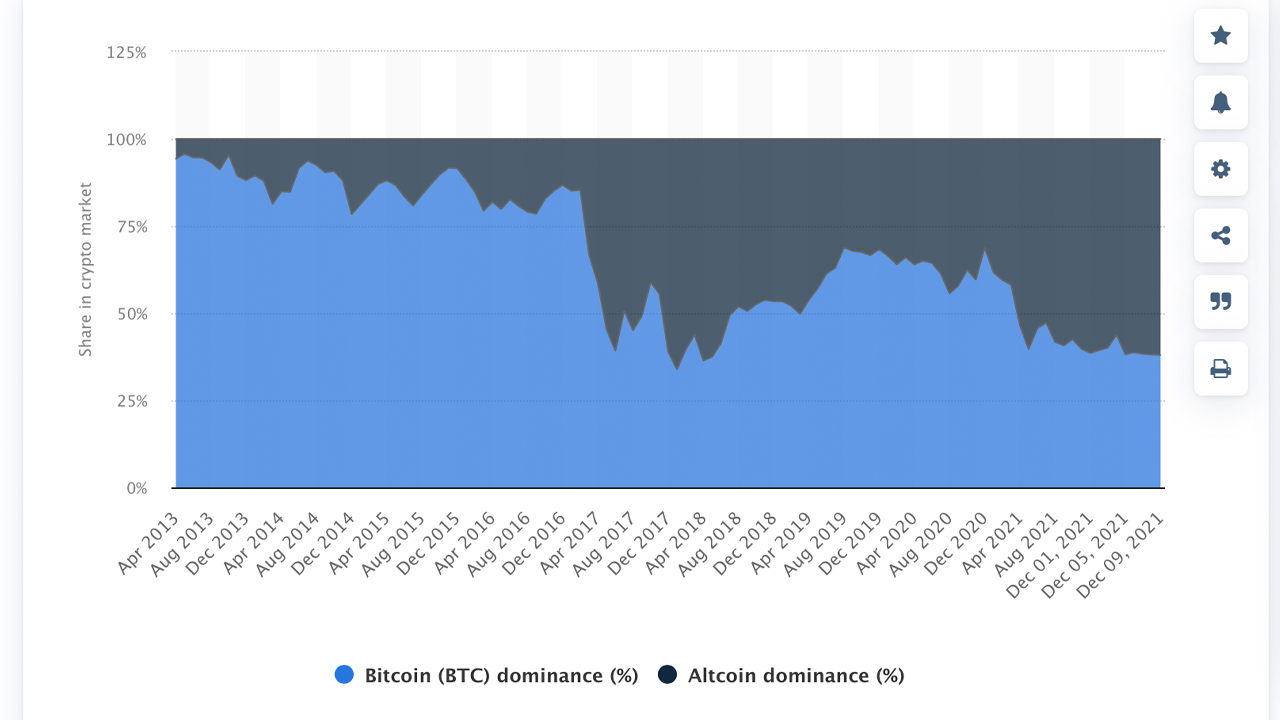

Bitcoin dominance has dropped to the lowest level in just over three and a half years since June 3, 2018, at 37%. Last year, at the end of March, bitcoin dominance hovered just above the 60% zone but since then, numerous digital asset market caps have swelled in value and gathered prominence in the market rankings along the way.

Bitcoin Dominance Dips Below 38%

The crypto economy currently has roughly 12,247 crypto assets traded across 542 exchanges worldwide. Crypto markets have shed more than 7% over the last 24 hours, dropping to a low of $2.16 trillion by 8:00 a.m. (EST).

While people measure the individual crypto market capitalizations regularly, bitcoin’s market valuation dominance, compared to the rest of the capitalizations, has been measured since the existence of multiple crypto markets.

During the first few years, BTC dominance was well above the 90% range, in terms of market capitalization dominance. Dominance was recorded more so during the month of May 2013, and at that time, BTC dominance was 94%.

This was measured against crypto assets like namecoin, novacoin, litecoin, terracoin, feathercoin, and freicoin. Between May 2013 and February 2017, bitcoin’s market dominance remained above 80%.

However, since February 26, 2017, bitcoin has not been able to jump back above the 80% zone and has only managed to get as high as 70% just over a year ago, last January.

11 Coins Besides Bitcoin and Ethereum Command Over 20% of the Crypto Economy

BTC’s dominance is currently coasting along at 37.7% while ethereum (ETH) commands 18.6%. While ethereum is a formidable foe, many other crypto caps have been moving in on bitcoin’s dominance territory.

Tether, binance coin, solana, usd coin, cardano, and xrp command more than 15% of the $2.18 trillion crypto economy. The aforementioned coins, plus terra, polkadot, avalanche, dogecoin, and shiba inu equate to 20.63% of the crypto economy.

All of these coins, including ethereum and removing SHIB, hold more than 1% or more in crypto market valuation dominance. Since January 2021, when BTC’s dominance was 70%, a myriad of altcoins have been nipping at bitcoin’s market cap heels.

What do you think about bitcoin’s low dominance levels today? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Statista,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link