- Institutional investors increased Bitcoin holdings by $127 billion in 2024, indicating strong long-term confidence in the asset.

- Favorable regulatory trends and historical cycles suggest robust capital inflows into Bitcoin during 2025.

The Bitcoin market is set for a big year in 2025, with price forecasts ranging from $145,000 to $249,000. Institutional capital flows, legislative changes, and historical cyclical tendencies all help to fuel this hopeful view. A research study by CryptoQuant indicates that these elements fit to provide suitable surroundings for the expansion of Bitcoin.

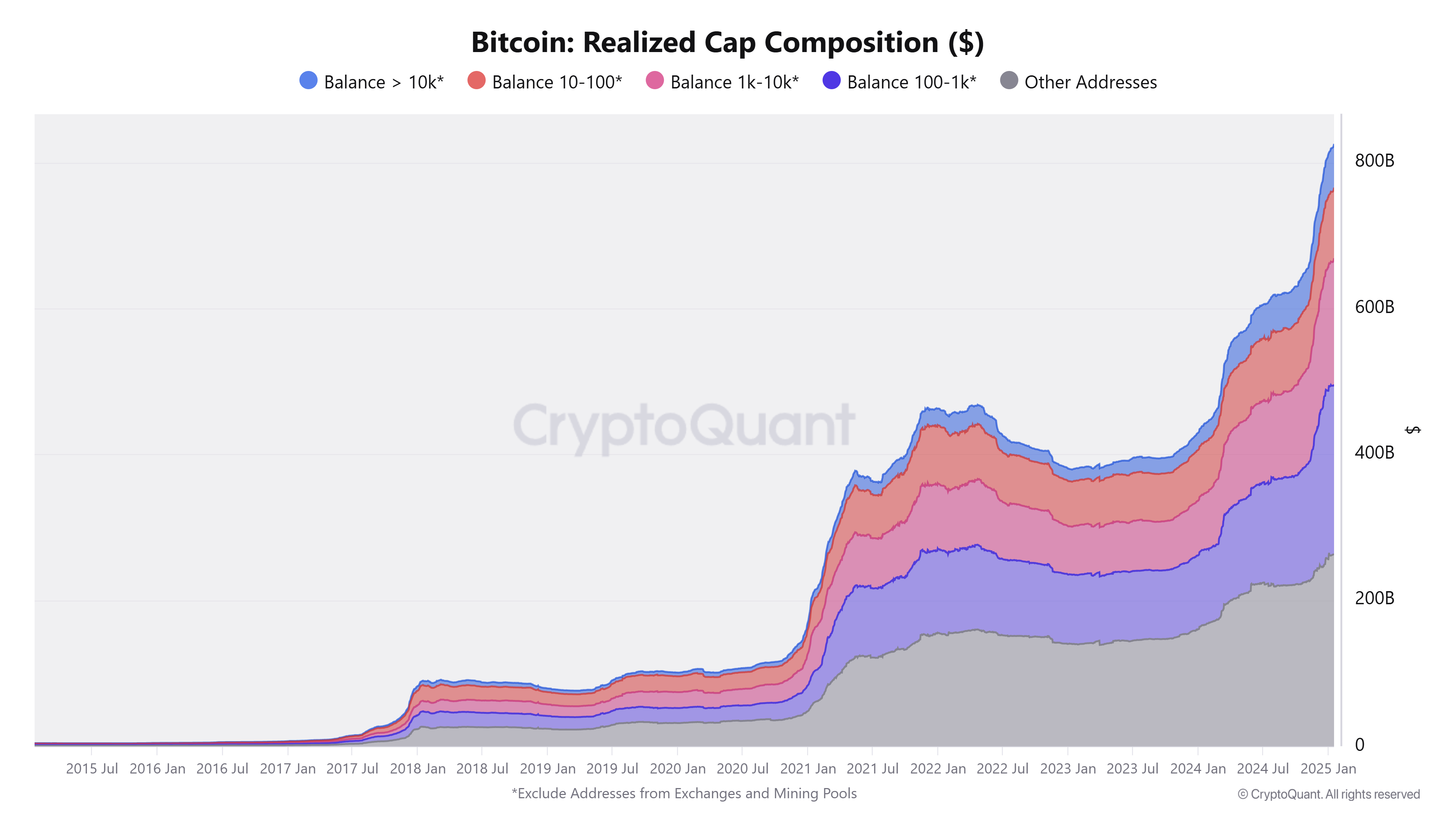

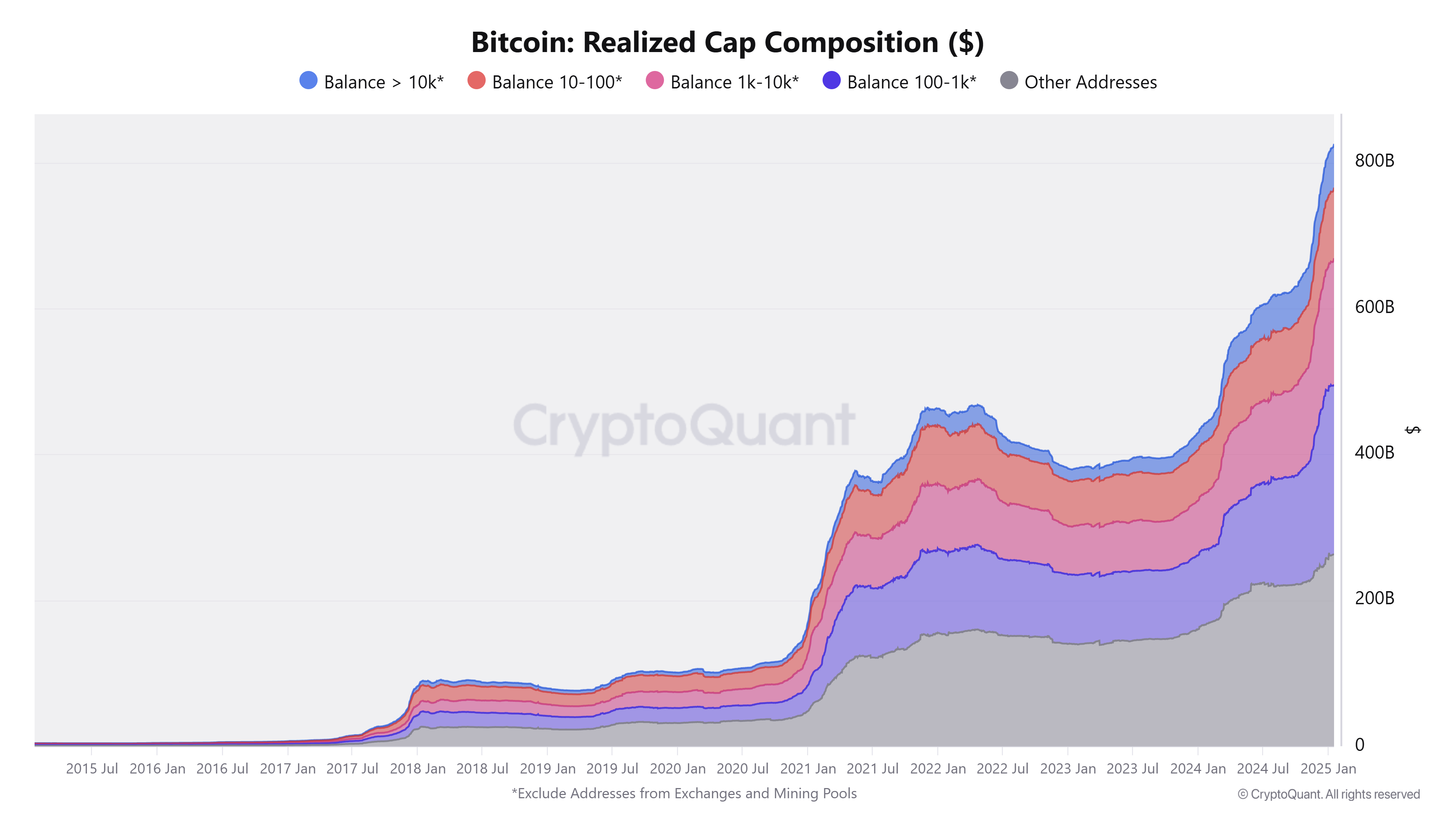

The present dynamics of BTC have been shaped in great part by institutional investors. Especially addresses between 100 and 1,000 BTC, which usually comprise ETFs and institutional custodial services, raised their holdings by $127 billion in 2024 alone. Reflecting belief in Bitcoin’s long-term value, this is a 127% increase.

