Geopolitical tensions are stretched to breaking point. Russia’s invasion of Ukraine has had wide reaching effects on global markets. After a sell off since early November last year, is this Bitcoin’s time to shine?

The Russian invasion of Ukraine, first and foremost, has caused dreadful human suffering and loss on both sides, but it has also completely tipped the global financial system on its head.

All the talk from the Federal Reserve in the US about how it was going to taper its securities purchases and also start to raise interest rates has been left in the dust, as war in the Ukraine has totally destroyed these plans.

Up until the Russian invasion, some analysts were predicting as many as 9 rate hikes as a measure to try and reign in inflation. However, such a move would clearly appear to be off the table, at least for the immediate future, as the Fed’s hands are probably tied in such a predicament.

So given this turnaround in the monetary environment, where could markets be heading now? The russian ruble has been absolutely annihilated, as it tries to recover from a 30% crash against the US dollar over the last 3 three weeks.

However, in western markets, the NASDAQ is up 7.4% over the last 2 days, and the Dow Jones Index is up 5.6% over the same period. Bitcoin is holding strong at over $38,000, and having taken a tumble over recent months, are the signs there that it is ready to maintain its recent rise?

The graphs show how markets typically rebound after invasions. It could probably be fair to say that the Ukraine invasion will be no different.

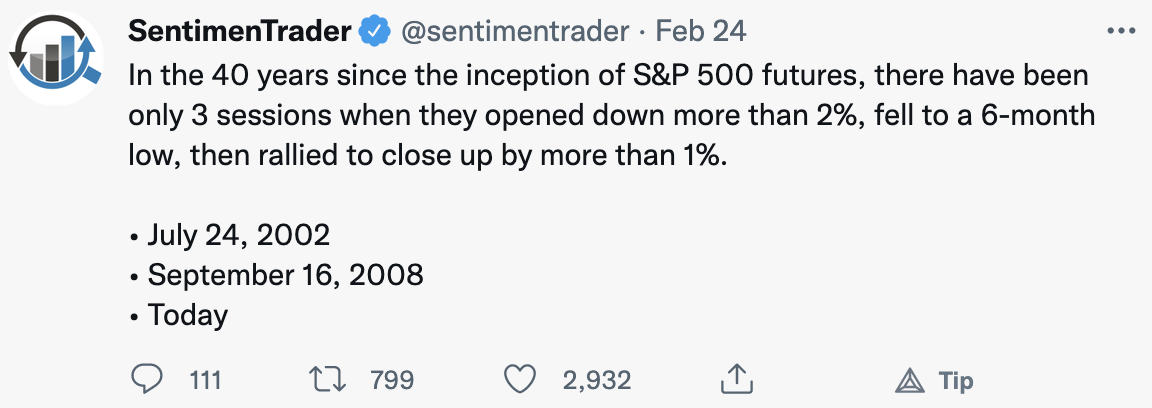

Another positive sign for markets is that both the NASDAQ and S&P 500 Futures went down strongly, yet closed well up afterwards. Something only seen after the Dot.com, and housing crashes of 2002 and 2008 respectively.

Bitcoin is the trade for these times. With the Fed having its hands tied on being able to raise interest rates enough to combat raging inflation, the perfect scene looks set for crypto. Willy Woo, the bitcoin analyst, thinks the same, and believes that this year will test the number one cryptocurrency as a possible safe haven.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Credit: Source link