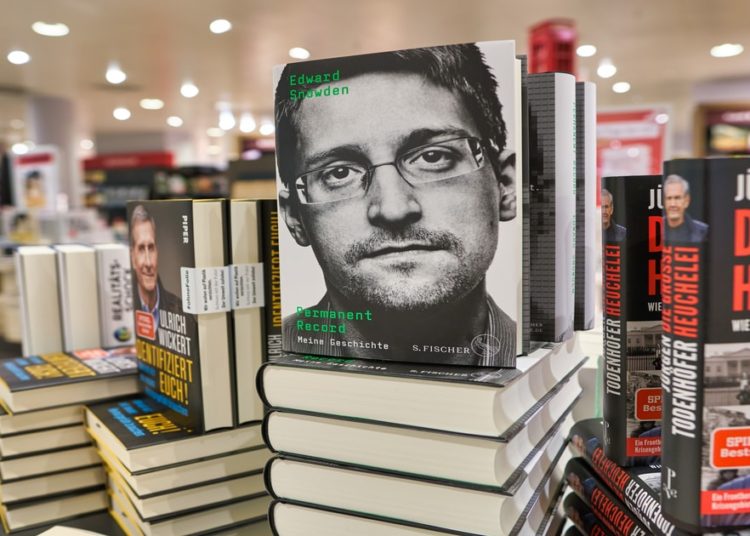

Snowden, who is now staying in Russia and is sought in the United States on accusations of espionage, turned to his official account to voice his dissatisfaction with Gensler. He said, “Jesus Christ Gary, get your shit together” and “You had one job.” The statements that he made are reflective of a more widespread feeling among crypto aficionados and executives on Wall Street who have questioned Gensler’s approach to regulatory policy. According to many who are familiar with the business, Gensler is notorious for his heavy-handed approach to crypto regulation, often going beyond the scope of his legislative power.

These events have brought to light the problematic position that the Securities and Exchange Commission (SEC) plays in the cryptocurrency business. Many people have accused the SEC of exceeding its jurisdiction and blurring the borders of its mandate. Furthermore, the hacking event has brought attention to the cybersecurity procedures that the SEC has implemented, which have recently been reinforced to compel regulated firms to report important cybersecurity incidents and tactics.

It was part of a bigger narrative in which the Securities and Exchange Commission (SEC) has been preparing for a significant announcement on the approval of Bitcoin spot ETFs. The bogus statement about Bitcoin ETFs was a part of this larger narrative. This permission is a significant step toward the development of the cryptocurrency market, which is already worth $1.7 trillion and has the potential to attract millions of individual investors. Regarding the timetable and the certainty of these approvals, however, doubts have been raised as a result of the event and the reaction from the SEC.

Source: X

In general, the event not only had an impact on the price of Bitcoin on the market, but it also brought up substantial concerns over the SEC’s capacity to handle sensitive information and to keep the market stable. While the industry waits for the SEC to make a judgment about spot Bitcoin exchange-traded funds (ETFs), the legitimacy and methodology of the regulatory body continue to be scrutinized.

At the time of writing, Edward Snowden has deleted his tweet criticizing the SEC and its Chair Gary Gensler, adding another layer of complexity to the unfolding narrative around this cybersecurity breach and its ramifications in the crypto market.

Image source: Shutterstock

Credit: Source link