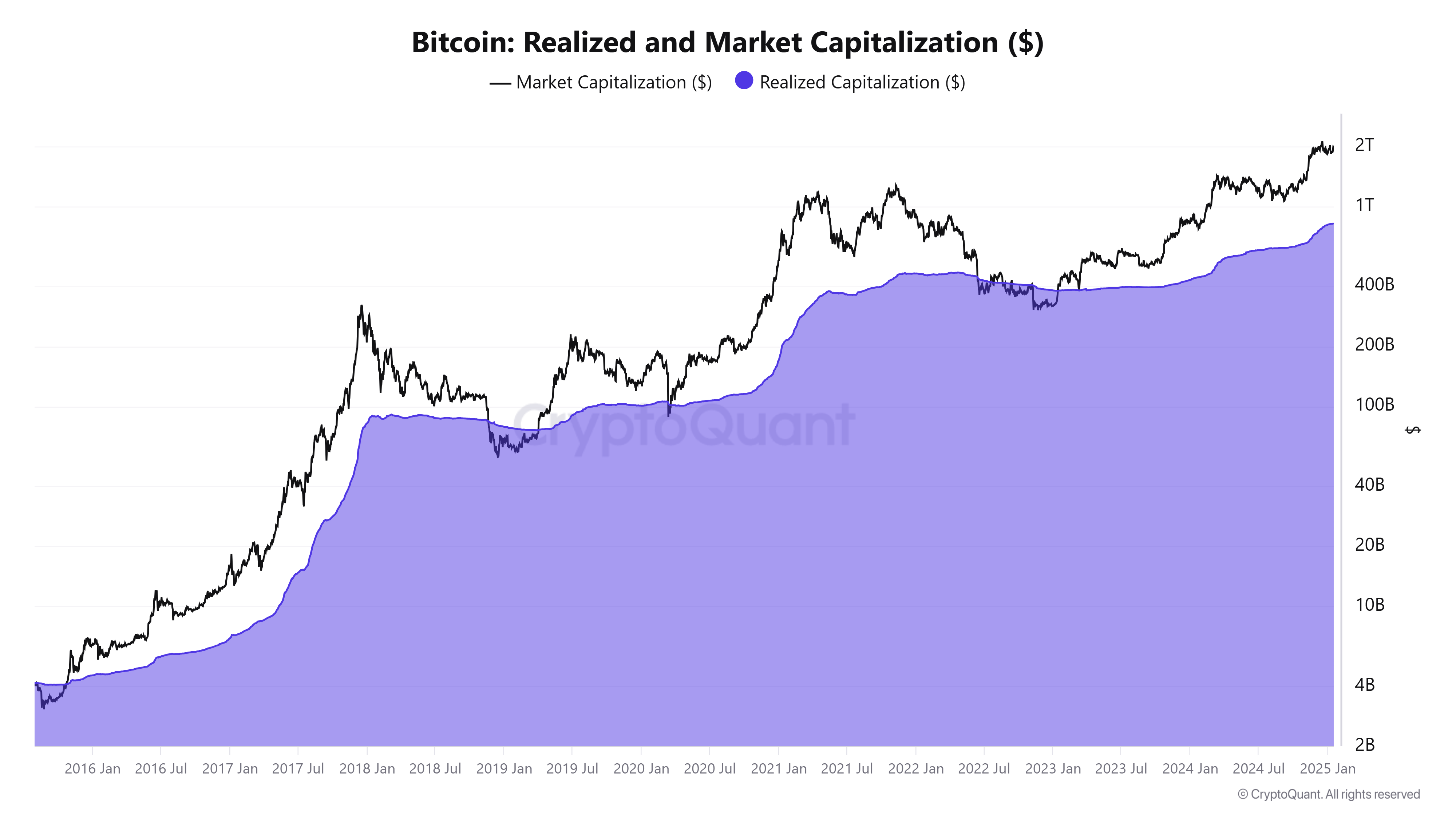

Moreover, supporting this positive story are historical patterns. During the last year of every Bitcoin cycle, capital flows have exploded. From 2015 to 2018, for example, $86 billion went into Bitcoin; between 2019 and 2021, $384 billion.

Capital inflows, which show consistent increase, hit $440 billion from the end of 2022 to 2024. Should this path be maintained, 2025 might see an extra $520 billion in fresh investments, hence confirming Bitcoin’s relevance.

Regulatory Support and Valuation Metrics Highlight Bitcoin’s Potential

Another important element is a supportive regulatory environment present in the United States. The pro-crypto stance of the next government, together with the appointment of crypto-friendly legislators, is expected to inspire more acceptance.

Furthermore, possible Federal Reserve interest rate reductions in 2025 could increase the appeal of risk assets such as Bitcoin, hence generating institutional demand.

