Crypto analytics platform Santiment says that one metric is indicating a potential rally for Bitcoin (BTC) on the horizon.

Santiment says that after the 0.25% rate hike by the Federal Open Market Committee (FOMC) earlier this week, Bitcoin is dominating discussions on social media platforms at the expense of other crypto assets.

According to the firm, Bitcoin’s social dominance indicates “fear” and this could potentially trigger an upward move in its price.

“The ratio of discussions related to Bitcoin vs. other top 100 assets has surged following the FOMC hiking rates, and BTC teasing $30,000 once again. Generally, this high social dominance is a sign of fear, increasing the likelihood of a price rise.”

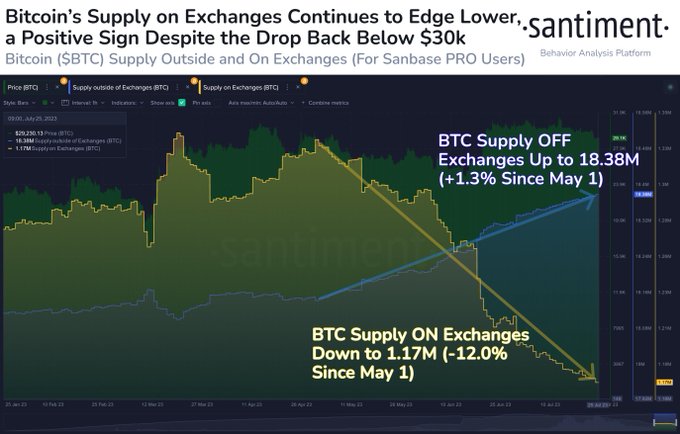

According to Santiment, the supply of Bitcoin on exchanges has fallen to a 55-month low, which is in itself another positive sign for the flagship crypto asset.

“Bitcoin’s supply on exchanges continues to move into self custody, and the drop below $30,000 last week hasn’t triggered severe reactions that would indicate fear, uncertainty and doubt (FUD) or more upcoming sell-offs. The 1.17 million BTC on exchanges is the least amount since November of 2018.”

Bitcoin is trading at $29,218 at time of writing.

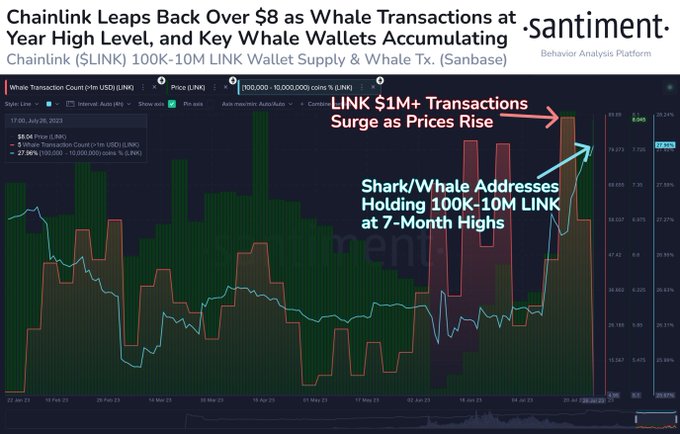

Looking at blockchain oracle Chainlink (LINK), Santiment says that whales are heavily accumulating the 22nd-largest crypto asset by market cap.

“Chainlink has jumped ahead of the altcoin pack Thursday. And prices appear to be powered by heavy whale accumulation, with the highest amount of transactions valued at $1 million+ this year. Wallets holding 100,000 – 10 million LINK are accumulating rapidly as well.”

LINK is worth $7.82 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Credit: Source link