Blockchain analytics platform Santiment says that the odds are Bitcoin (BTC) will soon move to the upside due to one factor.

The analytics platform says that Bitcoin is seeing a lot of short interest on two major crypto exchanges, which could set the stage for a short squeeze and send BTC beyond $30,000.

“Bitcoin traders are aggressively shorting on both Deribit and Binance, making potential liquidations more likely to boost prices. BTC’s price is +4% since the increase in shorting began to appear last week. This has a good probability of continuing.”

A short squeeze happens when traders who borrow an asset at a certain price in hopes of selling it for lower to pocket the difference are forced to buy back the assets they borrowed as momentum moves against them, triggering further rallies.

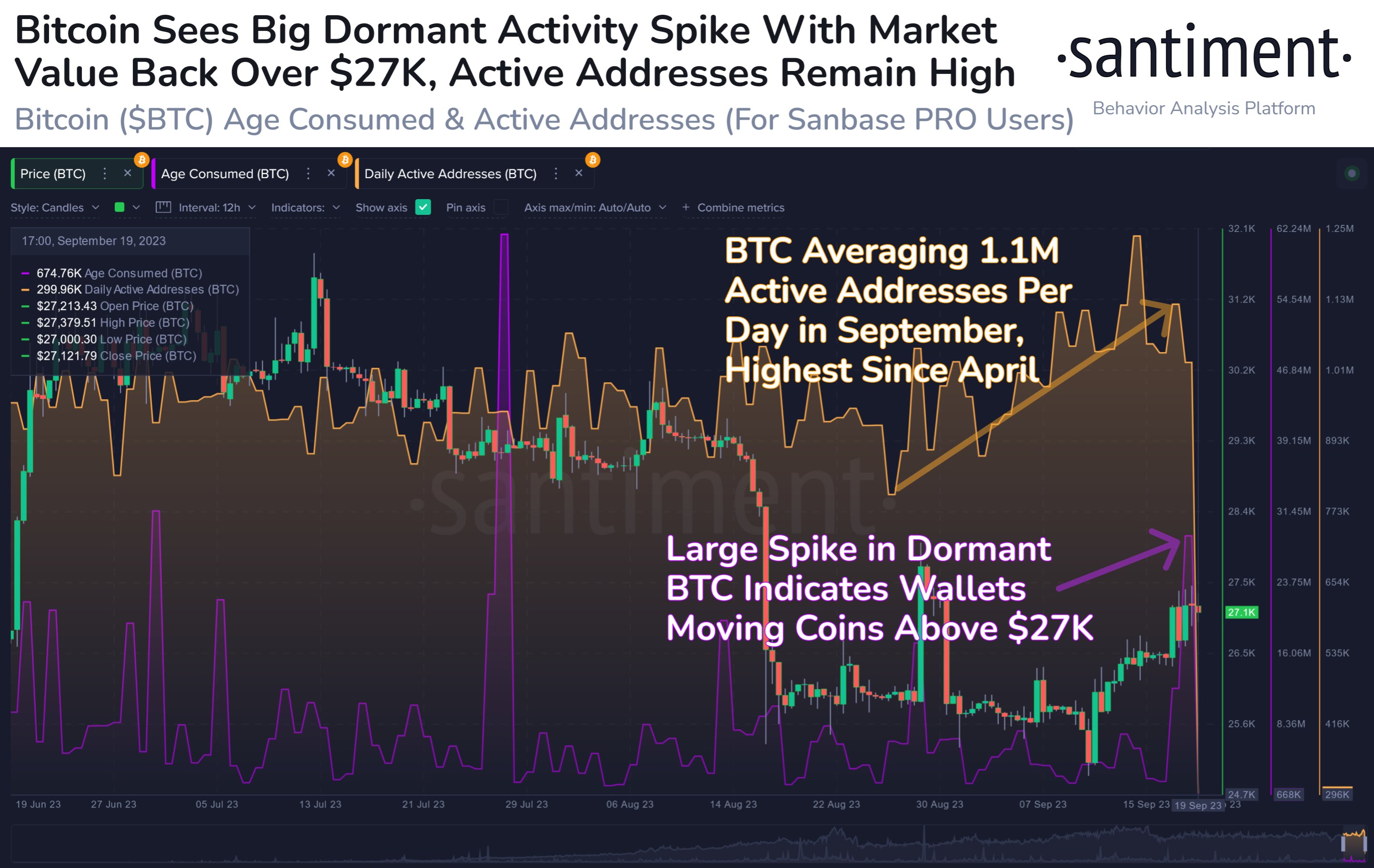

Santiment also says that Bitcoin’s network activity shot up this month as BTC crossed the $27,000 level.

“Bitcoin’s on-chain activity continues to be significantly higher than it has been since April. Utility is notably higher, and the third largest day [of activity] in dormant BTC in three months also occurred yesterday. The low $27,000 level is proving to be polarizing.”

The analytics firm is keeping a close eye on how many stablecoins deep-pocketed crypto investors are holding. An increase after a period of decline could indicate Bitcoin will move to the upside, according to Santiment.

“Whales have been dropping stablecoins, indicating that their buying power isn’t quite as strong as when Bitcoin was above $30,000 back in June. [Holdings are] now at the lowest level in six months. Look for $5 million+ whale wallets to increase again to signal a turnaround.”

Bitcoin is trading for $26,588 at time of writing, down 2.2% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/DomCritelli/Natalia Siiatovskaia

Credit: Source link