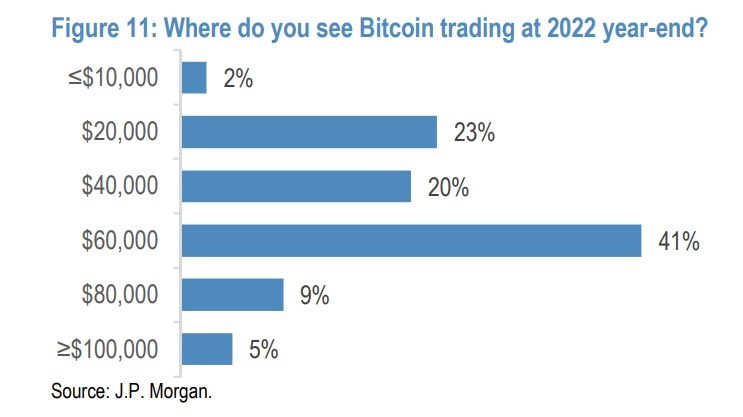

Global investment bank JPMorgan has asked its clients what they think the price of bitcoin will be by year-end. Among the bank’s clients who responded, 55% expect the price of bitcoin to end the year at $60K or higher.

What JPMorgan’s Clients Expect the Price of Bitcoin to Be by Year-End

JPMorgan has conducted a survey of its clients about what they expect the price of bitcoin to be by year-end. The global investment bank released the results earlier this week. The survey was conducted between Dec. 13 and Jan. 7 as part of a broader macroeconomic outlook for 2022. Forty-seven of JPMorgan’s clients participated in the survey.

About 41% of the bank’s clients who responded expect bitcoin to end the year at around $60,000. 23% expect the price to be $20,000 while 20% expect it to be $40,000.

In addition, 9% believe that the price of BTC will reach $80,000, 5% think that it could be $100,000 or more, while 2% expect it to fall to $10,000 or lower.

Nikolaos Panigirtzoglou, a JPMorgan strategist and an author of the research note that included the survey, commented:

I’m not surprised by bitcoin’s bearishness … Our bitcoin-position indicator based on bitcoin futures looks oversold.

He added that the cryptocurrency’s fair value is between $35,000-$73,000, depending on what investors assume about its volatility ratio compared to gold.

At the time of writing, the price of bitcoin is $43,291 based on data from Bitcoin.com Markets.

Recently, the president of El Salvador, Nayib Bukele, predicted that the price of bitcoin will reach $100,000 by the end of the year. Global investment bank Goldman Sachs also sees the $100,000 level for BTC as a possibility. Crypto lending platform Nexo, however, expects the price of BTC to hit $100K by the middle of this year.

What is your bitcoin price prediction? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link