Stepping into 2022, Bitcoin (BTC) falls below the psychological price of $50K, and the leading cryptocurrency has been consolidating between $46,000 and $49,000 ever since.

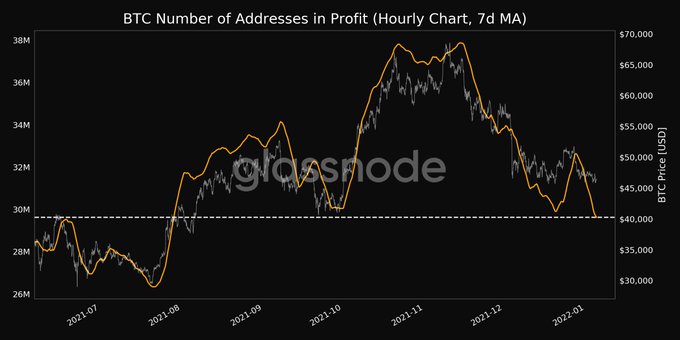

As a result, profitability in the BTC market has slipped to a 5-month low.

On-chain metrics provider Glassnode confirmed:

“The number of Bitcoin addresses in profit (7d MA) just reached a 5-month low of 29,629,091.393.”

On December 28, the Bitcoin market experienced significant bearish momentum as more than 165,000 traders liquidated their accounts, prompting the loss of $80 billion wiped in the crypto market in a span of 24 hours. Therefore, Bitcoin has not been able to recover since then as the price continues to consolidate.

Market analyst Will Clemente believes that BTC might enter a volatility squeeze as the month closes. He stated:

“Signal doesn’t come often, but when it does, you better pay attention. Think we enter a volatility squeeze by the end of the month. When it happens, I will let you know, as well as any clues that make me feel confident about position aggression.

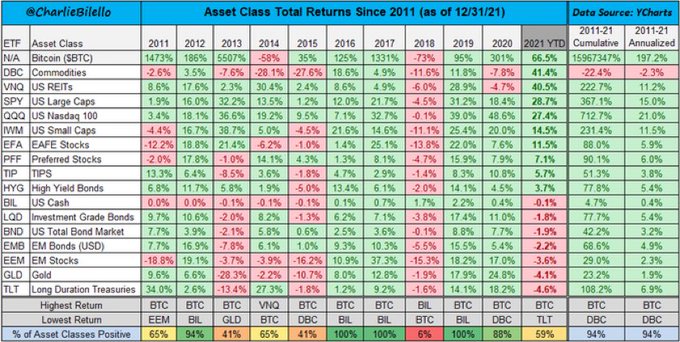

Despite the present drawdown in the BTC market, the top cryptocurrency has been the topnotch-performing asset class three years in a row, dwarfing others like commodities, gold, and high yield bonds.

Furthermore, total transaction fees on the Bitcoin network climbed to $1.017 billion in 2021. Crypto analyst Dylan LeClair noted:

“Bitcoin total transaction fees by year, in USD terms. Record setting year in 2021 with $1.017 billion in total transaction fees paid out to miners.”

With indicators pointing that Bitcoin should hold the $45,000 to $47,000 zone for a bullish momentum to be reignited, it remains to be seen how the benchmark cryptocurrency plays out as the month progresses.

Image source: Shutterstock

Credit: Source link