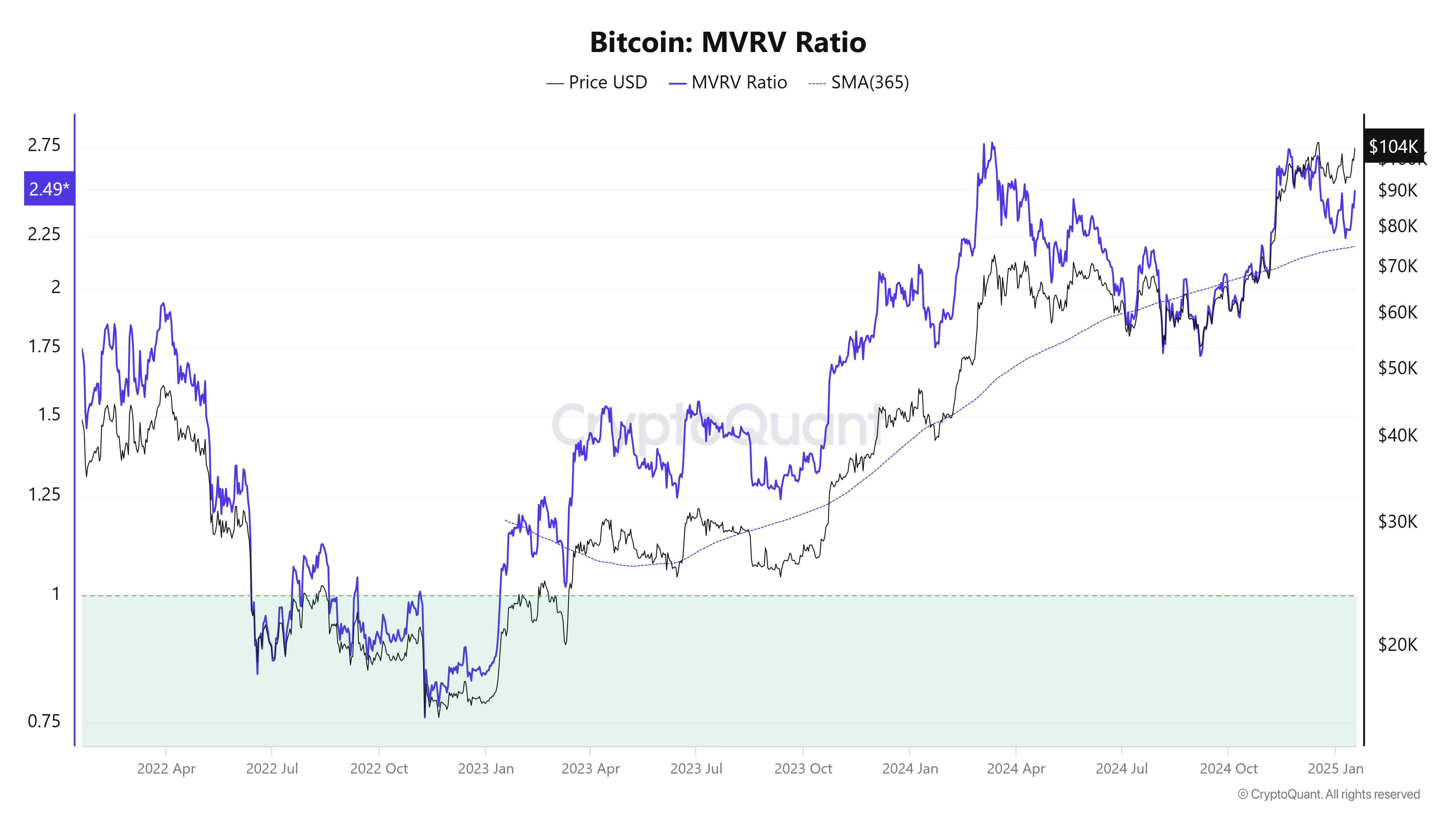

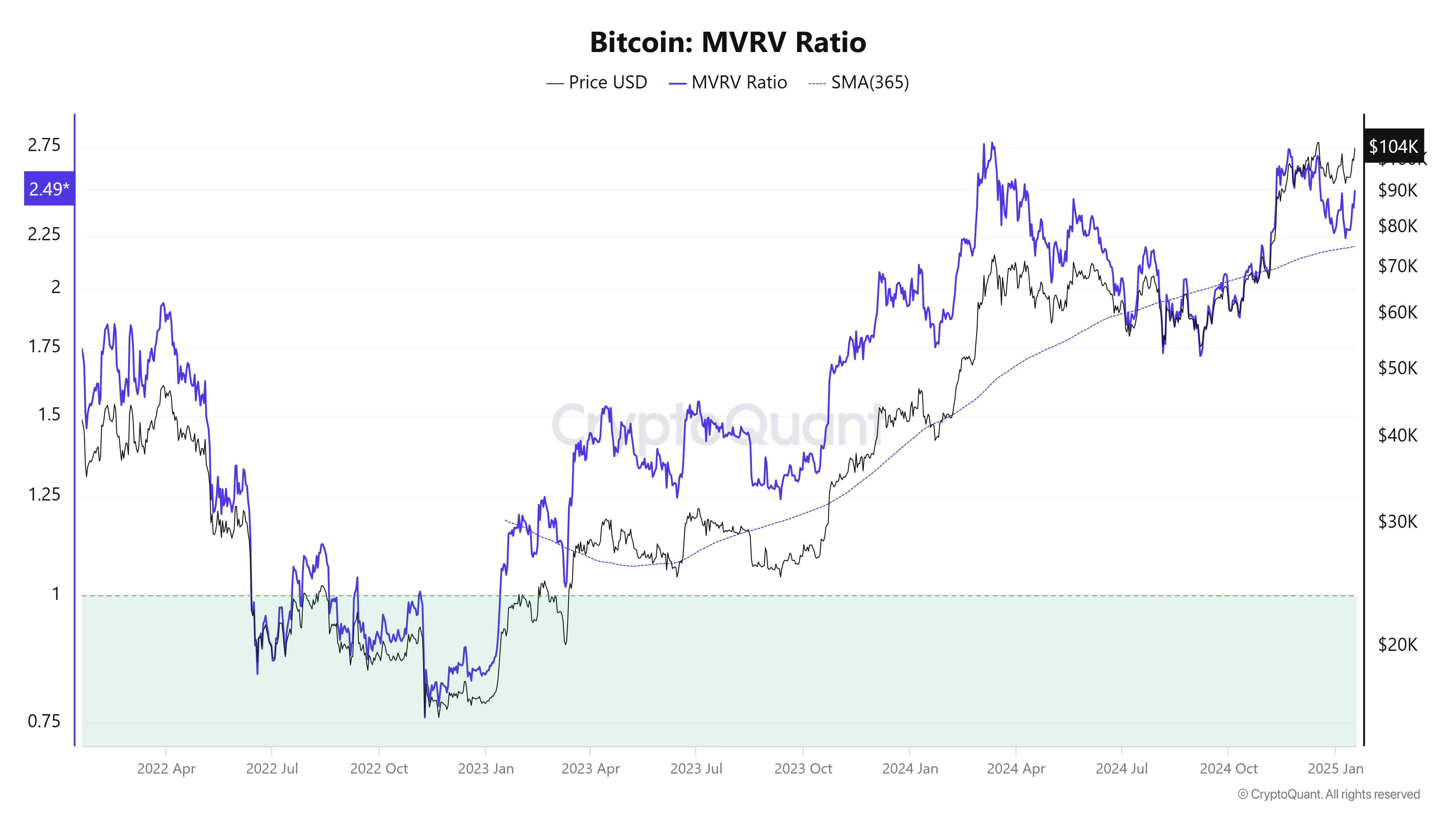

The MVRV ratio of Bitcoin, a value indicator used in CryptoQuant, shows 2.49—much below the overheated range of 3.8 to 4.0.

This implies that BTC is still undervalued and has great potential for development. Furthermore, showing strong market activity is the realized capitalization statistic, which gauges the total value of Bitcoin at the last on-chain movement, which has been gradually rising.

Historical Capital Flows Signal Strong Momentum for Bitcoin in 2025

According to historical data, the BTC price increase could be driven in great part by fresh capital flows. Capital inflows increased 4.5 times from 2018 to 2021, or $298 billion. But growth has been more measured in