Bitcoin (BTC) recently achieved a significant milestone of setting a new all-time high (ATH) price at the $66,900 level after 189 days of waiting. Nevertheless, the leading cryptocurrency is facing a correction, having retraced to the $63,349 area during intraday trading, according to CoinMarketCap.

Despite this trend, holders remain unperturbed if history is to repeat itself. Lucas Outumuro, the head of research at IntoTheBlock, explained:

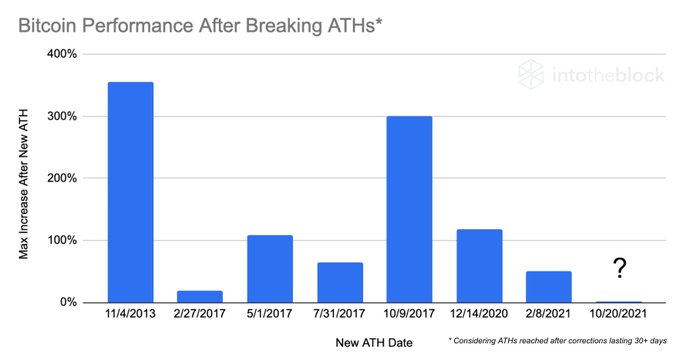

“Is Bitcoin facing a deeper correction? Unlikely. Historically after breaking an ATH following a correction of 30+ days, BTC proceeds to increase by 145% on average hodlers remain unfazed by the recent dip.”

Santiment believes that this retracement has sparked both positive and negative reactions. The on-chain metrics provider noted:

“Spirits remain quite high, and the pattern of overwhelmingly positive vs. negative BTC commentary has continued for a 9th straight week.”

Consultancy and educational platform Eight recently stated that Bitcoin was testing its previous record high level of $64.8K. If a bounce happens, the next areas to watch are around $75K, $87K, and $96K based on the Fibonacci retracement tool.

How different is the current ATH price compared to the previous one?

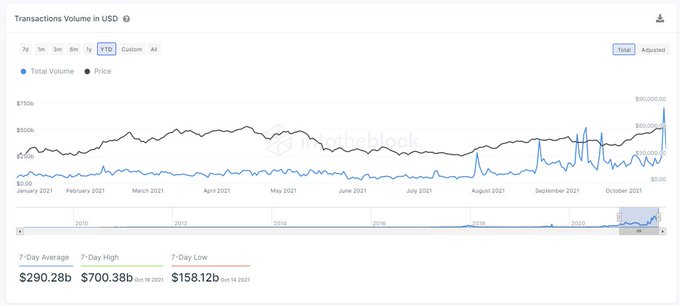

Data analytic firm IntoTheBlock disclosed that the current transaction volume is seven times the one recorded in April. Furthermore, the current record high price has been attained with less retail interest and lower speculation.

IntoTheBlock pointed out:

“What’s different between April’s Bitcoin ATH and this one? 1. Transactional Volume: Bitcoin has recorded this week +$700b in on-chain volume transacted. This is a 7x increase compared to April. More interesting, 99.7% of that volume comes from transactions greater than $100k.”

These large transactions have been showing the trickling of big money in recent months.

Image source: Shutterstock

Credit: Source link