Bitcoin’s consolidation between the $30,000 and $40,000 area continues, while the leading cryptocurrency was hovering around $36.8k during intraday trading, according to CoinMarketCap.

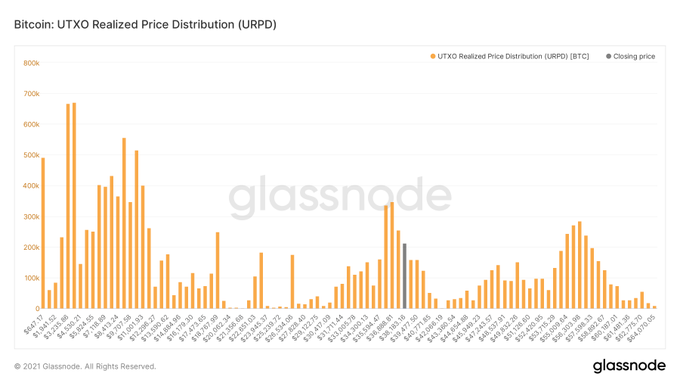

On-chain analyst William Clemente III disclosed that 13.38% of Bitcoin’s circulating supply standing at 18.73 million BTC has moved between the $31k and $40k range. He explained:

“13.38% of Bitcoin’s money supply has now moved between $31K-$40K. A lot of distribution at 35K-36K, wouldn’t want to flip that into resistance.”

The analyst, however, cautioned about this significant supply flipping to resistance, which could jeopardise Bitcoin’s upward rally.

Chris Weston, the head of research at Melbourne-based broker Pepperstone Financial Pty, recently asserted that BTC should trade above $40k for bulls to feel that they are out of vulnerability.

The percent of Bitcoin supply in profit hit a 13-month low

According to on-chain metrics provider Glassnode:

“The percent of Bitcoin supply in profit (7d MA) just reached a 13-month low of 72.140%.”

The recent market crash, which saw BTC nosedive from a record-high of $64.8k to lows of $30k, wiped profits of many investors, and miners were not spared either.

Reportedly, Bitcoin miners’ wallet net flows were increasingly turning negative.

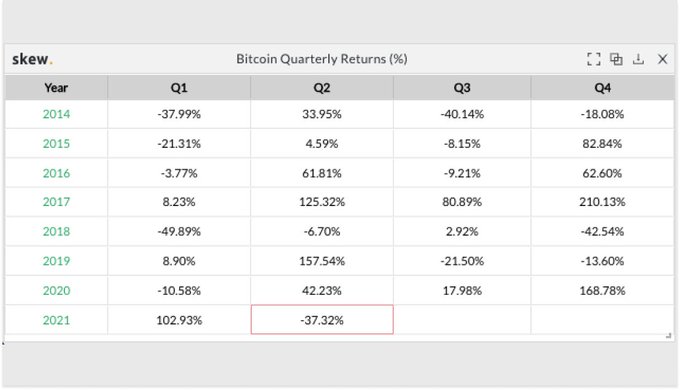

This downtrend in the BTC market is also set to make the Q2 of 2021 record a negative, as acknowledged by Skew. The crypto data provider noted:

“Bitcoin is on track for its first down quarter since Q1 2020.”

Meanwhile, US institutional Bitcoin demand had dried up because American-based crypto exchange Coinbase was experiencing more inflows.

According to a recent weekly report by digital asset firm CoinShares, institutional investors continued to reduce their long positions in BTC. The net outflow reached a record of $141.4 million in the past week.

Furthermore, that whale holdings of more than 1,000 BTC had been dropping since February. It, therefore, remains to be seen whether BTC will attract more institutional investors to spur an upward move.

Image source: Shutterstock

Credit: Source link