Cryptocurrency markets have dropped significantly in value during the last 24 hours as the entire market capitalization of all 10,000 crypto assets in existence has dropped below the $3 trillion mark to $2.77 trillion on Tuesday morning (EST). After tapping $66K on Monday, bitcoin’s price slid below the $60K handle to a low of $58,563 per unit. After the steep fall, bitcoin’s price has recovered some losses, rising back above the $60K range and has started to show some consolidation.

Bitcoin, Ethereum, Top Cryptos See Double-Digit Losses in 24 Hours

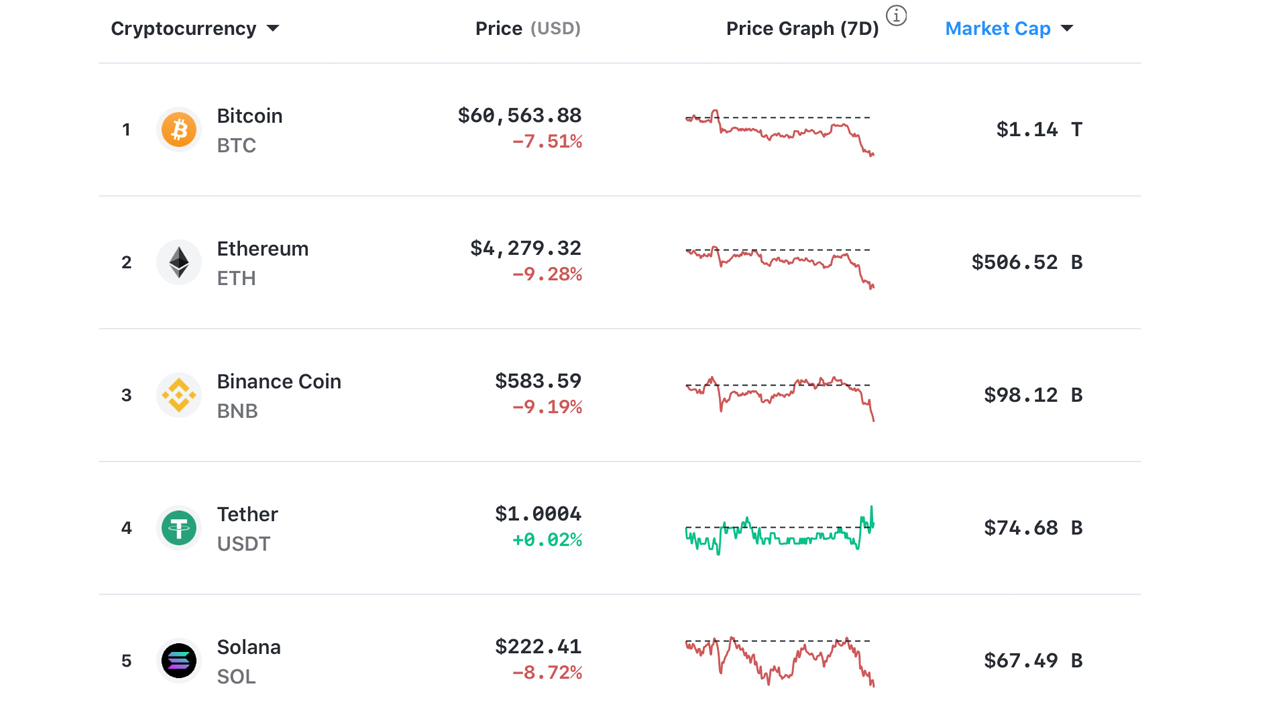

Digital currencies are down in value on Tuesday as the market capitalization of the entire crypto-economy shed billions during the last 24 hours. Bitcoin (BTC) is down 7.5% during the last day and has fallen 10.2% for the week.

At the time of writing, BTC is swapping for $60,563 per unit and has an overall market valuation of $1.14 trillion. BTC has $48 billion in 24-hour trade volume on Tuesday and 52.43% of those trades are paired with tether (USDT). This is followed by USD (18.75%), BUSD (6.61%), JPY (4.79%), EUR (4.45%), and KRW (2.70%).

Bitcoin’s drop from the $66K handle to just above $60K has also caused the myriad of alternative crypto asset markets to falter. Ethereum (ETH) has shed 9.2% during the overnight, and weekly stats show ether has lost 11.6%. While BTC has a dominance score of 41.5%, ethereum’s market is 18.3% of the entire crypto economy. Most digital currency markets suffered decent losses but coins like ecomi (OMI), nexo (NEXO), huobi token (HT), wonderland (TIME), and helium (HNT) have seen very little losses.

However, crypto assets like spell token (SPELL), kucoin token (KCS), near (NEAR), kadena (KDA), arweave (AR), dash (DASH), and zcash (ZEC) have lost between 15% to as high as 22.4% during the last day.

Ark36 Executive: ‘Drop Results in a Leverage Shakeout Which Contributes to a Healthier Market’

Meanwhile, as bitcoin, ethereum, and a slew of crypto markets suffer deep losses, the crypto assets hedge fund Ark36 executive Mikkel Morch told Bitcoin.com News that the drawdown is normal.

“Yet again, bitcoin has done what it does best – defy expectations,” Morch said. “After hitting an all-time high near the 69K level last week, the overall investor expectation was that the trend would immediately continue. Instead, we saw a largely sideways trend culminating in an almost 8% drop yesterday. Such a price decrease may seem disappointing or even concerning given the sweeping wave of enthusiasm the markets experienced just last week.” Morch continued:

However, it is vital to remember that an 8% drawdown is considered a normal market move in the crypto markets. At the moment, the overall bullish market structure remains largely intact. In fact, a sudden price drop results in a leverage shakeout which contributes to a healthier market that is better set up for an uptrend continuation in the medium term.

Huobi Global: Indicators Show ‘High Bearish Sentiment in the Market’

Bitcoin market fundamentals from Huobi Global indicate that there are many factors that show market sentiment is currently bearish. “All EMAs steeply downward, Bollinger band opening significantly expanded, the current indicators are indicating a high bearish sentiment in the market,” Huobi Global told Bitcoin.com News on Tuesday morning. “From the daily level, BTC is now in a long negative line, the short-term uptrend has broken, daily volume is enlarged, the short-term trend may continue to move downward, pay attention to the support below,” Huobi added.

In a similar market outlook report, Huobi noted that ethereum (ETH) market signals also indicate a “high bearish sentiment in the market.” ETH/USD chart indicators using a 4-hour time frame show EMAs and the K-line are all running downhill. “From a daily perspective, the upside channel of ETH may be broken, and this retracement falls below the short-term support level, and the follow-up continues to look for whether there is effective support below,” Huobi Global’s bitcoin and ethereum market outlook concluded.

What do you think about the downturn in crypto markets and the crypto economy shedding billions during the last 24 hours? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, markets.bitcoin.com, tradingview,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link