After recording a 10% daily loss on September 8, Bitcoin (BTC) has found itself on a negative trajectory as the leading cryptocurrency dropped from the $52K level to the $42K area.

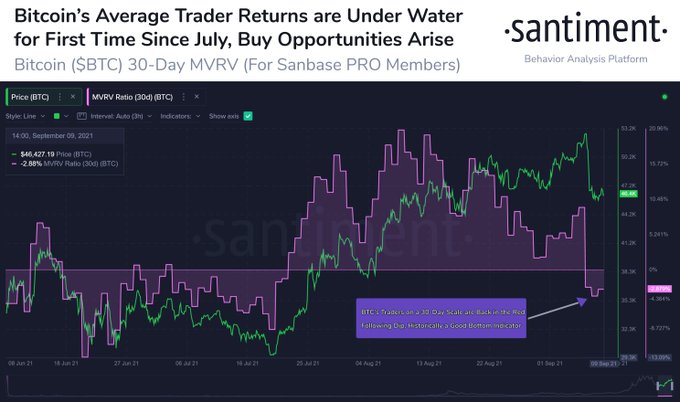

BTC was down by 8.08% in the last seven days to hit $45,994 during intraday trading. Therefore, this significant pullback has made the traders’ monthly returns slump. Crypto analytic firm Santiment explained:

“The average Bitcoin 30-day trader returns are in the red for the first time since July, implying a lower than average risk opportunity to buy. A return of -3% isn’t extreme for this timeframe, but it’s an encouraging sign that euphoria has cooled off.”

Before this crash, miners sold more than 300,000 BTC, as acknowledged by IntoTheBlock. The on-chain metrics provider noted:

“Bitcoin miners appear to have been selling over 300K BTC in the days prior to the recent crash. This does not necessarily mean miners caused the crash, but does highlight the miner’s cautious stance as their holdings reach a new all-time low.”

On the other hand, the Bitcoin futures perpetual funding rate turned negative, which illustrated a tendency to short the leading cryptocurrency as over-leveraged longs were flushed out of the market.

Is a bullish impulse expected?

According to market analyst Will Clemente:

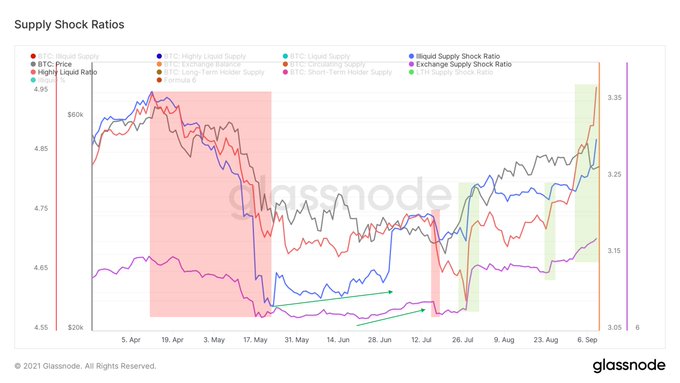

“Another bullish impulse of BTC moving to long-term investors and coins coming off exchanges.”

Glassnode echoed these sentiments by acknowledging that Bitcoin balance on exchanges reached a 3-year low.

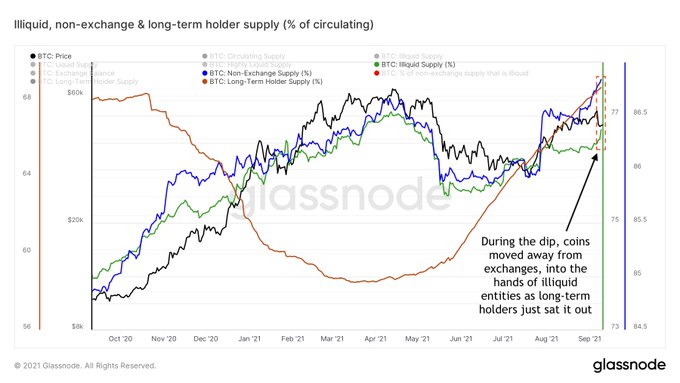

On-chain data provider Dilution-proof believes that the recent dip was a technical correction meant to clear excess leverage in the BTC market because illiquid supply didn’t move, coins left exchanges, and experienced holders didn’t sell.

Cryptocurrencies exiting exchanges and being held by long-term investors are bullish because it signifies a holding culture.

Image source: Shutterstock

Credit: Source link