During a year-long initial coin offering (ICO) that ended in 2018, EOS raised a record $4.2 billion, making it the biggest ICO in history. Combined with its Delegated Proof-of-Stake (DPoS) consensus mechanism, which has throughput thousands of times greater than Ethereum’s, expectations were high.

But these expectations continue to go unfulfilled. A look at EOS’s stagnant dapp development, and slide in the CoinMarketCap rankings, shows a project that has fallen by the wayside.

In December 2020, the CTO at the development firm behind EOS, Dan Larimer, resigned, adding to the project’s uncertain future.

But new research from forensic financial analysis firm Integra FEC throws fresh doubt on the project’s viability.

What happened to EOS?

The reasons for EOS falling by the wayside are many. First, there were claims that EOS’s structure is more akin to a distributed database rather than a cryptographic protocol. Meaning the network isn’t as decentralized as claimed.

“the EOS network is not necessarily a blockchain based cryptocurrency network, but rather a homogenous distributed database network that allows different user accounts to communicate and interact through the distributed network database.”

Then in late 2019, EOS suffered congestion issues resulting in slow transaction times and high fees. As a result, some accused it of being unfit for purpose.

At around the same time, on charges it had conducted an unregistered ICO, the SEC announced settling with EOS for $24 million.

In short, EOS had had a torrid time since its record-breaking ICO three years ago.

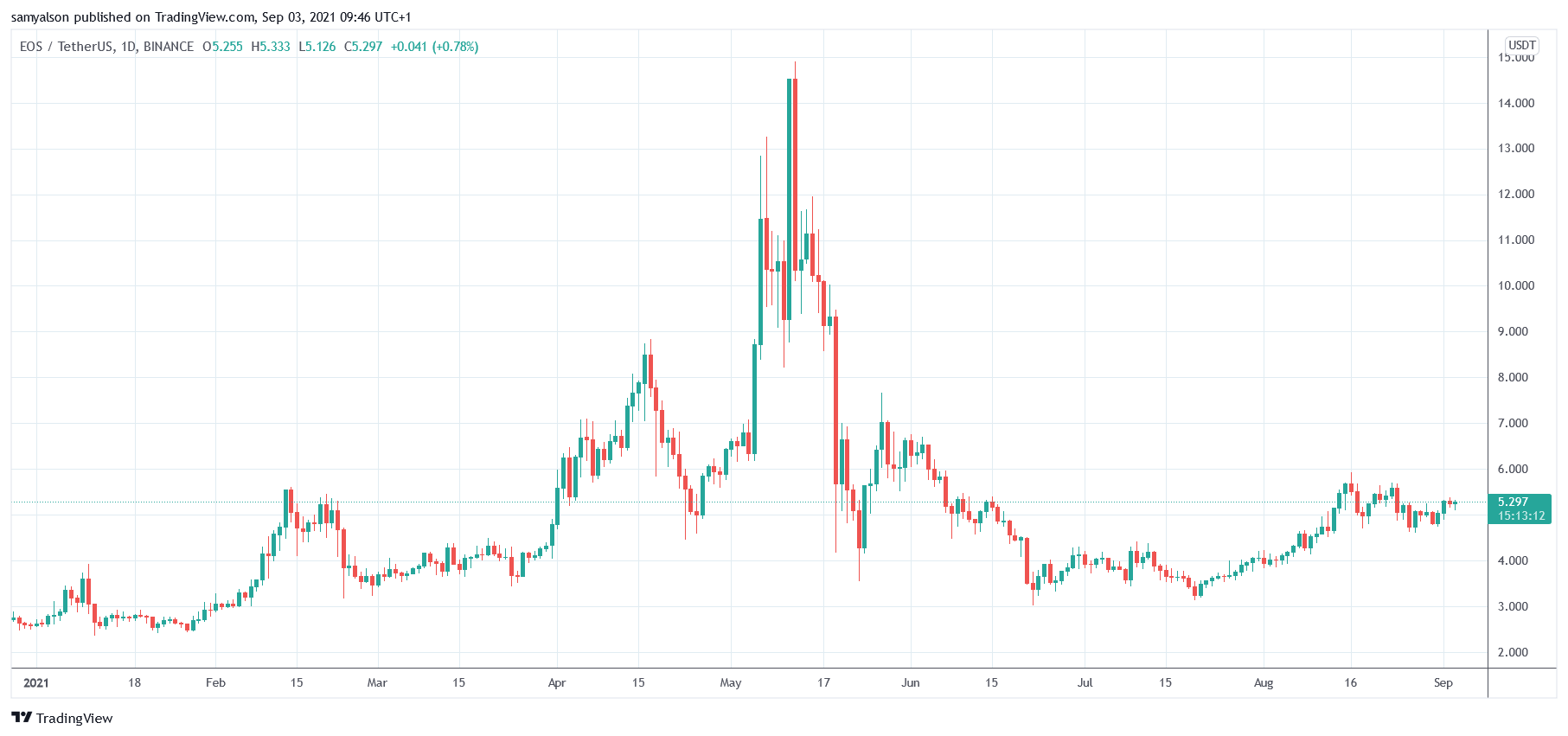

This is reflected in its price performance, which indicates a lack of interest in the project. April 2018 saw EOS hit its all-time high of $22.71. While there have been bouts of bullish price action teasing the possibility of re-reaching this level, they have all petered out so far.

The likes of Cardano and Solana continue hitting new all-time highs. But EOS is struggling to recapture its former glories.

What are the claims being made by Integra FEC?

Research conducted by Integra FEC, led by John Griffin of the University of Texas, points to suspicious trades during EOS’s ICO. It’s alleged that these transactions may have been wash trades, between associates designed to pump the price and draw unsuspecting investors in.

“The transactions, between potentially connected associates, “pumped up” the price of EOS and induced unwitting investors to buy the currency.”

Griffin expanded on this by saying it was a manipulation of the EOS offering price. The result of the suspicious transactions led to an inflated market value of the token. In turn, this enticed others to participate.

There are 21 accounts identified as being involved with the practice described by Griffin. He estimates the “recycled funds” amount to $815 million. But, the actual sums involved could be substantially higher given that other price manipulation methods may have been employed.

No claims are made on who owns these accounts, and nor does Griffin allege Block.one was involved.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link