- Indicators such as whale accumulation and a rise in Litecoin active addresses suggest that major investors are anticipating an LTC price recovery.

- Despite some encouraging signs, only 28% of Litecoin holders are currently profitable, with a significant portion still in the red, indicating uncertainty in the market.

Litecoin (LTC) has shown signs of weakening bearish momentum after a recent 4% decline over the past three days. At the time of writing, the LTC price was testing the critical support level of $67. This level holds importance for traders, as a break below it could result in more aggressive selling pressure, potentially pushing prices lower.

Conversely, if the current market indicators remain bullish, LTC might experience a rebound. The next few trading sessions will be pivotal in determining the popular altcoin’s immediate trajectory.

Whale Accumulation Suggests Litecoin Price

Large investors, often referred to as “whales,” have reportedly increased their Litecoin holdings. Analysis based on Santiment data reveals a growing trend of accumulation by these influential players. Typically, whale accumulation is seen as a signal that major investors believe the asset may have bottomed out or that current prices represent an attractive entry point. Per the CNF report, analysts are already predicting the LTC price will surge to a new all-time high.

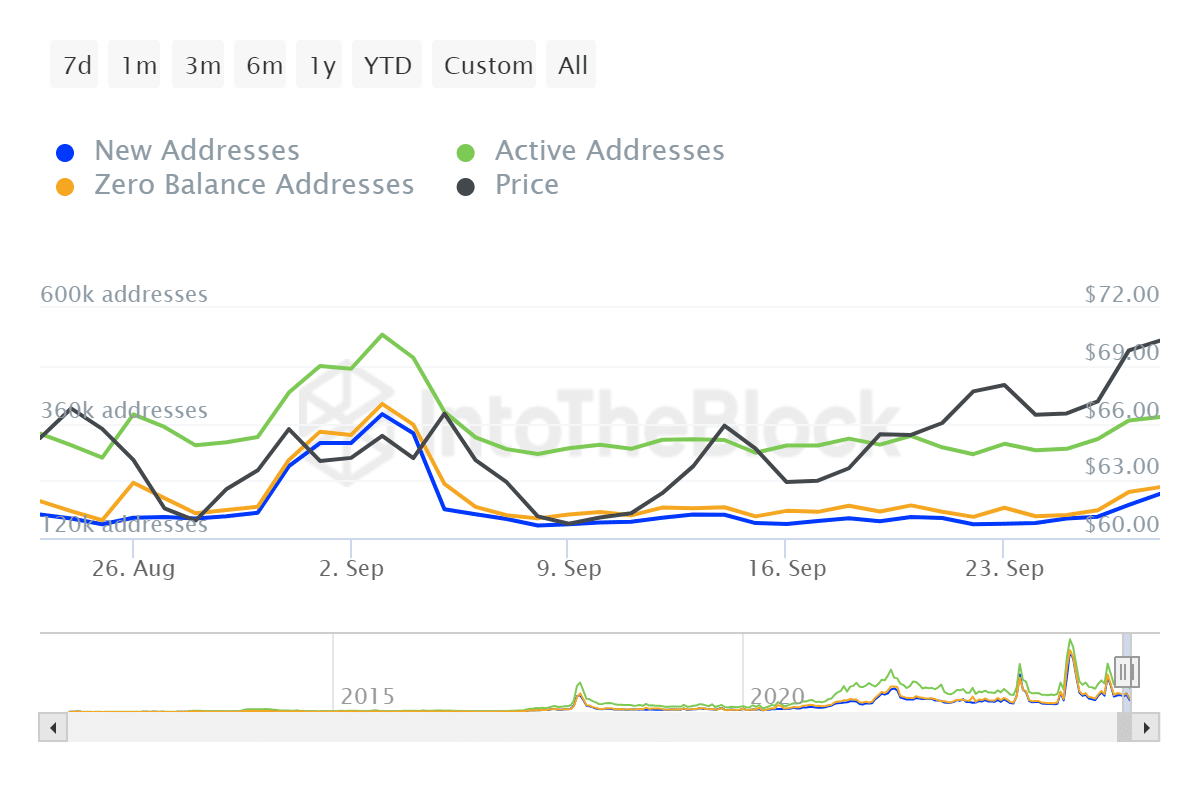

This aggressive buying by whales suggests a possible shift in market sentiment as they anticipate a Litecoin price recovery. Another encouraging indicator for Litecoin is the rising number of active addresses on its network.

The number of active addresses grew by 2% over the past 24 hours alone. This indicates an increase in user activity and engagement with the blockchain. This uptick in network participation is often associated with heightened demand and trading interest.

An increase in active addresses can serve as a positive signal for Litecoin price as it suggests more individuals are trading or transferring LTC. This surge in activity may precede a period of price stability or recovery as demand grows. On the other hand, Litecoin is approaching its maximum supply with only 9 million LTC left to mine, per the CNF report.

Majority of LTC Holders Still in the Red

Despite some positive indicators, according to data from IntoTheBlock, only 28% of Litecoin holders are currently seeing profits. This highlights that a significant portion of investors bought in at higher price points and are waiting for a potential market recovery to break even or realize gains.

Meanwhile, 6.06% holders are at breakeven. However, 5.45 million addresses are in losses. The fact that a majority of holders are underwater adds an element of uncertainty to the current market conditions.

Litecoin price’s short-term prospects depend largely on its ability to maintain support at the $67 mark with an expected return to $76, reported CNF. A breakdown below this level could trigger further losses. On the contrary, if this level holds steady it may give traders confidence in a potential upward move.

Currently, the LTC price is stagnant despite market volatility. At press time, the Litecoin price gained 0.11% to $68.24 on Tuesday, October 1. However, due to the sluggish performance, investors initiated $666,610 long liquidations in the last 24 hours, according to Coinglass data.

These long liquidations could further weigh on the price as sell pressure rises. On the other hand, short liquidations stand at $55,200, which is not enough to offset the impact of long liquidations.

Credit: Source link