The total value locked (TVL) in decentralized finance (defi) has risen 4% during the first four days of the new year from $245 billion on January 1, to $255.84 billion three days later. While the defi protocol Curve Finance dominates with a TVL of $24.44 billion, Convex Finance is closing in on the dominance with $21.27 billion. Meanwhile, out of several blockchains, Ethereum dominates the defi TVL with 62.91% or $160.96 billion out of the aggregate $255.84 billion locked today.

Defi TVL Increases 4% During the First 4 Days of 2022

Money is flowing back into decentralized finance (defi) and a number of defi tokens are swelling in value. Statistics from defillama.com show the TVL in defi hit a low of $228.13 billion on December 11 and since then, it’s jumped 12.14% in value. On the first day of 2022, the TVL in defi was $245 billion and it’s increased 4% to date reaching $255.84 billion on Tuesday.

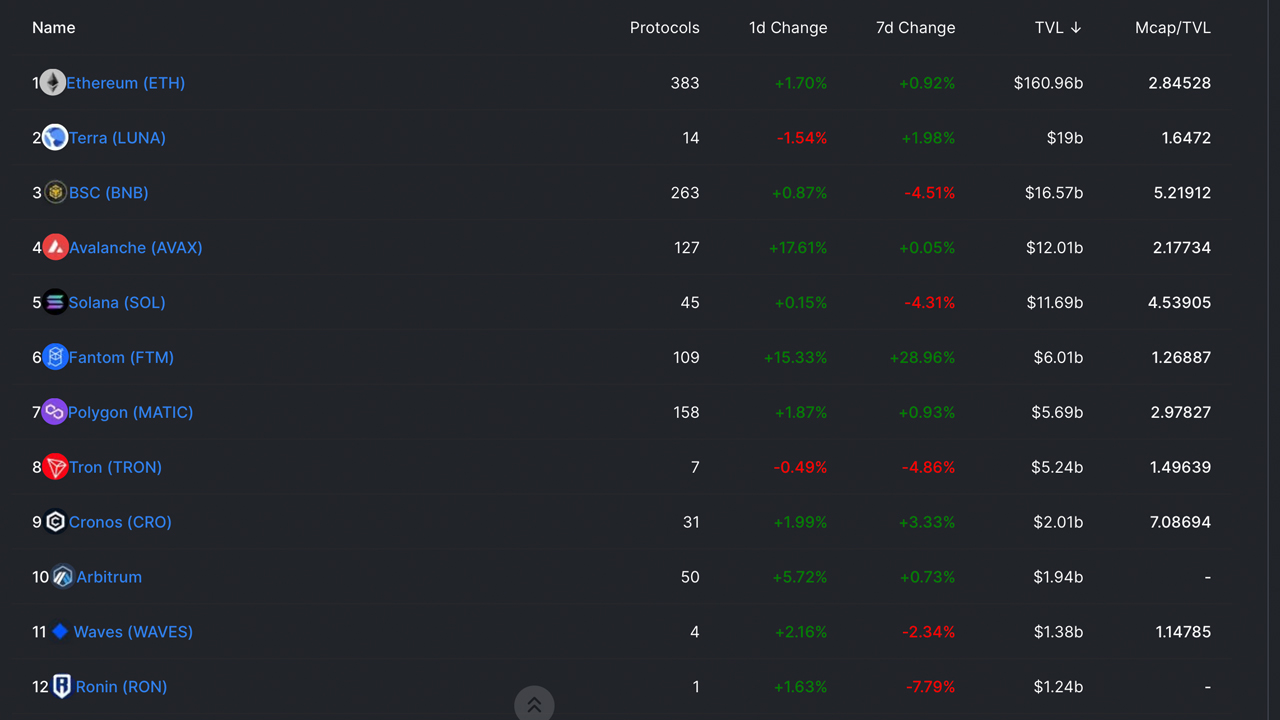

The $255.85 billion is tallied between numerous blockchains like Ethereum, Terra, Binance Smart Chain (BSC), Avalanche, Solana, Fantom, Tron, Cronos, Polygon, Arbitrum, Harmony, Waves, Ronin, Heco, Thorchain, Near, Smartbch, Elrond, and Osmosis.

Ethereum’s TVL across 383 protocols is $160.96 billion today followed by Terra’s $19 billion across only 14 defi protocols. BSC commands $16.57 billion on Tuesday across 263 defi protocols.

While Terra and BSC are the second and third-largest defi TVLs, they only represent 22.09% of the value locked in Ethereum defi protocols today. Terra has seen a 1.98% TVL increase during the last week, but Fantom jumped 28.96% to $6 billion, and Osmosis spiked 40.43% and crossed the $1 billion zone.

