- While Bitcoin mining difficulty is slated to continue rising until the last block is discovered, over 100 years to come, miners’ effect will remain significant in the BTC ecosystem.

- The state of the crypto market has induced some fears in Bitcoin miners who are selling all the freshly minted coins and some from their treasuries.

Bitcoin mining difficulty – a measure of how computers struggle to obtain rewards for the next BTC block – has scaled to an all-time high (ATH), 36,950,494,067,222. According to on-chain data, the total hashrate produced by all Bitcoin miners globally stands at approximately 240.68 Exahashes/s. Nonetheless, Bitcoin price is showing weaknesses of possible further decline. Moreover, Glassnode data shows increased selling pressure from Bitcoin miners, who sold over 8k Bitcoins following the FTX fallout.

Consequently, miners’ balance treasuries read approximately 78k Bitcoins, according to Glassnode. Thereby obliterating all gains made from January through October.

#Bitcoin miner Hash Price has plunged to a new all-time low of $58.3k per Exahash per day.

With $BTC prices now down over 76% from the peak, the mining industry remains under immense pressure.

Live Dashboard: https://t.co/64jyX7mRzj pic.twitter.com/z692xIFU7k

— glassnode (@glassnode) November 18, 2022

The FTX fallout has significantly affected the overall credibility of the cryptocurrency and blockchain industry, especially on centralized exchanges. Notably, on-chain data has shown a significant migration of crypto traders from centralized exchanges to DEXs in the past few weeks. As such, Bitcoin price has continued to shrink, hereby pushing miners to lower revenues under tight markets.

Following the collapse of FTX, #Bitcoin investors have been withdrawing coins to self-custody at a historic rate of 106k $BTC/month.

This compares with only three other times:

– Apr 2020

– Nov 2020

– June-July 2022https://t.co/92aYVYU4Yt pic.twitter.com/em7CsDBWUf— glassnode (@glassnode) November 13, 2022

While Bitcoin mining difficulty is slated to continue rising until the last block is discovered, over 100 years to come, miners’ effect will remain significant in the BTC ecosystem. The pressure coupled with the general sentiments of the falling crypto trend, Bitcoin price is expected to perform poorly this year’s fourth quarter compared to prior years.

A closer look at Bitcoin and crypto market outlook

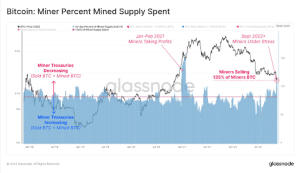

The state of the crypto market has induced some fears in Bitcoin miners who are selling all the freshly minted coins and extra from their treasuries. According to Glassnode, Bitcoin miners are currently spending at a rate of 135 percent of the daily issued coins.

From the above graph by Glassnode, it is evident that Bitcoin miners are on a selling spree during bull markets. However, the ongoing crypto winter has pushed miners to offload their treasuries to keep running. Moreover, the rising cost of living attributed to high global inflation has significantly cut down Bitcoin miners’ revenues.

Additionally, the fast-changing phases of Bitcoin mining hardware has significantly hampered miners’ revenues over time.

As countries recuperate from Covid-19’s devastations, the cryptocurrency and blockchain industries have been cited as key components of future economies. As such, different countries are looking into ways the crypto market can benefit their respective economies.

The CBDC and stablecoins market has been a major attraction sector for most global regulators. As a result, market strategists are confident that cryptocurrency and blockchain technologies will be part of human civilization for a long time.

Credit: Source link