- Jupiter Exchange will burn 30% of JUP tokens over six months for better transparency.

- Jupiter’s lower fees make it a strong competitor to Binance in perpetual trading.

In a tweet, SolanaFloor announced that Jupiter Exchange’s proposal to burn 30% of the JUP team tokens received overwhelming support, with 95% of the vote in favor. This huge action will see 3 billion JUP tokens, worth more than $2.37 billion, burned over a six-month period.

The primary goal of this supply reduction proposal is to provide confidence, alignment, and transparency (CAT) for all JUP token holders and the larger community.

🚨BREAKING: @JupiterExchange‘s proposal to burn 30% of the $JUP team tokens has passed with 95% of votes in favor.

(3 billion $JUP, worth over $2.37 billion, will be burned over a 6 month period) pic.twitter.com/tjOXW8TvT3

— SolanaFloor (@SolanaFloor) August 4, 2024

Jupiter Exchange Challenges Binance with Competitive Fees and Strong Market Performance

In addition to this significant advancement, the JUP token has shown strong performance in the crypto market. The token increased by 10.20% over the last 24 hours to $0.8033, with a daily trading volume of $287.37 million. This upward rise is part of a broader recovery trend in the cryptocurrency market, signaling increased investor confidence.

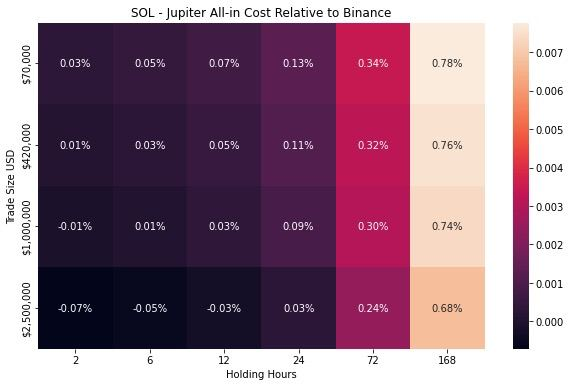

Meanwhile, Gauntlet reported that Jupiter Exchange is becoming a formidable challenger to Binance in everlasting trading. Contrary to popular opinion, Jupiter charges reasonable fees, especially for large deals.

A heatmap analysis of all-in costs over various holding periods in June and July reveals that Jupiter enables large traders to trade and retain exposure at a lower cost than Binance, particularly in the short term. This cost-effectiveness could draw additional traders to the platform, increasing its market presence.

Previously, as we reported, the decentralized exchange (DEX) unveiled Jupiter Spot, a function that consolidates all user favorites into a single, streamlined user interface.

Users can easily switch between the Dollar Cost Averaging (DCA) and Value Averaging (VA) methods, set Limit Orders, interact with price charts, and check their trading history. This update is intended to improve the user experience and trade efficiency on the platform.

Furthermore, the SOL Index is now included in the Jup Research Forum, which strengthens the company’s Solana diversification efforts. Jupiter also created the Active Staking Incentives Program, which distributed $60 million in incentives to Solana users.

No spam, no lies, only insights. You can unsubscribe at any time.

Credit: Source link