While the total value locked (TVL) in decentralized finance (defi) hovers just above the $214 billion mark, a defi protocol called Lido has been moving closer toward taking Curve’s top spot in terms of TVL in a defi protocol. Currently, the liquid staking solution Lido has $19.2 billion in staking assets derived from five different blockchain networks including Ethereum, Solana, Terra, Polygon, and Kusama.

Lido’s Staked Assets Represent Close to 9% of the $214 Billion Locked in Defi

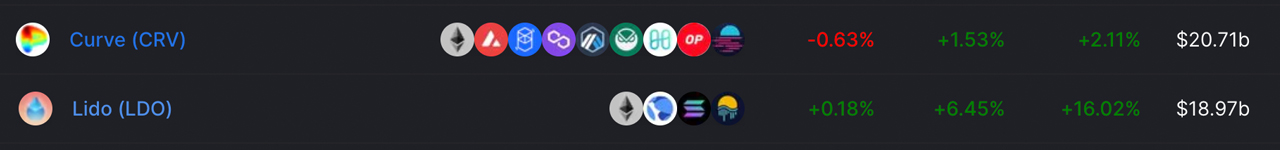

According to defillama.com, there’s $214 billion total value locked in decentralized finance at the time of writing. Presently, the largest defi protocol in terms of TVL size is Curve Finance, the decentralized exchange (dex) platform. Today, Curve dominates the pack with $20.71 billion and a dominance rating of around 9.67%, according to defillama.com statistics on April 20, 2022.

As far as TVL in defi protocols is concerned, Curve has led the pack for weeks on end, but the liquid staking solution Lido may take the reins soon. Lido’s TVL, at least according to today’s defillama.com metrics, is $18.97 billion, up 16.02% over the last 30 days. Lido has seen significant usage because the defi protocol allows Ethereum, Solana, Terra, Polygon, and Kusama users to use their staked assets to gain yield on top of yield.

So if a user decided to bond Terra’s LUNA into the token called BLUNA, they would exchange LUNA for BLUNA to start getting staking rewards. Meanwhile, in addition to the bond stake, BLUNA tokens can also be used in pools, to earn even more rewards from the bonded tokens. The same can be said about other networks like Ethereum, as Lido’s staked ether (STETH) commands the 18th largest market capitalization out of 13,671 cryptocurrencies. Lido staked solana (STSOL) is the 193rd largest market cap, and BLUNA is the 22nd largest on Wednesday.

While defillama.com notes that Lido’s TVL is $18.97 billion, it only accounts for four of the blockchains that Lido uses for staking. Polygon is missing from defillama.com’s metrics, and according to Lido’s stats on April 20, 2022, there’s $19,220,700,179 staked among 99,606 stakers. Lido stats show $10.6 billion from Ethereum, $8.21 billion from Terra, $363 million from Solana, $3.3 million from Kusama, and $13.8 million stemming from the Polygon network.

3.9%, 23.9% APY Depending on Chain Rewards and Skipping Validator Lock-Ups

According to current staking estimates, Lido’s Ethereum staking solution is the lowest with a 3.9% annual percentage yield (APY), while Kusama’s is the highest at 23.9% APY. While Lido is touted for its ability to double stake assets, there are some defi liquidity pool providers that take the reward from Lido staking services, and Lido warns users this can be the case.

One particular benefit of Lido is people can skip using a validator lock-up period (although there is an unbonding period) because they can sell their bonded tokens on the open market. Choosing this route, however, the user will lose the fee associated with the dex swap and roughly 1-2% in value depending on the bonded token.

Lido Finance is considered a “staking company,” and there are a number of staking companies in the industry. Today, there are staking companies such as Kyber Network, Celer Network, Blockdaemon, and more. Lido, however, has an enormous amount of value locked today across five different blockchains and in recent times the total quantity of staked assets has swelled exponentially.

What do you think about the liquid staking solution Lido? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link