Ethereum (ETH) has been witnessing an uptick in activities, which has prompted a price surge. The second-largest cryptocurrency was up by 16.31% in the last 24 hours to hit $3,379 during intraday trading, according to CoinMarketCap.

As the neck-to-neck battle between Bitcoin and Ethereum continues, the latter has emerged as the victor in terms of usage. Damian Sowers, the founder of Level Frames, acknowledged:

“ETH usage is now 54X BTC. Flippening is inevitable.”

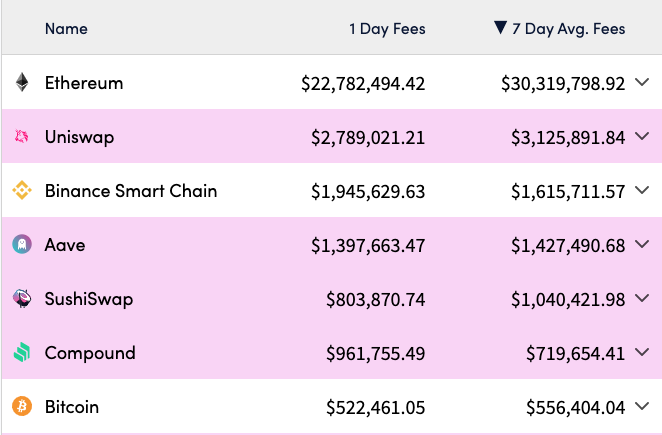

The skyrocketing usage can be explained by the fact that Ethereum has more use cases than Bitcoin. For instance, ETH has surfaced as the backbone of various sectors like non-fungible token (NFT) and decentralized finance (DeFi), which have witnessed exponential growth in the crypto space.

For instance, the DeFi industry is a billion-dollar sector because it was recently valued at $81.85 billion.

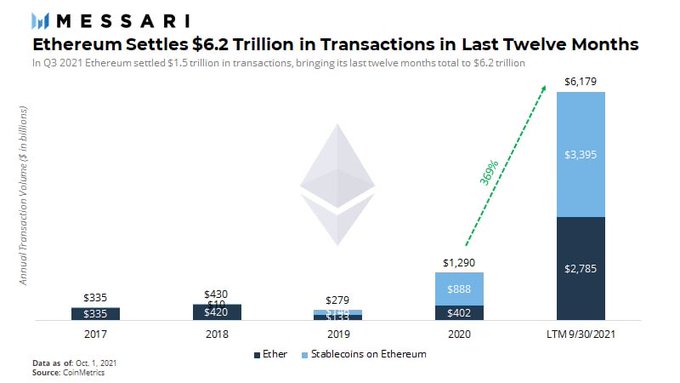

Furthermore, Ethereum settled transactions worth $6.2 trillion in the last 12 months. Ryan Watkins, a researcher at Messari Crypto, explained:

“In the past 12 months, Ethereum settled $6.2 trillion in transactions. This figure is up 369% compared to 2020, and was powered by a strong Q3 where Ethereum settled $1.5 trillion.”

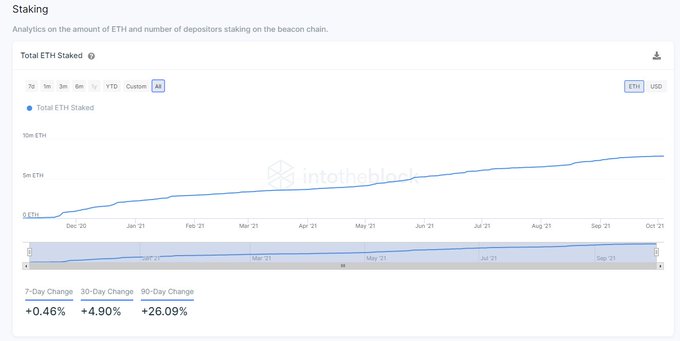

ETH 2.0 deposit contract is the largest Ethereum holder

According to data analytic firm IntoTheBlock:

“The Ethereum 2.0 staking contract has become the largest holder of ETH. There are now 7.84m ETH, meaning that the contract has been growing at a pace of 23,442 Ether per day, with a total 51,200 unique addresses depositing.”

The total value locked in ETH 2.0 recently hit an all-time high (ATH) as more investments continue to trickle.

Launched in December 2020, Ethereum 2.0 is seen as a stepping stone towards a proof-of-stake (POS) consensus mechanism from the current proof-of-work (POW) framework.

The POS algorithm allows the confirmation of blocks to be more energy-efficient and requires validators to stake Ether instead of solving a cryptographic puzzle. Therefore, scalability is expected to be improved through sharding.

Image source: Shutterstock

Credit: Source link