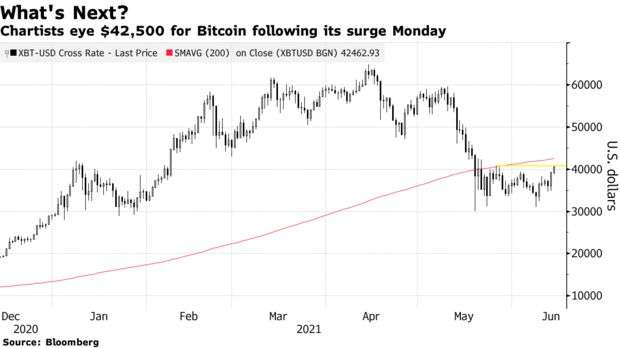

- Bitcoin has finally breached the $40,000 resistance level to set a three-week high, with experts looking at $42,500 as the next critical level.

- The move comes after billionaire investor Paul Tudor Jones praised the crypto and advocated for a 5 percent portfolio allocation, up from the unanimous 1 percent recommended allocation.

It’s finally happened – Bitcoin has hit $40,000. The top cryptocurrency has been flirting with this level but has fallen just short in the past three weeks. For several days, the crypto seemed stuck at the $37,000 level, unable to get any real momentum going. However, BTC started off the new week with one final push that breached the resistance and set a new three-week high.

Bitcoin’s surge to $40,000 started on Sunday when it saw a 12 percent gain to set a new two-week high. The spike was unusual, given the bearish nature of the weekends, especially for crypto. However, a combination of Elon Musk showing a reignition of the Bitcoin love that made him a darling of the crypto market and BTC outflow from exchanges boosted the top crypto.

Related: Bitcoin gains 12% to close in on $40,000 for the first time in two weeks, as analysts reveal two key levels

Bitcoin shot up to set a new three-week record at $40,978. The volume saw a slight uptick to hit $46.3 billion. Despite the rise, however, its dominance dropped slightly to 43.3 percent as altcoins saw an even greater spike, with Polkadot and Polygon leading the altcoin rally.

📈 #Bitcoin got up to a 3-week high $40.8k a few hours ago, and the upward push appears to be aided by a healthy flow of funds being moved off exchanges today. When flow balance heads into the negative like it consistently did Monday, it’s a #bullish sign. https://t.co/fP7yfPCpQS pic.twitter.com/XGHRHqYUmm

— Santiment (@santimentfeed) June 15, 2021

The next critical level for Bitcoin as it eyes $50,000

With $40,000 now in hand, Bitcoin’s next critical level will be $42,500, experts have revealed. This roughly represents its 200-day simple moving average. If BTC gets to hit this level, it will be set up to rally to $50,000 and consequently reignite the bull market it was on a few months ago.

Courtesy of Bloomberg

Art Hogan, the chief strategist at National Securities commented:

Getting back above $40,000 was technically a positive. The folks who look at this using technical analysis would tell you that when it breached $40,000, that sent a negative signal, and now that it’s recaptured that level, it sends a positive signal.

The rally comes at a time when U.S stocks are struggling to get any momentum going, with the Dow Jones Industrial Average and the S&P500 all recording lackluster closes on Monday. On Wednesday, the Federal Reserve will give a key update on its outlook in regards to inflation, and whatever chair Jerome Powell says will greatly affect the stock market, and consequently the crypto market as well.

Bitcoin’s rally comes at a time when big-time investors have expressed confidence in the asset. First was Paul Tudor Jones, a billionaire American hedge fund manager and philanthropist. Speaking to CNBC’s Squawk Box, he revealed that he finds Bitcoin one of the best stores of wealth.

I like bitcoin as a portfolio diversifier. Everybody asks me what should I do with my bitcoin? The only thing I know for certain, I want 5% in gold, 5% in bitcoin, 5% in cash, 5% in commodities. At this point in time, I don’t know what I want to do with the other 80% until I see what the Fed is going to do.

Tim Draper is also confident BTC has a bright future, stating that he’s holding on to his $250,000 price prediction for BTC by the end of 2022. Draper is one of the world’s most renowned venture capitalists with early investment in giants such as Coinbase, Tesla, Robinhood, Twitch, Skype and Twitter.

I think I’m going to be right on this one. I’m either going to be really right or really wrong [but]I’m pretty sure that it’s going in that direction.

Credit: Source link