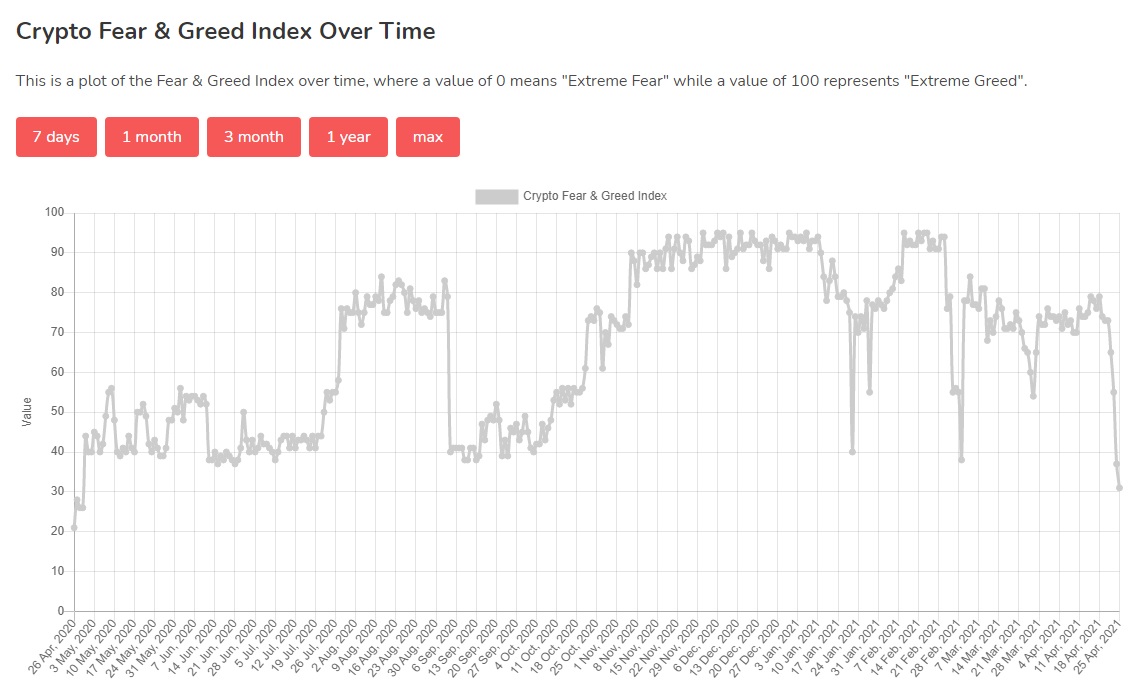

The “Crypto Fear and Greed Index,” a collective metric that measures current sentiments on the cryptocurrency market, swiftly swung from “Extreme Greed” (79 points) last week to “Fear” (31) today as most digital assets continue to wallow in the red zone.

Today’s Cryptocurrency Fear And Greed Index: 31

Ranking: Fear#Crypto #Bitcoin #Ethereum

— Crypto Fear And Greed Bot (@FearAndGreedBot) April 25, 2021

The index takes into account various aspects such as volatility, the market’s momentum and trading volumes, social media sentiments, trends, and so on. The metric scales from 0 (maximum “Fear”) to 100 (ultimate “Greed”).

Essentially, the “Crypto Fear and Greed Index” reflects the attitude of the majority of crypto enthusiasts. When it goes into the “Fear” territory, this means that prices of digital assets are likely going down and users are selling their crypto en masse.

Similarly, a high “Greed” usually accompanies strong price rallies as demand for crypto outweighs supply, propelling its value up. While not conclusive in any sense, the index can nonetheless help traders to navigate the treacherous waters of cryptocurrency markets.

Biden’s tax scare

The latest fear cycle on the crypto market was caused by the ongoing price decline across the board following rumors about potential tax law amendments in the U.S. As CryptoSlate reported, sources close to the Biden administration reported on Thursday that policymakers are planning to increase taxes for wealthy investors to as much as 43.5% for gains above $1 million.

This resulted in massive sell-offs across stocks and commodity markets, followed by digital assets as well. At press time, most cryptocurrencies are still trading in the red zone. However, the market has somewhat stabilized over the past couple of days as Bitcoin hovers around $50,000 (down from about $57,500 on Monday).

Sunday Survey:

Where will #Bitcoin bottom before we see the ATH again?

— Jimmy Song (송재준) (@jimmysong) April 25, 2021

Meanwhile, according to the “Crypto Fear and Greed Index” website, such levels of fear around 30 points have not been seen since April 2020—soon after Bitcoin plunged to $5,000 from $10,000 amid the coronavirus outbreak.

Further fueling the panic, Scott Minerd, chief investment officer at Guggenheim Partners, said oт Friday that Bitcoin could see a 50% drop in the near term because it ran “too far, too fast.”

“I think we could pull back to $20,000 to $30,000 on Bitcoin, which would be a 50% decline, but the interesting thing about Bitcoin is we’ve seen these kinds of declines before,” Minerd explained, adding that this would be “the normal evolution in what is a longer-term bull market.”

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link