New data from crypto analytics firm Messari reveals that money is pouring into crypto projects in defiance of falling markets.

According to a new report compiled with fundraising tracker Dove Metrics, Messari shows that crypto firms raised over $30 billion in nearly 1,200 rounds during the first half of 2022.

The report highlights several key sectors of the industry as receiving massive cash infusions despite the bear market, which has kept investors frustrated since last November.

Messari’s senior research analyst Thomas Dunleavy provides more details about the survey, first noting that,

“The biggest highlight: despite the bear market there was more invested in H1 2022 than all of 2021.”

Dunleavy next dives into several crypto niches, starting with decentralized finance (DeFi) and the affiliated decentralized exchanges (DEXs).

“Despite an epically rough May, deals accelerated for DeFi in June. DEXs led the way.

The majority of deals and dollars raised was on Ethereum-based ecosystems.”

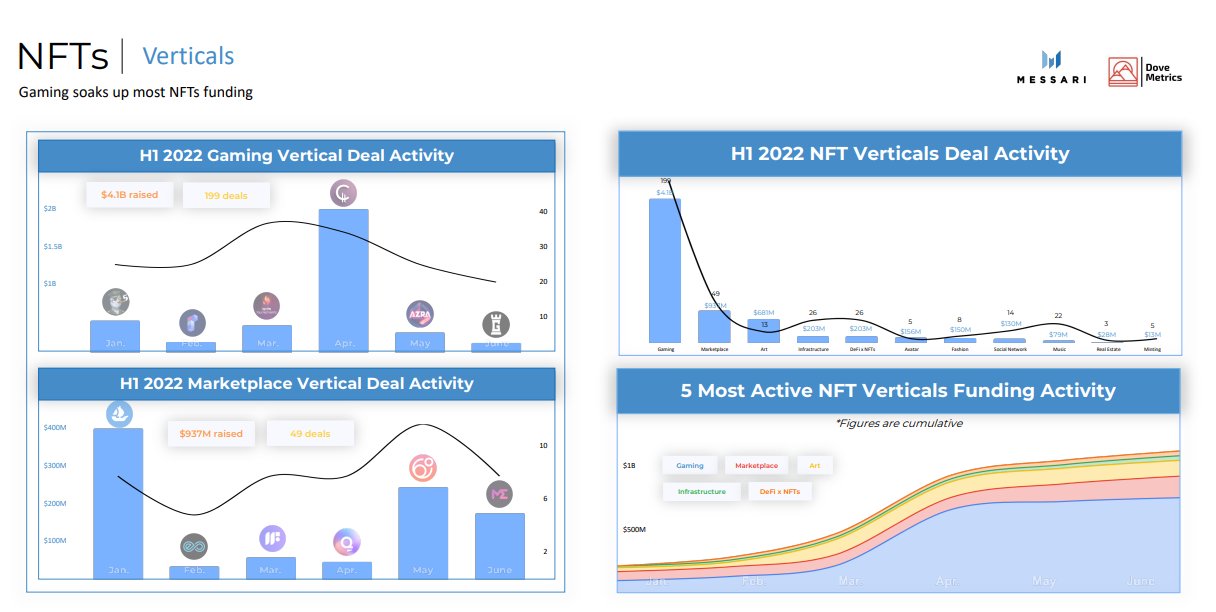

Also seeing a significant boost in funding was the non-fungible token (NFT) niche, which focuses both on unique digital art pieces as well as assets for blockchain-based video games.

“Gaming got $4 billion in funding, dwarfing all other segments.

Most of the deal volume was on Ethereum but money actually skewed towards other chains.”

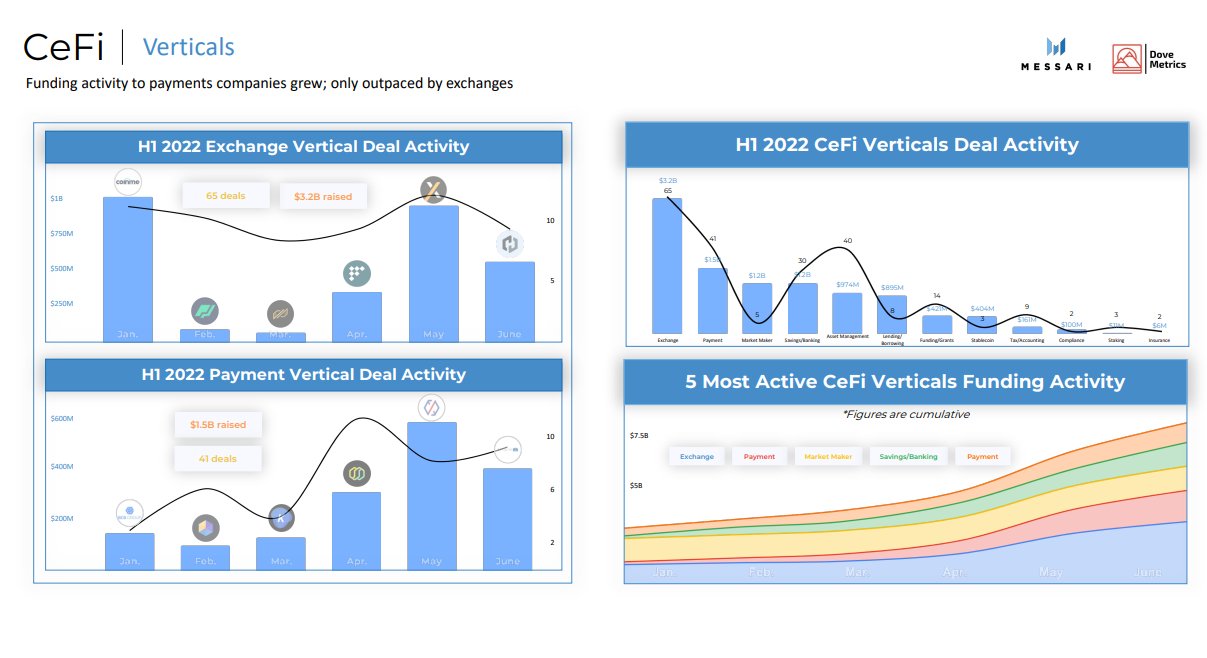

When it comes to centralized finance (CeFi), Dunleavy says the sector captured about a third of the funds raised in the first half of the year.

“CeFi exchanges led the way here as well. CeFi brought in $10.3 billion in the first six months of the year, with almost half of all funding rounds totaling more than $10 million.”

In addition to the nearly $20 billion the preceding three sectors raised, general blockchain infrastructure accounted for $9.7 billion in capital raised during the first six months of 2022.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/eliahinsomnia

Credit: Source link