The price of Bitcoin (BTC) has driven to the lowest point near $30k due to sharp corrections after hitting highs above $64.5k in mid-April.

On May 19, BTC fell to around $30K, resulting in the biggest single-day drop of price, up to 30%. The price level of $30K was close to the beginning of 2021, which indicated that the year-to-date (YTD) return of long-term investors by holding BTC was almost zero.

Furthermore, this price drop became the first time BTC had dropped to the 200-MA, a key strategic indicator, since May last year as the Covid-19 pandemic continued to wreak havoc globally.

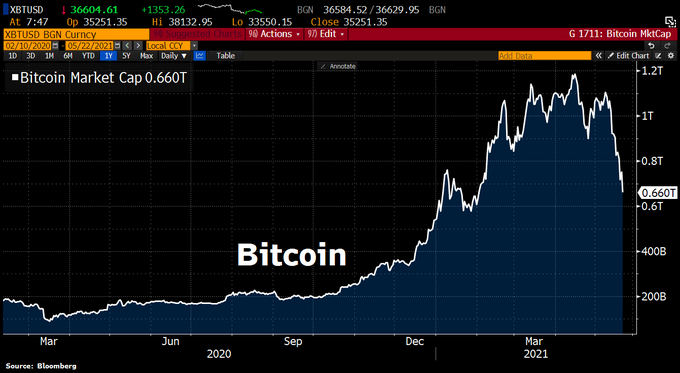

The downtrend witnessed in the Bitcoin market has caused the top cryptocurrency to shed more than $500 billion in market cap, as acknowledged by crypto analyst Holger Zschaepitz.

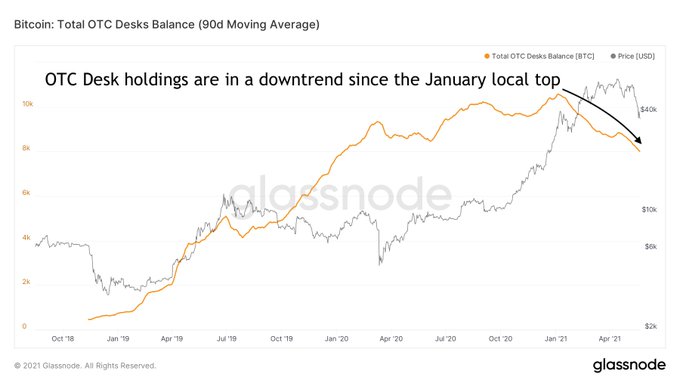

Bitcoin balances on OTC desks were shrinking.

The latest correction has also affected BTC trading on OTC desks, as stated by Dilution-proof. The crypto data provider explained:

“Since the January local top, Bitcoin balances on OTC desks are in a downtrend. OTC desks facilitate ‘over the counter’ trading for wealthy entities that are looking to buy or sell Bitcoin without moving markets.”

Yann & Jan, Glassnode co-founders, attributed the recent BTC selling to investors who bought the leading cryptocurrency in the last couple of months.

Nevertheless, Bitcoin miners consider the recent price drop as an ideal opportunity to accumulate more coins. They are not selling their holdings, as alluded to by data analyst Jan Wuestenfeld.

Meanwhile, Bill Miller, an American investor and fund manager, recently revealed his confidence in BTC as a safe investment despite the market crash as well.

Bitcoin was still below the psychological mark of $40k at the time of writing. The top cryptocurrency was trading at $38.2k with a market capitalization of $716 billion.

The market remains to be observed whether Bitcoin will regain momentum to continue with its bull run for the remaining days in 2021 or if it has come to an abrupt end.

Image source: Shutterstock

Credit: Source link