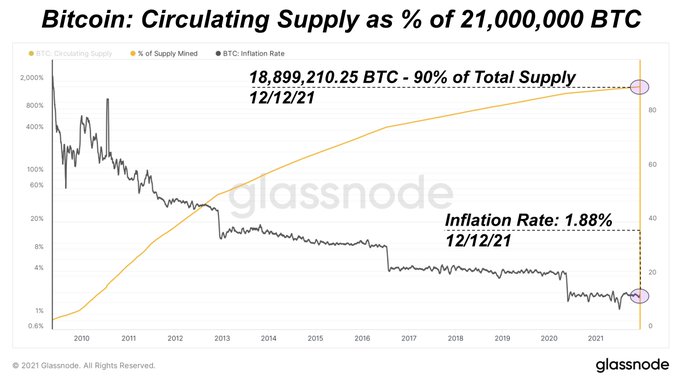

With a 21 million cap, 90% of Bitcoin’s total supply has already been mined, given that the coins in circulation stand at 18.89 million.

On-chain analyst Dylan LeClair explained:

“90% of the 21,000,000 BTC have now been mined. Current annual inflation of 1.88%, and programmatically declining for the next 119 years. Absolute scarcity.”

As the global monetary network evolves, cryptocurrencies are witnessing an uptick in usage and awareness. For instance, a recent Visa study noted that 94% of financial decision-makers were aware of cryptocurrencies. Moreover, the research stated that building wealth and a financial future were the key drivers of crypto usage and ownership.

Therefore, with only 10% of Bitcoin supply remaining unmined, a robust supply shock might become inevitable as demand for the leading cryptocurrency continues to scale the heights.

For example, Europe leads in terms of global crypto distribution with at least $5 trillion worth of cryptocurrencies received in a span of a year.

The inverse relationship between Bitcoin and the USD

According to crypto analyst Matthew Hyland:

“The US Dollar plays a pivotal role in Bitcoin bull markets. When the US Dollar is in a bear market, Bitcoin sees its maximum gains a key signal for a USD reversal into a Bear Market would be bearish divergence being formed on the 2-week time frame. we still await confirmation.”

Research shows that Bitcoin and the US dollar are inversely correlated because, in most cases, BTC rises when the dollar’s strength decreases.

For instance, as Bitcoin closed in 2020 with a 295% gain, the US Dollar Index (DXY) slipped to a 32-month low.

Meanwhile, Bitcoin has recently dragged between $47K and $50K levels. Crypto experts believe the bull market might not be triggered until the primary token returns to the $53K level.

Image source: Shutterstock

Credit: Source link