In this article, we will introduce the cryptocurrency tax software Crypto Tax Calculator and examine it to see if it’s a trustworthy and safe option.

What’s Crypto Tax Calculator

Crypto Tax Calculator is a software tool allowing users to calculate taxes on virtual currency trading activity. The platform supports more than 100 exchanges, a variety of DeFi protocols, and is one of the few currently in existence accurately supporting Binance Smart Chain and NFTs.

Founder Shane Brunette devised Crypto Tax Calculator after running into trouble calculating taxes after the 2017 ICO boom.

He found the services of a crypto accountant too expensive, but could not find software that could accurately categorize a large amount of complex Ethereum-based transactions.

Photo: Crypto Tax Calculator Website

Turning to a software engineering background, he launched Crypto Tax Calculator in 2018, according to an interview, and later brought his brother Tim as Chief Technical Officer.

A Unique And Popular Pricing Structure

Many other cryptocurrency tax software platforms charge by report. This means users trying to catch up on their taxes or who want to see data from past years would have to pay for multiple reports.

Since Crypto Tax Calculator just charges a flat yearly subscription fee, a user can access all financial year reports. This structure is a large advantage for people who need multiple years of crypto tax data or who might not have enough money to pay for individual year reports.

Photo: Crypto Tax Calculator Website

Currently, CryptoTaxCalculator single-year plans cover all tax years from 2013-2021. The four tiers include Rookie ($49 yearly), Hobbyist ($99), Investor ($189), Trader ($299). The Rookie plan covers up to 100 transactions while the Investor can handle up to 10,000. Those who buy the Trader plan can receive support for up to 100,000 transactions and compare different tax strategies.

According to the website, Crypto Tax Calculator offers a free trial and advertises a 30 day, 100% money-back guarantee for those who are willing to speak with the support team.

Is Crypto Tax Calculator Trustworthy And User Friendly?

The Crypto Tax Calculator website is simple and easy to understand. It walks through users on the platform’s features, pricing, FAQs about crypto taxes and Crypto Tax Calculator, and offers information on Terms of Service and the Privacy Policy.

In regard to security, Crypto Tax Calculator makes it clear how it collects and uses personal information. While it does not specifically list steps taken to ensure security, the website does note it takes security “extremely seriously.” Crypto Tax Calculator says users should be careful and not share important information like private wallets or API keys that enable the withdrawal of funds.

The platform’s user-friendliness looks to be enhanced by a variety of support options. Users can email the Crypto Tax Calculator team, message via live chat, or reach out on social media platforms like Facebook and Twitter.

Overall, Crypto Tax Calculator is comprehensive about the service it provides and does a good job educating users about cryptocurrency taxes and what they can expect. The platform has not had any security breaches and the website is easy to navigate and understand.

Hot to use Crypto Tax Calculator

Getting started on Crypto Tax Calculator is pretty simple. A user simply heads to the signup page to make an account by giving an email address and password.

Photo: Crypto Tax Calculator Website

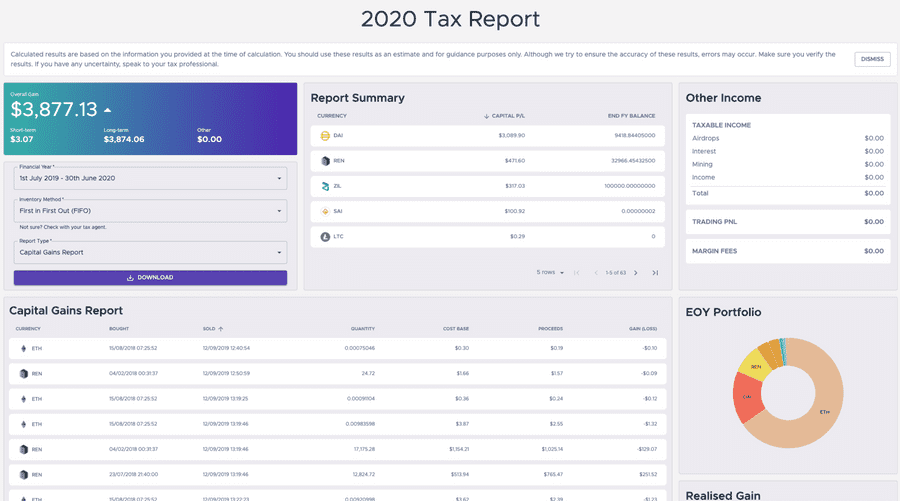

After logging in, a user connects their exchange data and/or public wallet address to let Crypto Tax Calculator’s algorithms import and categorize transactions. Information can also be uploaded via API or CSV.

Crypto Tax Calculator users can then generate tax reports and overviews to give to an accountant or use the information to do their own taxes. The reports page looks pretty comprehensive with charts, graphs, and other accounting tools. The website has a searchable list of all supported exchanges. Well-known options include Binance, Coinbase, Deribit, Huobi, Poloniex, and the Uniswap DEX.

Right now, Crypto Tax Calculator can be used by crypto holders in several nations. Supported countries include the United States, Australia, the United Kingdom, and Canada, according to the website.

Other supported nations mostly include Western European countries and a few in other parts of the world, like South Africa, New Zealand, Japan, and Singapore. Notebly, it looks to be one of the few tax software platforms available right now for Australians.

Photo: Crypto Tax Calculator Website

Conclusion

Our review of Crypto Tax Calculator shows the platform is easy to use, pretty simple to understand, and can save crypto holders a lot of time and energy instead of trying to figure out crypto taxes on their own.

The team seems very intent on adding support for new protocols and financial instruments as fast as possible, which is a huge plus in a rapidly expanding and complex crypto ecosystem (especially as DeFi grows). Overall, Crypto Tax Calculator looks like an effective platform for those looking for online software to help calculate tax obligations.

Credit: Source link