- Twitter mentions for Bitcoin are up 350 percent in the past year as ATMs deployed hit 33,850, up by 142 percent in 2021.

- VC firms are also flocking into the industry, investing $25 billion into BTC firms, up sevenfold from the $3.5 billion they invested last year.

That it’s been a good year for Bitcoin is no secret. The cryptocurrency set new record highs, broke them, and set new ones as the world woke up to the immense opportunity BTC offers. And there are statistics to prove it besides the price, with the number of Twitter mentions for Bitcoin up 350 percent as venture capital funding for BTC firms shot up sevenfold.

Twitter has become a very important medium of interaction in the world, with most global leaders in politics, business, science, and technology using it to reach out to their followers. Former U.S President Donald Trump was among the first to recognize the power of Twitter, and others have followed on.

For Bitcoin, Twitter has become crucial.

There were 101,000,000 tweets containing the word “bitcoin” in 2021 – 350% the volume of 2020. H/T @wullon pic.twitter.com/c9NhwWQCbH

— Jameson Lopp (@lopp) December 26, 2021

Earlier in the year, it was Twitter that was influencing price action. Elon Musk was the king of moving markets through the social media platform, but others aped in as well. And it’s not just Bitcoin. Other cryptocurrencies like Dogecoin shot into the limelight through Twitter and grew a legion of fans. Shiba Inu was also made by Twitter and it became the year’s highest gainer among the top 100 coins with tens of millions in percentage gains.

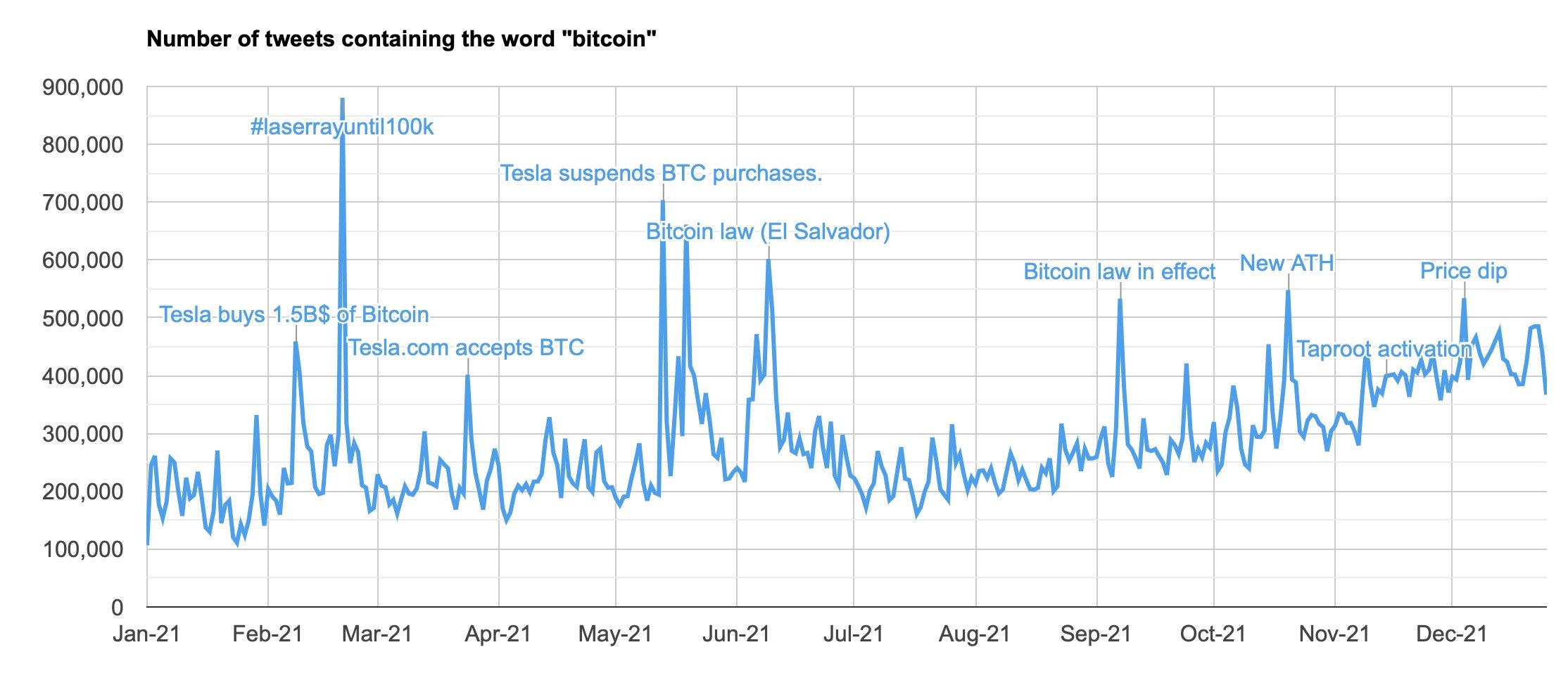

As the chart below shows, some of the most popular talking points on Twitter revolved around Elon Musk and his electric vehicle behemoth Tesla. Tesla’s purchase of $1.5 billion worth of BTC, its acceptance of BTC payments and its suspension of those payments topped the list. El Salvador was also a major topic, with its Bitcoin law taking effect this year. Taproot activation and the BTC price dip also made headlines.

Venture capital in Bitcoin up 700%

This year has seen Bitcoin hit prices that many could have only dreamed about a few years back when the crypto winter set in. And with its price rise has come loads of venture capital money into the ecosystem.

Back in 2013, only $23 million was injected into Bitcoin startups by VCs. Fast forward to 2021, there was $25 billion invested in these firms. This is 7 times higher than last year when the funding stood at $3.5 billion.

Crypto industry venture capital funding:

2012: $23M

2013: $120M

2014: $368M

2015: $850M

2016: $850M

2017: $1,200M

2018: $6,000M

2019: $3,000M

2020: $3,500M

2021: $25,000M— Jameson Lopp (@lopp) December 27, 2021

U.S VC firms dominated this field, data by PitchBook shows. Coinbase Ventures was one of the most active firms and in the third quarter of 2021, no VC made more deals. And as one executive revealed, the firm invests more to support the ecosystem than to make profits.

Speaking to the New York Times, Shan Aggarwal, the head of Coinbase Ventures, stated:

Return isn’t the primary metric by which we measure the success of Coinbase Ventures. We see a world where the best start-ups of tomorrow are all built on web3 blockchain infrastructure,. That’s the future we’re building.

But not everyone is happy about VC firms getting into crypto. Charles Hoskinson, the founder of Cardano, believes that these firms are going against the ethos of decentralization which is what crypto was built on. Cardano has not accepted money from any VC firm since it was founded.

Credit: Source link