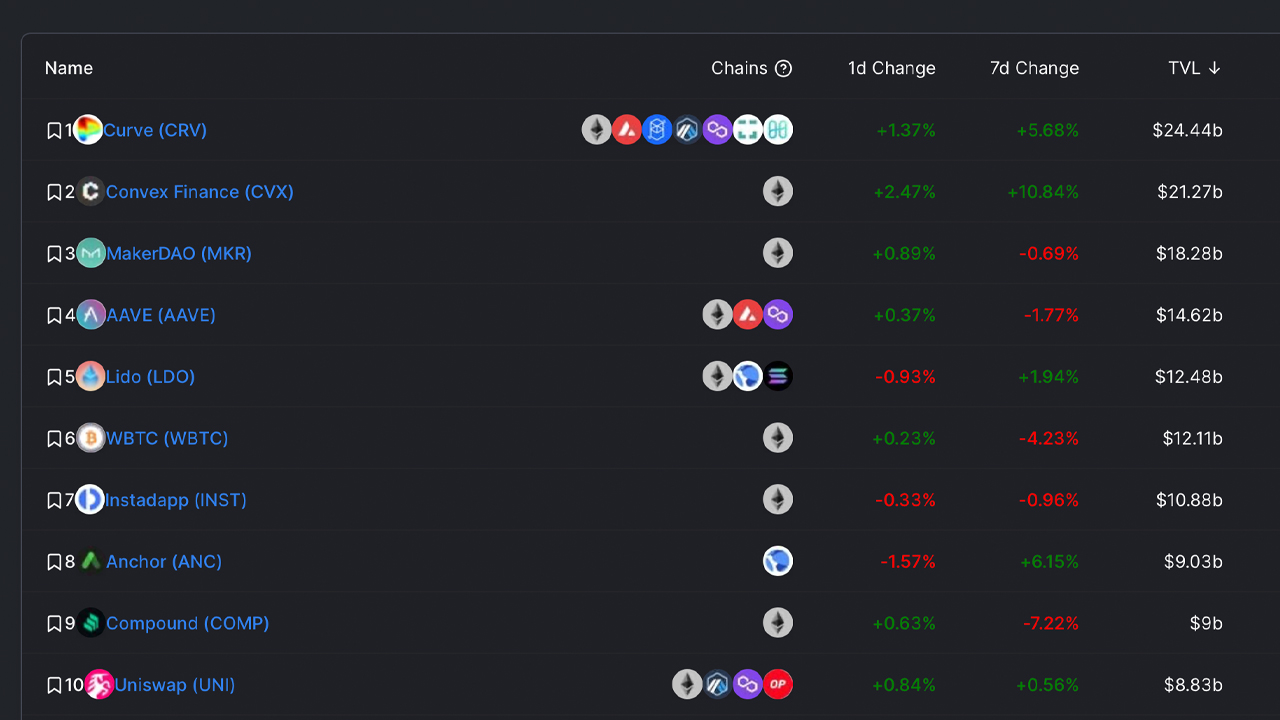

Curve Dominates With 9.55% of the TVL in Defi, Fuse Jumps 183%, Top 7 Smart Contract Networks See Weekly Losses

Metrics show that Curve commands the largest TVL in defi today across seven different chains with $24.44 billion and 9.55% dominance amid the $255.84 billion locked. Curve is followed by Convex ($21.27B), Makerdao ($18.28B), Aave ($14.62B), Lido ($12.48B), WBTC ($12.11B), and Instadapp ($10.88B).

Today, the TVL in cross-chain bridges to Ethereum totals $24.67 billion, which represents a 1.5% change in 30 days. The number of unique addresses among the cross-chain bridge TVL in 30 days is 87,855 addresses.

Polygon bridges rank the largest TVL on Tuesday with $6.6 billion, and Ronin has $6.1 billion. This is followed by Avalanche ($5.8B), Arbitrum ($2.8B), Fantom ($1.4B), and Optimism ($538M). The top seven smart contract blockchain platforms by market valuation are all down in value between 3.2% to 12.5% during the last week. The seven smart contract blockchain platforms include Ethereum, Solana, Cardano, Polkadot, Terra, Avalanche and Polygon.

Meanwhile, the eighth through tenth-largest smart contract networks Chainlink (+5.3%), Algorand (+3.2%), and Near (+12.6%) have seen seven-day gains. The biggest smart contract network seven-day gainer this week was fuse (FUSE) jumping 183.6% against the U.S. dollar.

Enigma (ENG) increased 48.8% in seven days and velas (VLX) swelled by 35.7% this week. Velas Network AG just partnered with the Italian luxury sports car manufacturer Ferrari. The largest smart contract platform loser this week was poa network (POA) shedding 49.8% in value, followed by cypherium (CPH) losing 37.8% in seven days.

What do you think about the recent defi action this past week? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, defillama.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link