After a long wick down to the $42,000 level, Bitcoin looks to have consolidated above the strong support of $47,000. With a possible BTC recovery on the cards, now could be a good time to start cautiously buying into the strong fundamental altcoins.

Bitcoin’s latest correction, down around 39% from its all-time-high of $69,000, has done a lot to reset what was an extremely overheated market. Rampant leverage has been crushed and large numbers of what were probably inexperienced retail hands were shaken out of the market.

That’s not to say that we may not experience one more leg down to $40,000, which would be extremely likely to spell massive capitulation. However, as far as some of the strong alts are concerned, they are bottoming out on a lot of the most significant indicators, and look ready for some more serious dollar cost averaging.

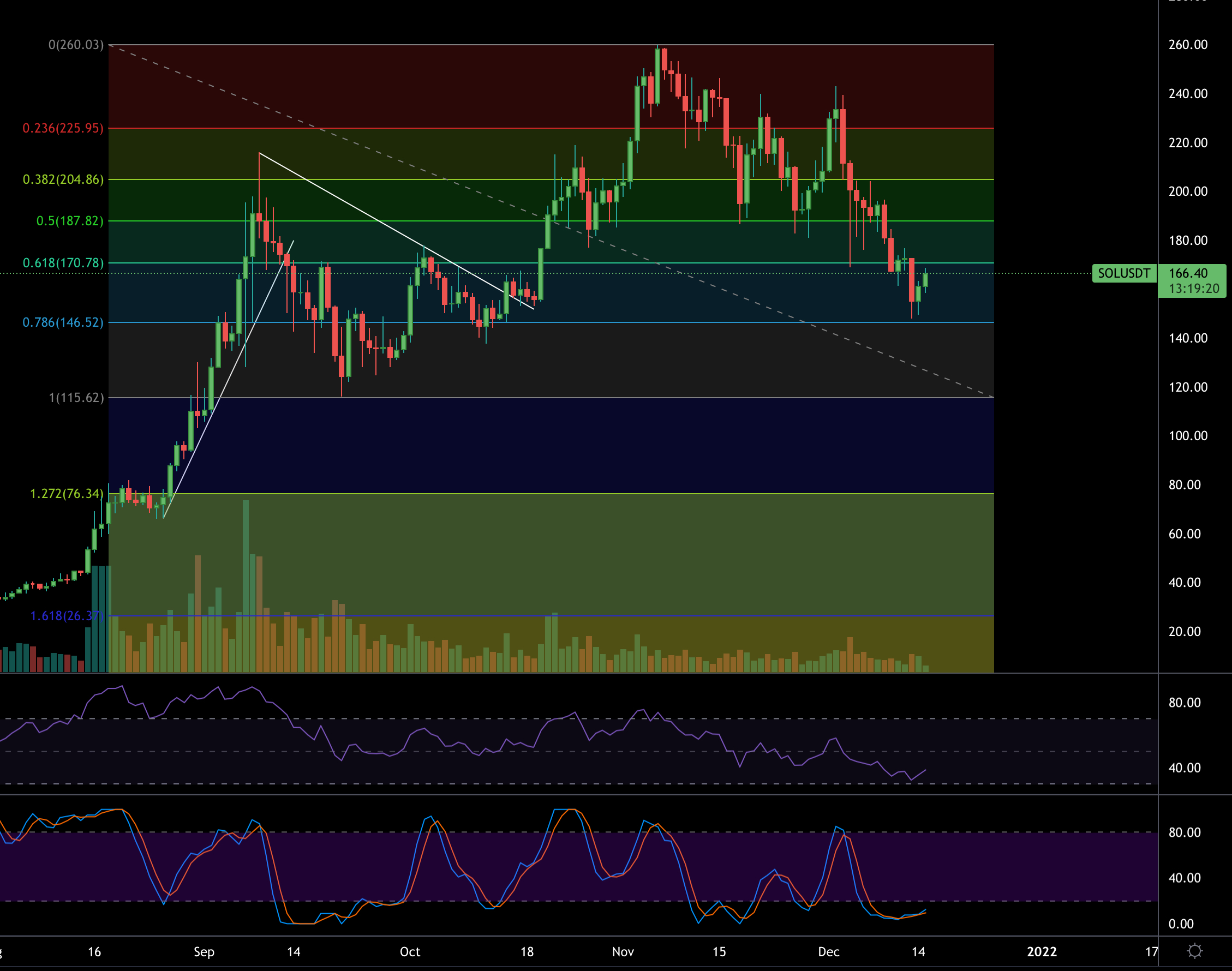

Source: Trading View

The ETH to BTC chart looks incredibly promising. A cup and handle chart pattern in play since May 2018 has just retested the top of the handle beautifully, and looks set to reclaim previous highs. Could a flippening happen during this bull market?

Solana (SOL) is another layer 1 that looks to be shaping up nicely after coming down to the 78.6 fibonacci level. Strong previous support was also found at this level and the price has bounced from it. RSI almost went down to oversold, and the Stochastic looks to have bottomed out.

With AVAX, the fibonacci levels look even more clean and precise. A return to the 61.8 fib level coincided perfectly with support at the $76 level. A strong bounce from here looks a good possibility.

Finally, we have yet another layer 1 in EGLD. A strong break-out of the descending trend should see the price return to the upward trendline that began in February of this year. Both RSI and Stochastic indicators look very positive.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Credit: Source link