the current cycle (2022–2025), with a $56 billion gain thus far. This prepares the ground for maybe a spike in 2025.

By the end of 2025, Bitcoin might draw up to $1.7 trillion in fresh money if capital flows resemble past cycles. Assuming a 2.25x multiplier, even a more cautious projection shows an extra $520 billion in realized capitalizing next year.

With the historical market value multiplier of Bitcoin ranging from 2 to 6, this inflow might drive prices into the $145k-$249k range.

Balancing Risks and Opportunities in the Financial Landscape

Though the view is positive, several risks still exist. Delayed interest rate cuts brought on by inflation worries could sap market fervor. Furthermore, low participation of weak retail investors could lead to a difference in attitude between institutional and ordinary investors.

Short-term profit-taking could also be sparked by a possible “sell-the-news” impact following major political events, such as Donald Trump’s comeback to office.

New sources of demand, such as corporate acquisitions and Bitcoin ETFs, could balance these risks, though. Especially big holders, institutional investors are expected to keep propelling market momentum.

Since 2025 marks the end of Bitcoin’s present four-year cycle, past trends indicate a considerable possibility of notable price increase. Given institutional capital anticipated to rule inflows and a favorable macroeconomic environment, Bitcoin is positioned to reach unprecedented heights.

Recommended for you:

Credit: Source link