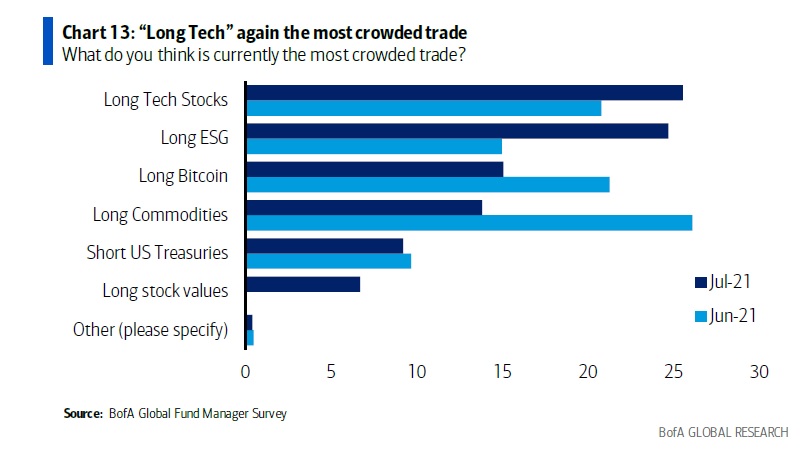

Bank of America’s latest global fund manager survey shows that “long bitcoin” is now the third most crowded trade. The most crowded trade is now “long tech stocks,” followed by “long ESG.”

Bank of America’s global fund manager survey for July, published Tuesday, shows that “long bitcoin” has fallen to third place among the most crowded trades. The Global Fund Manager Survey is Bank of America Securities’ monthly report that canvasses the views of approximately 200 institutional, mutual, and hedge fund managers around the world.

The most crowded trade is now “long tech stocks,” followed by “long ESG,” and “long bitcoin.” “Long commodities” has fallen to fourth place from being the most crowded trade last month.

The surveyed fund managers in July were much less bullish over growth, earnings, and inflation compared to earlier in the year, Bank of America’s survey shows. Overall, 74% of fund managers still expect growth and inflation to be “above trend.”

“Long bitcoin” was the most crowded trade in May when “long tech stocks” came second, followed by “long ESG.” In June, “long commodities” overtook “long bitcoin” as the most crowded trade, leaving the cryptocurrency trade in second place. “Long tech stocks” ranked third and “long ESG” fourth at the time.

Meanwhile, Bank of America has established a cryptocurrency research team, according to the bank’s internal memo. “We are uniquely positioned to provide thought leadership due to our strong industry research analysis, market-leading global payments platform, and our blockchain expertise,” the bank said last week. Bank of America also recently released a report stating that digital currency “could boost economic growth” in developing countries.

What do you think about tech stocks and ESG overtaking bitcoin as the most crowded trades in the new Bank of America survey? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bank of America

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link